IRS 5309 2001 free printable template

Show details

Form

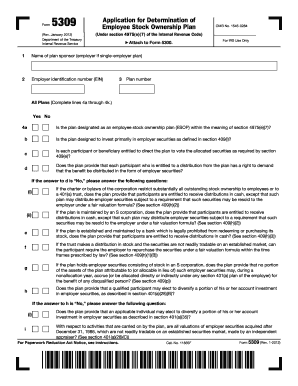

5309

Name of employer or plan sponsor

(Rev. August 2001)

Department of the Treasury Internal Revenue Service

Application for Determination of Employee Stock Ownership Plan

(Under section 409

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 5309

Edit your IRS 5309 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 5309 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 5309 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 5309

How to fill out IRS 5309

01

Obtain Form IRS 5309 from the IRS website or your local IRS office.

02

Fill in your identification details including name, address, and taxpayer identification number.

03

Indicate the type of plan you are providing information for in Part I.

04

Complete Part II by checking the appropriate boxes related to the qualifications of your retirement plan.

05

If applicable, provide details about the plan sponsor and the plan name.

06

Sign and date the form at the bottom of Part III.

07

Submit the completed form to the designated IRS address or include it with your tax return.

Who needs IRS 5309?

01

Employers who established a retirement plan using a prototype or volume submitter plan.

02

Taxpayers requesting a determination letter regarding the tax-qualified status of their retirement plan.

03

Entities that are seeking to preserve the qualified status of their retirement plans with the IRS.

Fill

form

: Try Risk Free

People Also Ask about

Where can I get IRS forms 2022?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

Where can I get IRS tax forms?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRS 5309?

IRS 5309 is a form used to apply for a determination of tax-exempt status for certain types of retirement plans, specifically those established under Internal Revenue Code Section 401(a).

Who is required to file IRS 5309?

Employers who sponsor a qualified retirement plan and wish to obtain a favorable determination letter from the IRS regarding the plan's tax-exempt status are required to file IRS 5309.

How to fill out IRS 5309?

To fill out IRS 5309, the plan sponsor should provide details about the retirement plan, including plan type, specific provisions, and other required information as outlined in the instructions provided by the IRS.

What is the purpose of IRS 5309?

The purpose of IRS 5309 is to allow plan sponsors to request a determination from the IRS about the tax-exempt status of their retirement plan, ensuring that it meets federal guidelines.

What information must be reported on IRS 5309?

Information that must be reported on IRS 5309 includes the name and address of the plan sponsor, the plan name, the type of plan, plan provisions, and any other relevant details needed for the IRS review.

Fill out your IRS 5309 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 5309 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.