IRS 2031 2000-2025 free printable template

Show details

I would like this election to take effect beginning with the tax year shown on line 5. I understand that as a result of this election I will be subject to tax as a self-employed person in accordance with the provisions of chapter 2 of subtitle A of the Internal Revenue Code with respect to self-employment income derived from such service for such tax year and each tax year thereafter. I further understand that this election is irrevocable. Signat...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign revocation tax ministers religious orders form

Edit your 2000 2031 ministers form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2000 2031 ministers form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2000 2031 ministers form online

To use the services of a skilled PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2000 2031 ministers form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2000 2031 ministers form

How to fill out IRS 2031

01

Gather necessary information, including your total income and expenses.

02

Download or obtain a copy of IRS Form 2031 from the IRS website.

03

Fill out your personal information at the top of the form.

04

Enter your income details in the designated section.

05

List any deductions or credits you qualify for in the appropriate sections.

06

Calculate your total tax liability or refund based on the provided instructions.

07

Review the form for accuracy and completeness.

08

Sign and date the form before submission.

Who needs IRS 2031?

01

Individuals or entities that are required to report specific income or deductions as outlined by the IRS.

02

Taxpayers seeking to claim certain credits or deductions available on the form.

Fill

form

: Try Risk Free

People Also Ask about

Do church pastors pay into Social Security?

Churches are prohibited from paying FICA tax for clergy but are encouraged to pay a social security allowance for their pastor, which offsets their social security burden. Many churches assume at least 50% of its pastor's Social Security tax burden by providing a Social Security Allowance to him or her.

Why can pastors opt out of Social Security?

ANSWER: Pastors can opt out of Social Security on a religious basis. Under the tax law you can be a conscientious objector. God clearly tells us to manage our money well and Social Security is not a good money manager, so you have a viable reason for opting out of Social Security.

Can a pastor opt back in to Social Security?

An exemption from self-employment coverage under Social Security can be obtained by: Any duly ordained, commissioned, or licensed minister of a church, member of a religious order who has not taken a vow of poverty; or.

Can pastors opt back into Social Security?

An exemption from self-employment coverage under Social Security can be obtained by: Any duly ordained, commissioned, or licensed minister of a church, member of a religious order who has not taken a vow of poverty; or.

What is IRS form 2031?

Form 2031 is a new form that the IRS has released to help taxpayers report their cryptocurrency transactions.

What is the IRS form for self-employment deductions?

In order to report your Social Security and Medicare taxes, you must file Schedule SE (Form 1040 or 1040-SR ), Self-Employment TaxPDF. Use the income or loss calculated on Schedule C to calculate the amount of Social Security and Medicare taxes you should have paid during the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2000 2031 ministers form directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your 2000 2031 ministers form as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I modify 2000 2031 ministers form without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your 2000 2031 ministers form into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I make edits in 2000 2031 ministers form without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit 2000 2031 ministers form and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

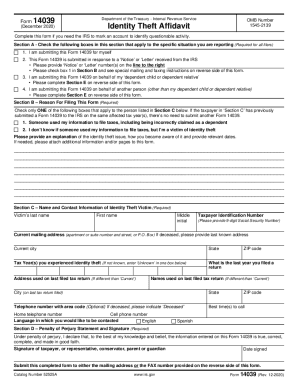

What is IRS 2031?

IRS 2031 is a form used by individuals and entities to report certain information related to their income tax obligations as required by the Internal Revenue Service (IRS).

Who is required to file IRS 2031?

Individuals or entities that meet specific criteria set forth by the IRS, generally those involved in certain types of business activities or transactions, are required to file IRS 2031.

How to fill out IRS 2031?

To fill out IRS 2031, taxpayers need to provide their identifying information, report relevant income data, and disclose any deductions or credits applicable to their tax situation. It's advisable to consult IRS guidelines or a tax professional for assistance.

What is the purpose of IRS 2031?

The purpose of IRS 2031 is to ensure compliance with tax laws by collecting essential information about taxpayers' incomes and any applicable deductions or credits, allowing the IRS to accurately assess tax liabilities.

What information must be reported on IRS 2031?

Information that must be reported on IRS 2031 includes taxpayer identification details, income sources, amounts, deductions, credits, and any other relevant financial data needed for accurate tax assessment.

Fill out your 2000 2031 ministers form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2000 2031 Ministers Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.