IRS 1040-NR - Schedule NEC (SP) 2023 free printable template

Show details

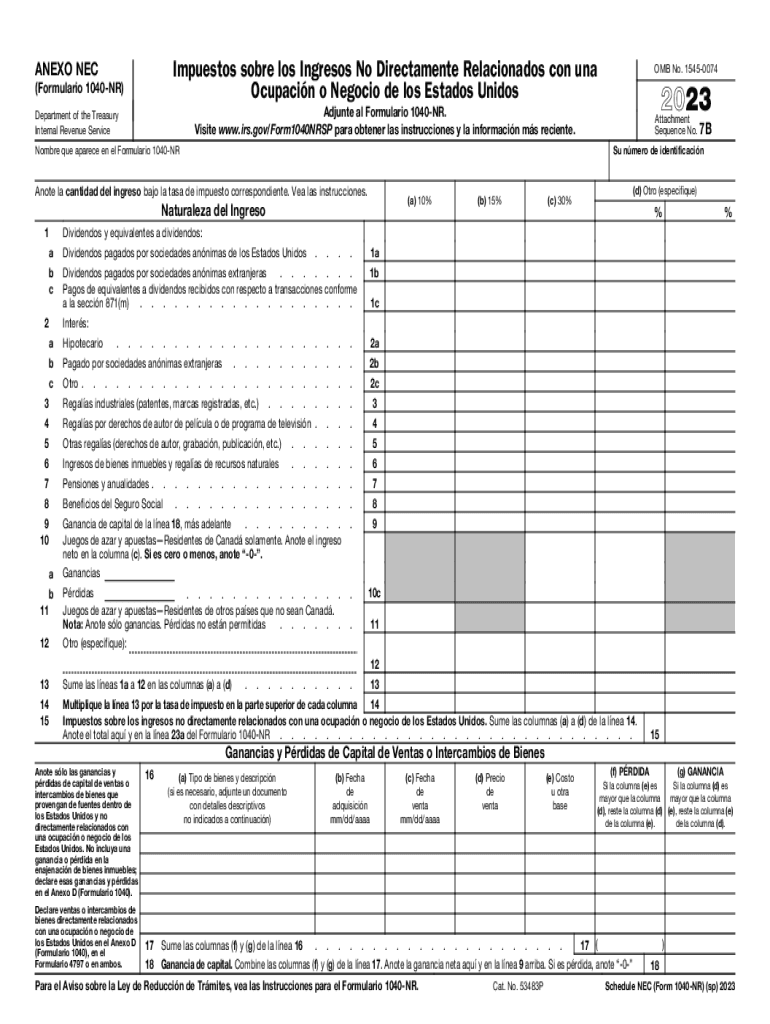

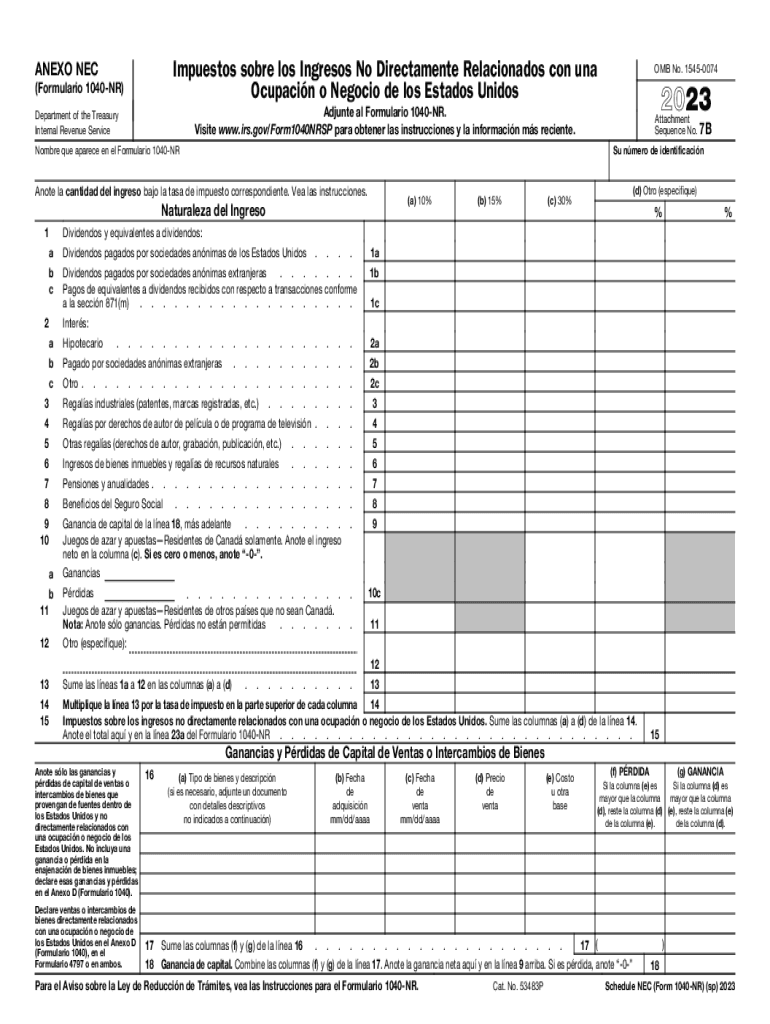

Impuestos sobre los Ingresos No Directamente Relacionados con una Ocupacin o Negocio de los Estados UnidosANEXO NEC(Formulario 1040NR)Anote la cantidad del ingreso bajo la tasa de impuesto correspondiente.

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign 1040 nr form

Edit your IRS 1040-NR - Schedule NEC SP form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1040-NR - Schedule NEC SP form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 1040-NR - Schedule NEC SP online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 1040-NR - Schedule NEC SP. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1040-NR - Schedule NEC (SP) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1040-NR - Schedule NEC SP

How to fill out IRS 1040-NR - Schedule NEC (SP)

01

Obtain IRS Form 1040-NR and Schedule NEC (SP) from the IRS website or through a tax professional.

02

Fill out your personal information at the top of the form, including your name, address, and taxpayer identification number.

03

Complete the income section by reporting any effectively connected income that is subject to U.S. taxation.

04

Report any income that is not effectively connected, using the instructions provided in the Schedule NEC (SP).

05

Calculate the total income to determine your tax liability.

06

Fill out any applicable deductions and credits to reduce your tax owed.

07

Review the completed form for accuracy before signing and dating it.

08

Submit the form by the appropriate deadline, either electronically or via mail to the IRS.

Who needs IRS 1040-NR - Schedule NEC (SP)?

01

Non-resident aliens who have U.S. source income that is not effectively connected with a trade or business in the United States.

02

Individuals who must report income such as dividends, interest, royalties, or other income subject to withholding.

03

Foreign students and scholars who received taxable income in the U.S.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IRS 1040-NR - Schedule NEC SP without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your IRS 1040-NR - Schedule NEC SP into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I sign the IRS 1040-NR - Schedule NEC SP electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your IRS 1040-NR - Schedule NEC SP and you'll be done in minutes.

Can I edit IRS 1040-NR - Schedule NEC SP on an Android device?

You can make any changes to PDF files, such as IRS 1040-NR - Schedule NEC SP, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is IRS 1040-NR - Schedule NEC (SP)?

IRS 1040-NR - Schedule NEC (SP) is a form used by nonresident aliens to report income that is not effectively connected with a trade or business in the United States.

Who is required to file IRS 1040-NR - Schedule NEC (SP)?

Nonresident aliens who have U.S. source income that is not effectively connected with a trade or business in the U.S. are required to file IRS 1040-NR - Schedule NEC (SP).

How to fill out IRS 1040-NR - Schedule NEC (SP)?

To fill out IRS 1040-NR - Schedule NEC (SP), taxpayers should provide personal information, report income not effectively connected with a U.S. business, and calculate tax owed based on the applicable rates.

What is the purpose of IRS 1040-NR - Schedule NEC (SP)?

The purpose of IRS 1040-NR - Schedule NEC (SP) is to report U.S. source income that is not effectively connected to a trade or business, allowing the IRS to assess the appropriate tax.

What information must be reported on IRS 1040-NR - Schedule NEC (SP)?

The information that must be reported on IRS 1040-NR - Schedule NEC (SP) includes details of income from U.S. sources, exemptions or deductions claimed, and the resulting tax calculation.

Fill out your IRS 1040-NR - Schedule NEC SP online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1040-NR - Schedule NEC SP is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.