Get the free Form T

Show details

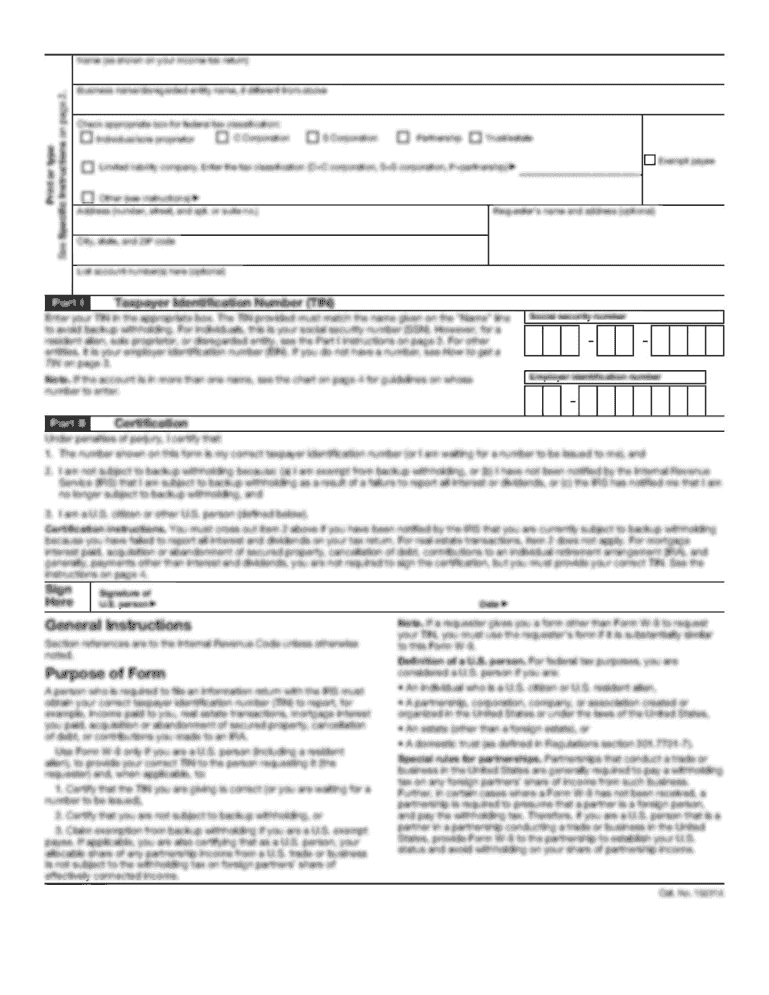

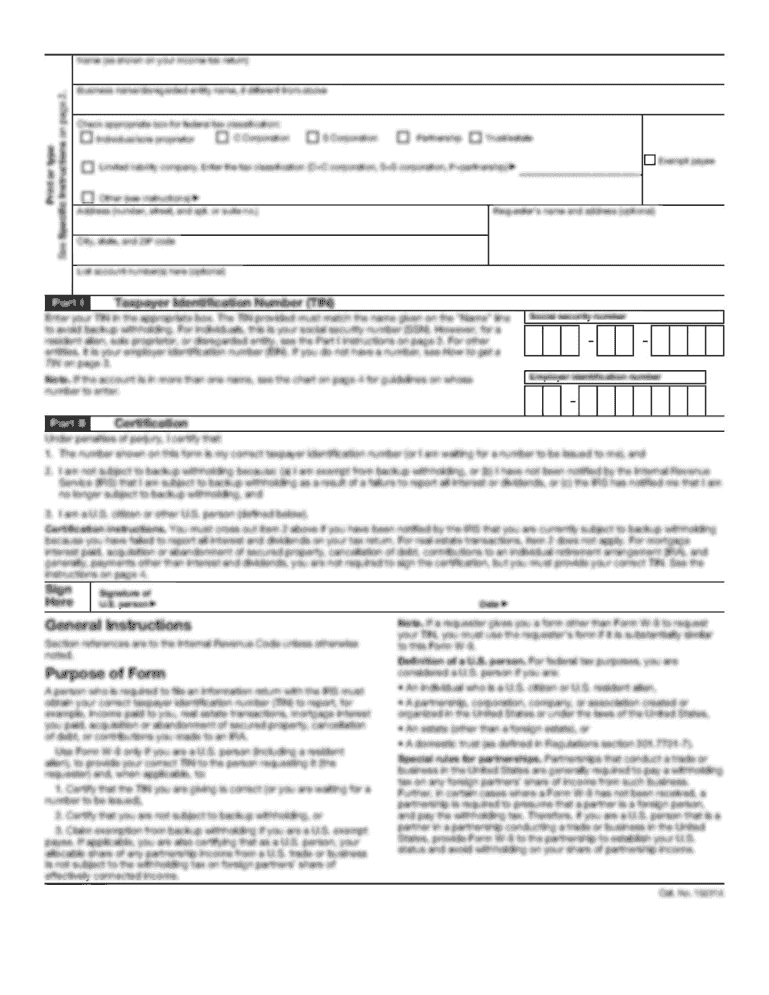

Form T is used to provide information on timber accounts for tax purposes when timber is sold, exchanged, or deemed sold during the tax year. It includes sections for acquisitions, sales, timber depletion,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form t

Edit your form t form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form t form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form t online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form t. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form t

How to fill out Form T

01

Download Form T from the official website or acquire a copy from an authorized office.

02

Read the instructions carefully before starting to fill out the form.

03

Fill in your personal information, including your name, address, and contact details.

04

Enter any relevant identification numbers, such as Social Security Number or Tax Identification Number.

05

Complete each section of the form according to the prompts provided, ensuring all information is accurate.

06

Review the filled-out form to ensure all fields are completed and correct.

07

Sign and date the form at the designated area.

08

Submit the form according to the instructions provided, either electronically or by mail.

Who needs Form T?

01

Anyone who is required to report certain financial information as per tax regulations.

02

Individuals seeking to claim specific tax benefits or deductions.

03

Taxpayers who have received a notice requiring them to fill out Form T.

Fill

form

: Try Risk Free

People Also Ask about

Is form the same as grade?

Though Forms can be roughly equivalent to grade levels and ages, it is possible for a younger student to move on to a higher Form once all the requirements for the current Form have been met. In this way, each student can get the full benefits from the curriculum and keep advancing as rapidly as he or she is maturing.

What is a form in English schools?

A form is an educational stage, class, or grouping of pupils in a school. The term is used predominantly in the United Kingdom, although some schools, mostly private, in other countries also use the title.

What is form in English class?

Form is a term used to describe the style in which a text is written and presented. Some examples of forms include scripts, novels and the various types of poetry.

What is form in English class?

Form is a term used to describe the style in which a text is written and presented. Some examples of forms include scripts, novels and the various types of poetry.

Is form the same as homeroom?

A homeroom, tutor group, form class, or form is a brief administrative period that occurs in a classroom assigned to a student in primary school and in secondary school.

What form do I fill out for British citizenship?

Become a British citizen by naturalisation (form AN) Apply for citizenship by naturalisation if you live in the Channel Islands, Isle of Man, a British Overseas Territory or if you live elsewhere and want to apply by post.

What is a form in English school?

A form is an educational stage, class, or grouping of pupils in a school. The term is used predominantly in the United Kingdom, although some schools, mostly private, in other countries also use the title.

What is form language in English?

FORM - is the name of the text type that the writer uses. For example, scripts, sonnets, novels etc. All of these are different text types that a writer can use. The form of a text is important because it indicates the writer's intentions, characters or key themes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form T?

Form T is a tax form used in Canada for reporting income and tax obligations related to certain types of transactions, typically involving trusts or certain investment income.

Who is required to file Form T?

Individuals or entities that are involved in specific transactions requiring reporting, such as trustees of trusts or those receiving certain types of income, are required to file Form T.

How to fill out Form T?

To fill out Form T, you need to provide your personal information, details of the transactions, income amounts, and any applicable deductions or credits as specified in the form instructions.

What is the purpose of Form T?

The purpose of Form T is to ensure that all relevant income is reported to the Canada Revenue Agency (CRA) and to calculate the appropriate tax owed or refundable credits.

What information must be reported on Form T?

Form T requires reporting of personal identification information, details of the transactions, types and amounts of income, and any deductions or expenditures relevant to the tax year.

Fill out your form t online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form T is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.