IRS 1120-A 2003 free printable template

Show details

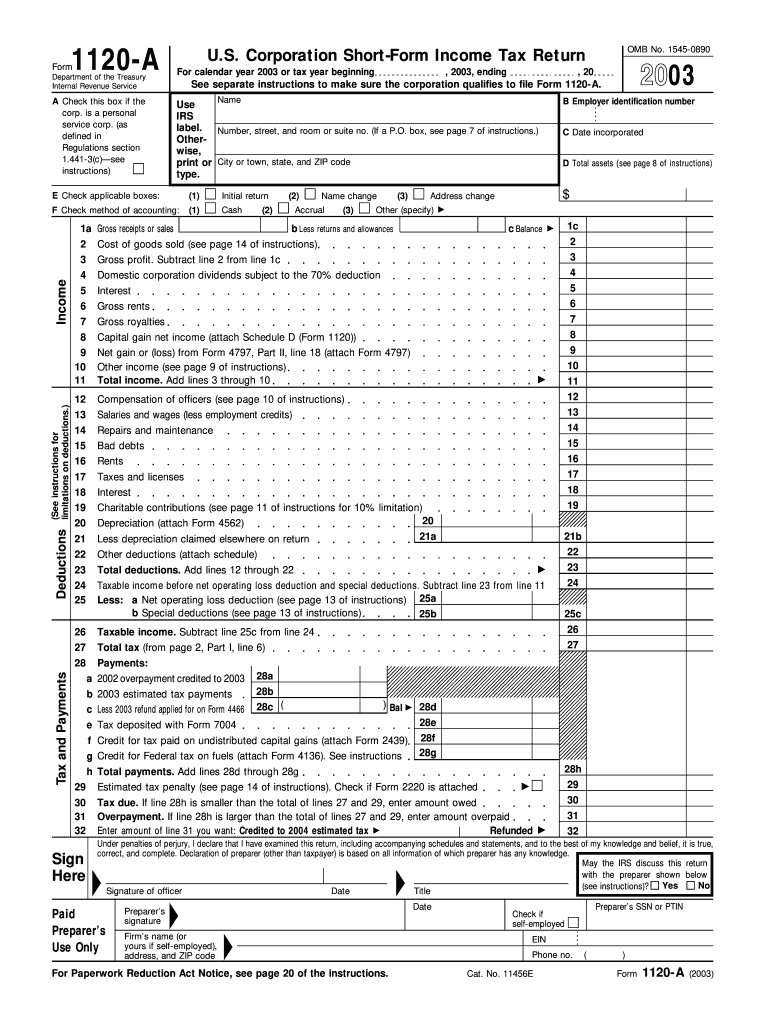

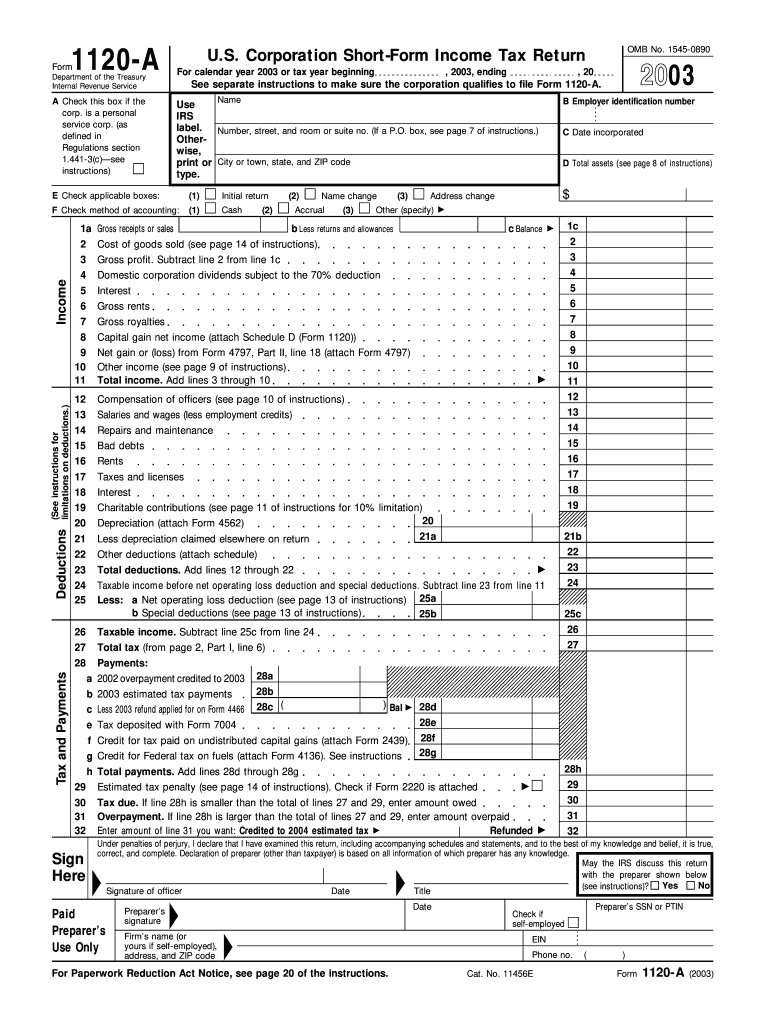

Form Department of the Treasury Internal Revenue Service 1120-A U.S. Corporation Short-Form Income Tax Return For calendar year 2003 or tax year beginning Name OMB No. 1545-0890, 2003, ending, 20

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1120-A

Edit your IRS 1120-A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1120-A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 1120-A online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 1120-A. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1120-A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1120-A

How to fill out IRS 1120-A

01

Gather necessary documentation, including financial statements and receipts.

02

Begin filling out the identifying information at the top, including the corporation's name, address, and EIN.

03

Complete the income section by reporting total income from operations, other income, and deductions.

04

Calculate and report the taxable income by taking total income and subtracting deductions.

05

Fill out the tax computation section to determine the amount of tax owed.

06

Report any payments made and credits applied to the tax liability.

07

Complete additional schedules and forms as needed based on specific corporate circumstances.

08

Review the completed form for accuracy and completeness.

09

Sign and date the return, ensuring that it's filed by the due date.

Who needs IRS 1120-A?

01

Corporations that are not classified as S Corporations under IRS regulations need to file IRS 1120-A.

02

Business entities that wish to report income, deductions, and credits for the corporate tax year.

03

Corporations with uncomplicated tax situations, as 1120-A is a simplified version of the standard 1120 form.

Fill

form

: Try Risk Free

People Also Ask about

Can you rely on a private letter ruling?

Private Letter Ruling A PLR may not be relied on as precedent by other taxpayers or IRS personnel. PLRs are generally made public after all information has been removed that could identify the taxpayer to whom it was issued.

What are IRS publications?

IRS publications are informational booklets written by the Internal Revenue Service that give taxpayers detailed guidance on tax issues.

Which source of law is most binding on the IRS?

Statutes are the primary source of federal tax law; they are the supreme law of the land outside of the Constitution (and Tax Treaties, discussed below).

What is the fastest way to get an IRS transcript?

We recommend requesting a transcript online since that's the fastest method. If you can't get your transcript online, you can request a tax return or tax account transcript by mail instead.

What are the three basic types of IRS examinations?

There are three types of examinations: correspondence examinations are done through the mail; field examinations involve face-to-face interaction, typically conducted in a taxpayer's home or business, while office examinations are conducted in IRS offices.

What is an IRS publication?

IRS publications are informational booklets written by the Internal Revenue Service that give taxpayers detailed guidance on tax issues.

Can you rely on IRS publications?

Such unofficial guidance generally isn't subject to careful internal review or public commentary before being released. Moreover, the IRS takes the position that taxpayers cannot rely on unofficial guidance even though the IRS has put it out there for public consumption.

Does everyone get a letter from the IRS?

Every year the IRS mails letters or notices to taxpayers for many different reasons. Typically, it's about a specific issue with a taxpayer's federal tax return or tax account. A notice may tell them about changes to their account or ask for more information. It could also tell them they need to make a payment.

How do you cite the IRS in MLA format?

When IRS information is included in the text, put a citation inside parentheses. Use the department's full name and the document's page number after the pertinent material, such as: (Internal Revenue Service 5). If the department's name is included in the text, omit it from the parentheses.

Did the IRS recently send out letters?

WASHINGTON — Starting this week, the Internal Revenue Service is sending letters to more than 9 million individuals and families who appear to qualify for a variety of key tax benefits but did not claim them by filing a 2021 federal income tax return.

Why is everyone getting a letter from the IRS?

The IRS sends notices and letters for the following reasons: You have a balance due. You are due a larger or smaller refund. We have a question about your tax return.

Where can I get IRS publications?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

What are most letters from IRS about?

Most IRS letters and notices are about federal tax returns or tax accounts. Each notice deals with a specific issue and includes specific instructions on what to do. A notice may reference changes to a taxpayer's account, taxes owed, a payment request or a specific issue on a tax return.

Fill out your IRS 1120-A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1120-A is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.