IRS Publication 517 2019 free printable template

Show details

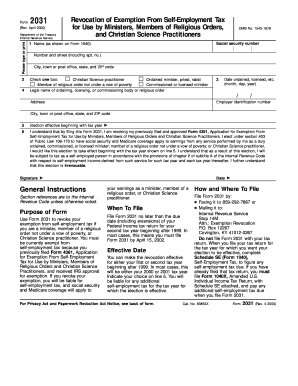

Publication 517ContentsSocial Security and Other Information for Members of the Clergy and Religious WorkersFuture Developments. . . . . . . . . . . . 1Cat. No. 15021X Department of the Treasury Internal

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Publication 517

Edit your IRS Publication 517 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Publication 517 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Publication 517 online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS Publication 517. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Publication 517 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Publication 517

How to fill out IRS Publication 517

01

Obtain a copy of IRS Publication 517 from the IRS website or your local tax office.

02

Read the introduction to understand the purpose of the publication.

03

Identify the specific sections that apply to your situation regarding social security and Medicare coverage.

04

Follow the instructions in each section carefully, ensuring you provide accurate information.

05

Complete any required forms referenced in the publication as needed.

06

Double-check your entries for accuracy before submitting supporting documents or the forms to the IRS.

Who needs IRS Publication 517?

01

Individuals who have worked abroad and need to report their social security benefits.

02

Taxpayers looking for information on U.S. social security taxes for foreign service workers.

03

People with questions about their eligibility for social security and Medicare benefits while living outside the U.S.

Fill

form

: Try Risk Free

People Also Ask about

What is the housing allowance for pastors in 2023?

Housing Allowance - The minimum Housing Allowance for 2023 has been increased to $26,400.

Do pastors pay Social Security on housing allowance?

This is 7.65% of the pastor's cash salary and housing, regardless of whether the housing is provided in the form of a housing allowance or in the form of a parsonage with utilities paid by the church. The Social Security allowance is considered taxable salary when reporting income to the IRS on W-2 form.

What is the average housing allowance for a pastor?

The median base salary for part-time solo pastors is $14,400, while the median housing allowance is $12,000.

What is the tax publication 517?

517 is a set of work- sheets that you can use to figure the amount of your taxable ministerial in- come and allowable deductions. Note. In this publication, the term “church” is generally used in its generic sense and not in reference to any particular religion. Comments and suggestions.

What is IRS publication number 517?

About Publication 517, Social Security and Other Information for Members of the Clergy and Religious Workers | Internal Revenue Service.

How does housing allowance work for pastors?

The housing allowance is sometimes called a “parsonage allowance” for clergy who are provided with a parsonage and a “rental allowance” for clergy who rent their home. Example: A church pays its pastor an annual salary of $35,000. In addition, she is provided the rent-free use of a furnished home owned by the church.

What can be included in clergy housing allowance?

Generally, those expenses include rent, mortgage interest, utilities, and other expenses directly relating to providing a home. The amount excluded can't be more than reasonable compensation for the minister's services. If you own your home, you may still claim deductions for mortgage interest and real property taxes.

Why are pastors allowed to opt out of Social Security?

Any Christian Science practitioner who is conscientiously opposed, or because of religious principles is opposed, to the acceptance of Social Security benefits (or other public insurance providing similar benefits) based on services as a minister, member or practitioner.

How is minister's housing allowance calculated?

To determine your housing allowance, you should calculate both your anticipated expenses and the fair market rental value of your home. Then request the lesser amount.

How much can a pastor claim for housing allowance?

A minister can designate up to 100% of their salary be paid to them as a housing allowance. However, the IRS states that the maximum amount it will allow to be excluded from gross income is the smallest of the following: 1. The amount actually paid to provide for the personal residence for the year, 2.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute IRS Publication 517 online?

pdfFiller makes it easy to finish and sign IRS Publication 517 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make edits in IRS Publication 517 without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your IRS Publication 517, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit IRS Publication 517 straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing IRS Publication 517.

What is IRS Publication 517?

IRS Publication 517 provides guidelines for tax treatment of plan participants in retirement plans and outlines information regarding the tax rules applicable to retirement plans for members of the uniformed services.

Who is required to file IRS Publication 517?

Individuals who receive distributions from military retirement plans or need to report contributions to retirement plans related to military service are required to file IRS Publication 517.

How to fill out IRS Publication 517?

To fill out IRS Publication 517, follow the instructions provided in the publication, which may include entering personal information, detailing retirement plan distributions, and reporting contributions. It generally requires financial documentation regarding contributions made to retirement plans.

What is the purpose of IRS Publication 517?

The purpose of IRS Publication 517 is to educate taxpayers about the tax implications of retirement plans for uniformed service members, including how to report their retirement plan transactions correctly.

What information must be reported on IRS Publication 517?

Information that must be reported on IRS Publication 517 includes details of the retirement plans involved, any distributions received, contributions made, and other relevant financial details concerning the taxpayer's retirement plans.

Fill out your IRS Publication 517 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Publication 517 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.