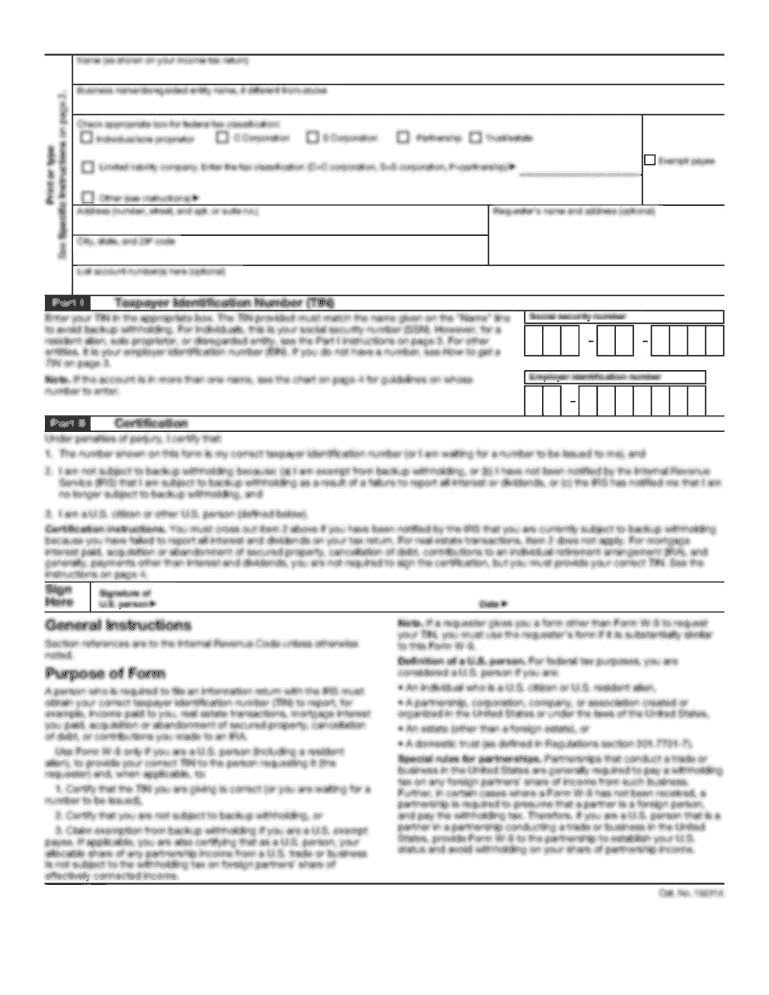

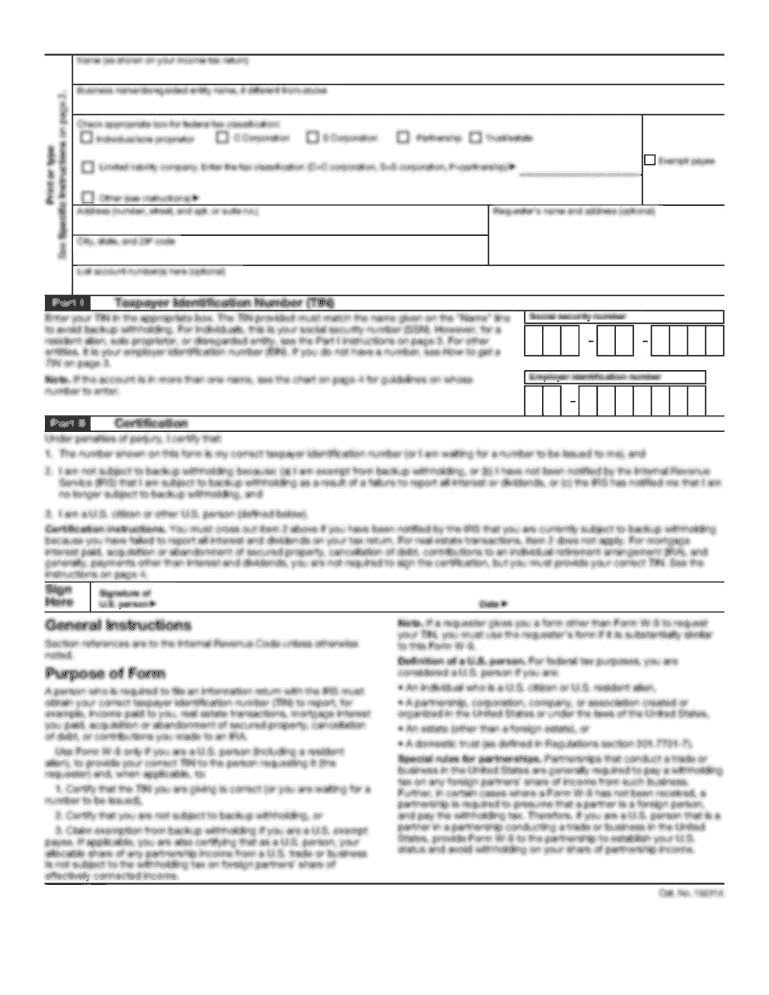

suspicious activity report 2000-2025 free printable template

Show details

Feb 18, 2003 ... Search http://www.irs.gov/. Search http://www.irs.gov/. IRS.gov .... 47. 52. Education credits. Attach Form 8863. 45. 50. Other credits. ... 2002 estimated tax payments and amount

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign suspicious activity report

Edit your suspicious activity report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your suspicious activity report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing suspicious activity report online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit suspicious activity report. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out suspicious activity report

How to fill out suspicious activity report

01

Identify the red flags or suspicious activities that warrant a report.

02

Gather all relevant information about the individuals or entities involved.

03

Document the specifics of the transaction or behavior that raised suspicion.

04

Complete the designated suspicious activity report form provided by the regulatory authority.

05

Include all pertinent details such as dates, amounts, and any other observations.

06

Submit the completed report to the appropriate authority following their submission guidelines.

Who needs suspicious activity report?

01

Financial institutions and their employees.

02

Real estate professionals.

03

Insurance companies.

04

Professional service providers such as accountants and attorneys.

05

Any organization required to comply with anti-money laundering regulations.

Fill

form

: Try Risk Free

People Also Ask about

What are the requirements for filing a SAR?

Dollar Amount Thresholds – Banks are required to file a SAR in the following circumstances: insider abuse involving any amount; transactions aggregating $5,000 or more where a suspect can be identified; transactions aggregating $25,000 or more regardless of potential suspects; and transactions aggregating $5,000 or

How do I fill out a suspicious activity report?

The Introduction Provide a brief statement of the SAR's purpose. Generally describe the known or suspected violation. Identify the date of any SARs previously filed on the subject & the purpose of that SAR. Indicate any internal investigative numbers used by the filing institution to maintain records of the SAR.

What is a common reason to file a suspicious activity report?

A Suspicious Activity Report (SAR) is a document that financial institutions, and those associated with their business, must file with the Financial Crimes Enforcement Network (FinCEN) whenever there is a suspected case of money laundering or fraud.

Which of the following acts require an employee of a financial institution to file a SAR?

Section 356 of the USA PATRIOT Act amended the BSA to require financial institutions to monitor for, and report, suspicious activity (so-called SAR reporting). Under FinCEN's SAR rule (31 C.F.R.

Who is responsible for filing a SAR?

A financial institution is required to file a suspicious activity report no later than 30 calendar days after the date of initial detection of facts that may constitute a basis for filing a suspicious activity report.

When must a suspicious transaction be reported?

A suspicious transaction must be reported as soon as possible and not longer than 15 working days after a person becomes aware of the facts which gives rise to the suspicion.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my suspicious activity report directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your suspicious activity report and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I modify suspicious activity report without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your suspicious activity report into a dynamic fillable form that you can manage and eSign from anywhere.

How do I complete suspicious activity report online?

Completing and signing suspicious activity report online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

What is suspicious activity report?

A suspicious activity report (SAR) is a document that financial institutions and certain other entities must file with the Financial Crimes Enforcement Network (FinCEN) when they detect suspicious behavior that may indicate money laundering, fraud, or other financial crimes.

Who is required to file suspicious activity report?

Institutions such as banks, credit unions, securities brokers, insurance companies, and other financial entities are required to file a suspicious activity report.

How to fill out suspicious activity report?

To fill out a suspicious activity report, the filer must provide details about the suspicious activity, including the nature of the observation, the involved parties, and relevant account or transaction details. It requires a description of the suspicious activity, timestamps, and any supporting documentation.

What is the purpose of suspicious activity report?

The purpose of a suspicious activity report is to assist law enforcement and regulatory agencies in detecting and investigating potential financial crimes.

What information must be reported on suspicious activity report?

Key information that must be reported includes the date and location of the suspicious activity, a description of the activity, identification details of the individuals involved, and any supporting evidence.

Fill out your suspicious activity report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Suspicious Activity Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.