Get the free Retirement Plan Life Cycle

Show details

This brochure highlights the many benefits of an employee retirement plan and addresses the first steps of thinking about a retirement plan, including the stages in the life of the plan such as choosing,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retirement plan life cycle

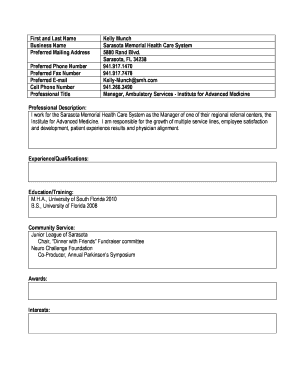

Edit your retirement plan life cycle form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retirement plan life cycle form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing retirement plan life cycle online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit retirement plan life cycle. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out retirement plan life cycle

How to fill out Retirement Plan Life Cycle

01

Gather all necessary personal and financial information.

02

Determine your retirement goals, including desired lifestyle and age of retirement.

03

Assess your current savings and investments.

04

Understand different retirement plan options available.

05

Calculate how much you need to save annually to reach your goals.

06

Choose a suitable retirement plan based on your needs.

07

Complete the application or enrollment process for the chosen plan.

08

Review and adjust your retirement plan periodically as circumstances change.

Who needs Retirement Plan Life Cycle?

01

Individuals planning for retirement.

02

Employees seeking to understand their employer-sponsored retirement options.

03

Self-employed individuals wanting to secure their financial future.

04

Anyone wanting to ensure financial stability during their retirement years.

Fill

form

: Try Risk Free

People Also Ask about

What is the 3 rule in retirement?

Our aim with this retirement planning guide is to help you achieve that goal. Know when to start retirement planning. Figure out how much money you need to retire. Prioritize your financial goals. Choose the best retirement plan for you. Select your retirement investments.

What are the 7 steps in planning your retirement?

7 steps to prepare for your upcoming retirement Make sure you're diversified and investing for growth. Take full advantage of retirement accounts, especially catch-up contributions. Downsize your debt. Calculate your likely retirement income. Estimate your retirement expenses. Consider future medical costs.

What is the golden rule of retirement planning?

The final and most important golden rule to keep your retirement plans on track is to stay invested. It is evident that the longer you invest, the better your returns are. Unfortunately, some individuals keep withdrawing funds from retirement plans to fulfil temporary family obligations or to manage an emergency.

What are the stages of retirement planning?

Your retirement will evolve over time. Most people go through three stages of retirement: exploring, nesting and reflecting. In the first stage of retirement, while your health is good and you have goals to accomplish, you might travel the world, learn new skills, volunteer and take up new hobbies.

What is the lifecycle of a retirement plan?

The process of creating a retirement plan includes identifying your income sources, adding up your expenses, putting a savings plan into effect, and managing your assets. By estimating your future cash flows, you can judge whether your retirement income goal is realistic.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

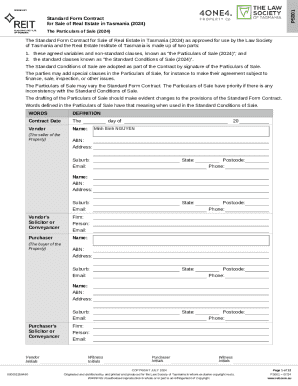

What is Retirement Plan Life Cycle?

The Retirement Plan Life Cycle refers to the various stages a retirement plan goes through from its inception to its termination. It includes stages like plan design, implementation, ongoing management, and eventual termination or rolling over of benefits.

Who is required to file Retirement Plan Life Cycle?

Retirement plan sponsors, including employers that offer retirement plans such as 401(k)s or pension plans, are required to file documentation that outlines the Retirement Plan Life Cycle.

How to fill out Retirement Plan Life Cycle?

To fill out the Retirement Plan Life Cycle, plan sponsors must gather information related to the plan's design, enrollment, funding, investment choices, participant contributions, and distribution processes, and report these in the designated forms.

What is the purpose of Retirement Plan Life Cycle?

The purpose of the Retirement Plan Life Cycle is to ensure that all aspects of a retirement plan are properly managed, compliant with regulations, and provide the intended benefits to participants during their working years and in retirement.

What information must be reported on Retirement Plan Life Cycle?

The information that must be reported on the Retirement Plan Life Cycle includes the plan's structure, compliance status, participant demographics, contribution rates, investment performance, and any distributions made, among other details.

Fill out your retirement plan life cycle online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retirement Plan Life Cycle is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.