Get the free FORM 10-K/A AMENDMENT NO. 3 - sec

Show details

This document serves as an amendment to the annual report for Hercules Incorporated, addressing issues related to internal controls and financial reporting, particularly regarding foreign tax credits

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 10-ka amendment no

Edit your form 10-ka amendment no form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 10-ka amendment no form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 10-ka amendment no online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 10-ka amendment no. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 10-ka amendment no

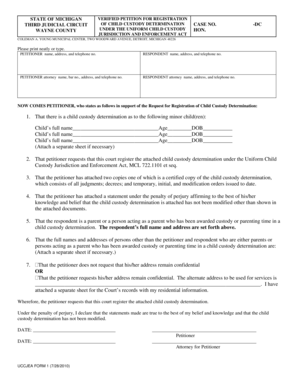

How to fill out FORM 10-K/A AMENDMENT NO. 3

01

Step 1: Gather necessary financial documents and information for the fiscal year being reported.

02

Step 2: Review the original Form 10-K to identify sections that need to be amended or updated.

03

Step 3: Complete the cover page with relevant company information, including the name and SEC file number.

04

Step 4: Fill out the itemized sections according to the specific amendments being made, ensuring accuracy.

05

Step 5: Provide updated financial statements if there are changes in financial performance or position.

06

Step 6: Include signatures from appropriate company officials attesting to the accuracy of the information.

07

Step 7: Review the entire document for completeness and accuracy before submission.

08

Step 8: Submit the amended form through the SEC's EDGAR system in accordance with required deadlines.

Who needs FORM 10-K/A AMENDMENT NO. 3?

01

Publicly traded companies that previously filed a Form 10-K and need to update or amend their financial disclosures.

02

Investors seeking updated information about a company's financial condition and operations may use this form for better decision-making.

Fill

form

: Try Risk Free

People Also Ask about

What is the amendment to the Form 10-K?

0:41 5:38 Position or operations. Companies may file a 10 K/ A for various. Reasons including correction ofMorePosition or operations. Companies may file a 10 K/ A for various. Reasons including correction of errors. This could involve fixing typos numerical mistakes or other inaccuracies in the original.

Who is required to file Form 10-K?

What is a 10-K form? Every publicly traded company is required to file financial reports with the Securities and Exchange Commission, or the SEC. The SEC Form 10-K offers a comprehensive snapshot of the company's financial health throughout the year, almost like an annual report for the business numbers.

What is the 10-K for private companies?

The 10-K is the official annual report filed with the SEC. Since private companies do not have the same obligation to report to the SEC, it is harder to locate information on them and the information you will find is probably self-reported.

Who must file Form 10-K?

What is a 10-K form? Every publicly traded company is required to file financial reports with the Securities and Exchange Commission, or the SEC. The SEC Form 10-K offers a comprehensive snapshot of the company's financial health throughout the year, almost like an annual report for the business numbers.

What triggers the filing of Form 10?

The SEC requires a company to file SEC Form 10 when it has more than $10 million in total assets and more than 500 shareholders. A company with fewer shareholders or assets may voluntarily make this SEC filing, but it is not required.

Do all companies have to file a 10-K?

Most U.S. public compa- nies are required to produce a 10-K each year and file it with the U.S. Securities and Exchange Commission (SEC). (Non-U.S. public companies usually file their annual reports with the SEC on different forms.)

What is the instruction G 3 to the Form 10-K?

General Instruction G(3) of 10-K permits a company to omit from the 10-K some or all of the information called for by Part III of 10-K, and instead incorporate this information by reference to the company's definitive (not preliminary) proxy statement, so long as the company files the definitive proxy statement within

What triggers a Form 3 filing?

When a person becomes an insider (for example, when they are hired as an officer or director), they must file a Form 3 to initially disclose his or her ownership of the company's securities. Form 3 must be filed within 10 days after the person becomes an insider. What's a Form 4?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM 10-K/A AMENDMENT NO. 3?

FORM 10-K/A AMENDMENT NO. 3 is an amendment to the annual report (FORM 10-K) filed with the SEC that provides updated information or corrections to the originally submitted 10-K report.

Who is required to file FORM 10-K/A AMENDMENT NO. 3?

Publicly traded companies that have previously filed a FORM 10-K are required to file FORM 10-K/A AMENDMENT NO. 3 if they need to amend their original report.

How to fill out FORM 10-K/A AMENDMENT NO. 3?

To fill out FORM 10-K/A AMENDMENT NO. 3, the filer must complete the relevant sections of the form by providing the necessary updates or corrections and ensuring compliance with SEC regulations.

What is the purpose of FORM 10-K/A AMENDMENT NO. 3?

The purpose of FORM 10-K/A AMENDMENT NO. 3 is to disclose any material changes, corrections, or additional information that was omitted or needs to be revised from the original 10-K filing.

What information must be reported on FORM 10-K/A AMENDMENT NO. 3?

FORM 10-K/A AMENDMENT NO. 3 must report any amended financial statements, management discussions, risks, and other relevant information that need to be updated based on the changes being filed.

Fill out your form 10-ka amendment no online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 10-Ka Amendment No is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.