Get the free Form 8819

Show details

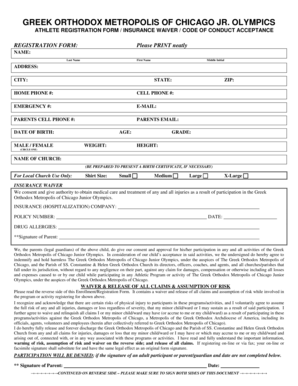

Form 8819 is filed by or on behalf of a noncontrolled section 902 corporation to elect the U.S. dollar as its functional currency.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 8819

Edit your form 8819 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8819 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 8819 online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 8819. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 8819

How to fill out Form 8819

01

Download Form 8819 from the IRS website or obtain a physical copy.

02

Enter your name and tax identification number at the top of the form.

03

Complete Part I by listing the partnership that made the election.

04

Fill out Part II by providing details about the tax year and the type of entity.

05

If applicable, complete Part III to report any adjustments needed for the prior year.

06

Review the instructions to ensure all sections are accurately filled.

07

Sign and date the form where indicated.

08

Submit the completed form with your tax return or follow the instructions for separate submission.

Who needs Form 8819?

01

Form 8819 is required for partnerships that have made an election to change their method of accounting for tax purposes.

02

It is necessary for partners who need to report the partnership's reported amounts on their individual tax returns.

Fill

form

: Try Risk Free

People Also Ask about

Are there IRS forms to cancel debt?

File Form 1099-C in the year following the calendar year in which the identifiable event occurs. See Exceptions, later. If you cancel a debt before an identifiable event occurs, you may choose to file Form 1099-C for the year of cancellation.

Why is the IRS asking me for form 8962?

Premium tax credit (PTC). The credit provides financial assistance to pay the premiums for the qualified health plan offered through a Marketplace by reducing the amount of tax you owe, giving you a refund, or increasing your refund amount. You must file Form 8962 to compute and take the PTC on your tax return.

What is the form for IRS forgiveness of debt?

Form 1099-C. Lenders or creditors are required to issue Form 1099-C, Cancellation of Debt, if they cancel a debt owed to them of $600 or more. Generally, an individual taxpayer must include all canceled amounts (even if less than $600) on the "Other Income" line of Form 1040.

What is the tax form that can erase your debt legally?

This form must be submitted by creditors when they cancel a debt of $600 or more. Timing: Creditors are required to issue Form 1099-C for the tax year in which the debt was canceled. For example, if a debt was forgiven in 2024, the creditor must file the form by Jan.

What is the IRS form to cancel all debt?

Form 1099-C. Lenders or creditors are required to issue Form 1099-C, Cancellation of Debt, if they cancel a debt owed to them of $600 or more. Generally, an individual taxpayer must include all canceled amounts (even if less than $600) on the "Other Income" line of Form 1040.

What is the fastest way to change my address with the IRS?

You can use Form 8822 to notify the Internal Revenue Service if you changed your home mailing address. If this change also affects the mailing address for your children who filed income tax returns, complete and file a separate Form 8822 for each child.

What is form 8819 used for?

More In Forms and Instructions This form is filed by or on behalf of a noncontrolled section 902 corporation (defined in section 904(d)(2)(E)) to elect the U.S. dollar as its (or its qualified business unit (QBU) branch's) functional currency.

What is a 1099C and how does it work?

Lenders must submit Form 1099-C: Cancellation of Debt to the Internal Revenue Service (IRS) when they forgive or cancel $600 or more that a taxpayer owes. The taxpayer then keeps this money, so it's considered income. Therefore, it must be reported on the taxpayer's return, and tax must be paid on it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 8819?

Form 8819 is a tax form used by individuals and businesses to report certain tax information related to the resolution of disaster relief benefits and the effects on tax liabilities.

Who is required to file Form 8819?

Individuals and entities who receive disaster relief payments or benefits that may affect their tax situation are required to file Form 8819.

How to fill out Form 8819?

To fill out Form 8819, taxpayers need to provide their personal information, details about the disaster relief benefits received, and any necessary calculations regarding taxes owed. Accurate reporting is crucial, and taxpayers may need to refer to the attached instructions for guidance.

What is the purpose of Form 8819?

The purpose of Form 8819 is to ensure that recipients of disaster relief benefits accurately report these benefits on their tax returns and understand any tax implications related to them.

What information must be reported on Form 8819?

Form 8819 must report the taxpayer's identification information, details about the disaster relief received, previous years' tax liabilities affected, and any calculations necessary to determine changes in tax liability due to the relief benefits.

Fill out your form 8819 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8819 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.