Get the free Schedule D-1 (Form 1040)

Show details

This document is used to list additional transactions related to short-term and long-term capital gains and losses that are to be reported on Schedule D of Form 1040 for the tax year 2005. It includes

We are not affiliated with any brand or entity on this form

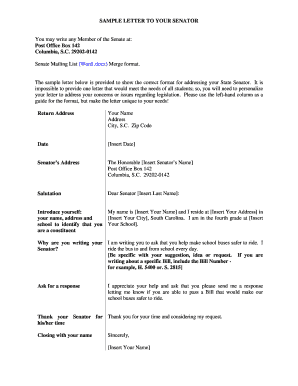

Get, Create, Make and Sign schedule d-1 form 1040

Edit your schedule d-1 form 1040 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule d-1 form 1040 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule d-1 form 1040 online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit schedule d-1 form 1040. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule d-1 form 1040

How to fill out Schedule D-1 (Form 1040)

01

Gather all your investment information including stock sales, mutual funds, and other capital assets.

02

Obtain Schedule D-1 (Form 1040) from the IRS website or your tax preparation software.

03

Start by filling in your name and Social Security number at the top of the form.

04

Input details for each transaction: date acquired, date sold, description of the asset, sales price, cost basis, and gain or loss.

05

Add short-term and long-term capital gains and losses separately as instructed.

06

Calculate the net capital gain or loss by summarizing your totals.

07

Transfer your total to the appropriate line on Form 1040.

08

Review the filled out Schedule D-1 for any errors before submitting.

Who needs Schedule D-1 (Form 1040)?

01

Individuals who have sold capital assets like stocks, bonds, or real estate during the tax year.

02

Taxpayers who need to report capital gains or losses to the IRS.

03

Anyone who has previously filed a Schedule D and needs to report any adjustments or additional sales.

Fill

form

: Try Risk Free

People Also Ask about

What is IRS Schedule D used for?

Most people use the Schedule D form to report capital gains and losses that result from the sale or trade of certain property during the year. In 2011, however, the Internal Revenue Service created a new form, Form 8949, that some taxpayers will have to file along with their Schedule D and 1040 forms.

Who must file Schedule D Form 1040?

Who has to file Schedule D? Anyone selling investments in a taxable brokerage account, certain real estate, or businesses should file Schedule D. Even if you reinvest money you've made from selling investments, taxes on sales through taxable accounts are due annually and you need to report those sales on this form.

What does schedule D mean?

Use Schedule D (Form 1040) to report the following: The sale or exchange of a capital asset not reported on another form or schedule. Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or profit.

What is the new 1040 form for seniors?

Form 1040-SR is available as an optional alternative to using Form 1040 for taxpayers who are age 65 or older. Form 1040-SR uses the same schedules and instructions as Form 1040 does.

What is a Schedule D 1 tax form?

Use Schedule D-1 to report the sale or exchange of business property when the California basis of the asset(s) is different from the federal basis due to differences between California and federal law.

What does D mean on a tax return?

D. Elective deferrals to a section 401(k) cash or deferred arrangement. Also includes deferrals under a SIMPLE retirement account that is part of a section 401(k) arrangement.

What is Schedule D Part 1?

You'll use Schedule D to report capital gains and losses from selling or trading certain assets during the year. Capital assets include personal items like stocks, bonds, homes, cars, artwork, collectibles, and cryptocurrency. You need to report gains and losses from selling these assets.

What is instruction 1040 Schedule 1?

Written by a TurboTax Expert • Reviewed by a TurboTax CPA Updated for Tax Year 2024 • March 21, 2025 2:05 AM. Form 1040 Schedule 1 allows you to claim additional sources of income that aren't listed on Form 1040, including unemployment compensation, prize or award money, and gambling winnings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule D-1 (Form 1040)?

Schedule D-1 (Form 1040) is a form used to report additional capital gains and losses that are not reported on the main Schedule D form, allowing taxpayers to provide detailed information about their transactions in capital assets.

Who is required to file Schedule D-1 (Form 1040)?

Taxpayers who have capital gains and losses that exceed certain thresholds or those who have complex transactions that require additional reporting are required to file Schedule D-1 along with their Form 1040.

How to fill out Schedule D-1 (Form 1040)?

To fill out Schedule D-1, taxpayers should report details of their capital gains and losses in the specified sections, including each transaction’s date, description, type of gain or loss, and amounts, following the provided instructions for the form.

What is the purpose of Schedule D-1 (Form 1040)?

The purpose of Schedule D-1 is to provide the IRS with detailed information on additional capital gains and losses that affect a taxpayer's overall tax liability, ensuring accurate reporting of investment income.

What information must be reported on Schedule D-1 (Form 1040)?

Taxpayers must report information such as the type of asset sold, the date acquired, date sold, sales proceeds, cost basis, and any gain or loss realized from the sale of the capital assets on Schedule D-1.

Fill out your schedule d-1 form 1040 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule D-1 Form 1040 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.