Get the free Form 56

Show details

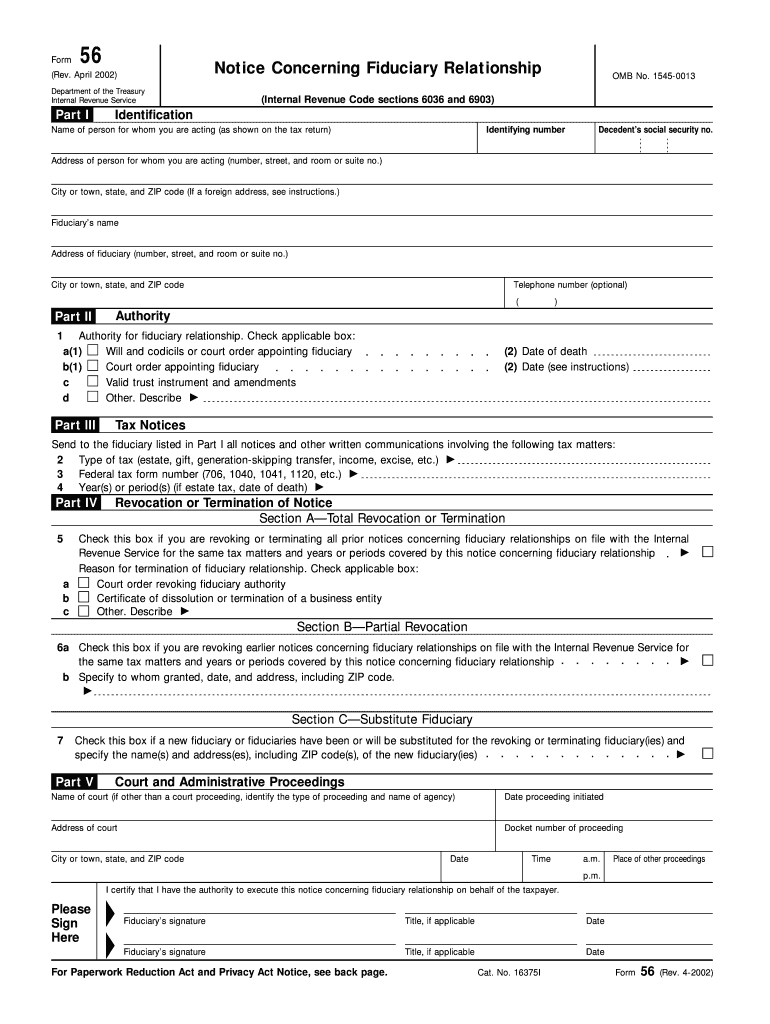

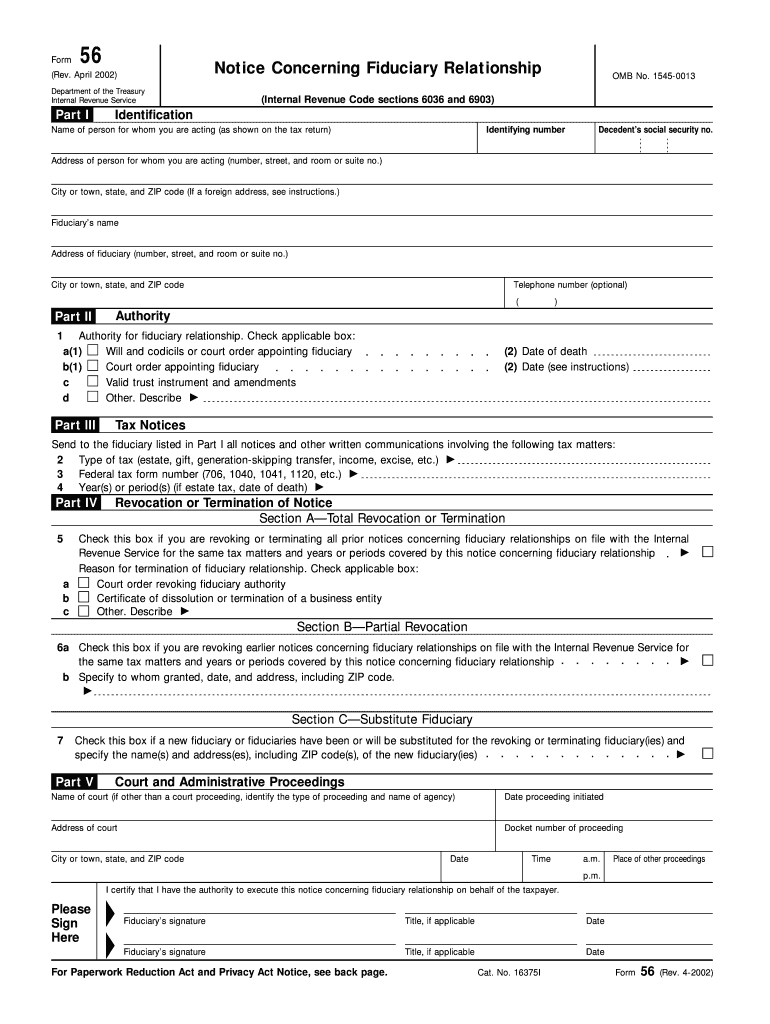

Form 56 is used to notify the IRS of the creation or termination of a fiduciary relationship under section 6903 and to give notice of qualification under section 6036. This form is necessary for fiduciaries

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 56

Edit your form 56 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 56 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 56 online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 56. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 56

How to fill out Form 56

01

Obtain Form 56 from the relevant tax authority website or office.

02

Fill in your personal information, including name, address, and taxpayer identification number.

03

Indicate the type of entity or individual you are (e.g., individual taxpayer, corporation).

04

Provide the necessary financial information and any relevant details concerning the application.

05

Review the form for accuracy and completeness.

06

Sign and date the form to validate it.

07

Submit the completed form to the tax authority, either electronically or through mail.

Who needs Form 56?

01

Individuals or entities who are required to file a tax return.

02

Taxpayers seeking to report specific financial situations or changes.

03

Individuals involved in trusts, estates, or other fiduciary arrangements.

Fill

form

: Try Risk Free

People Also Ask about

Is there a penalty for not filing form 56 after?

Is There a Penalty for Filing Form 56 Late? The IRS could impose penalties on fiduciaries who do not file Form 56 promptly. For that reason, it's important to complete and submit the form as soon as possible following the creation or termination of a fiduciary relationship.

What happens if I don't file form 56?

What happens if I don't file IRS Form 56? Failing to file IRS Form 56 when required can lead to several consequences: Lack of Recognition: The IRS may not recognize you as the fiduciary, which can complicate managing tax matters for the estate, trust, or individual.

What is a form 56 for a deceased person?

Filing IRS Form 56 notifies federal agencies and creditors to send mail regarding the estate to the fiduciary. The main purpose of this form is to establish the trustee or fiduciary as responsible for the accounts of an estate.

What is a 56 F form used for?

Use Form 56-F to notify the IRS of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift).

What is the filing form 56?

Generally, you must file Form 56 when you create (or terminate) a fiduciary relationship. File Form 56 with the Internal Revenue Service Center where the person for whom you are acting is required to file tax returns. Proceedings (other than bankruptcy) and assignments for the benefit of creditors.

Is IRS form 56 mandatory?

Generally, you must file Form 56 when you create (or terminate) a fiduciary relationship. File Form 56 with the Internal Revenue Service Center where the person for whom you are acting is required to file tax returns.

Does a personal representative have to file form 56?

The personal representative is responsible for filing any final individual income tax return(s) and the estate tax return of the decedent when due. You may need to file Form 56, Notice Concerning Fiduciary Relationship to notify the IRS of the existence of a fiduciary relationship.

What happens if you don't report a tax form?

Failing to report income may cause your return to understate your tax liability. If this happens, the IRS may impose an accuracy-related penalty that's equal to 20% of your underpayment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 56?

Form 56 is a document used to notify the Internal Revenue Service (IRS) of the creation of a fiduciary relationship, such as a trust or estate.

Who is required to file Form 56?

Individuals or entities that are acting as fiduciaries for estates or trusts are required to file Form 56.

How to fill out Form 56?

To fill out Form 56, provide the name and address of the fiduciary, the taxpayer identification number, and details about the fiduciary relationship and the entity involved.

What is the purpose of Form 56?

The purpose of Form 56 is to inform the IRS that a fiduciary relationship exists, which may affect the tax obligations of the estate or trust.

What information must be reported on Form 56?

Form 56 must report the fiduciary's name and address, the name of the entity (trust or estate), the taxpayer identification number, and the dates during which the fiduciary relationship is effective.

Fill out your form 56 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 56 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.