1120-H 2003-2025 free printable template

Show details

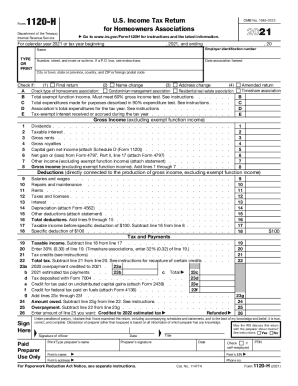

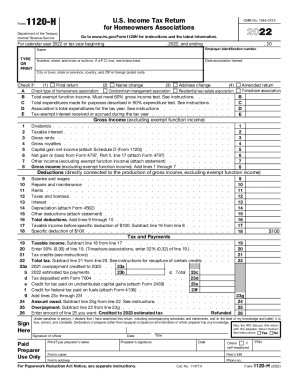

Cat. No. 11477H Form 1120-H 2003 How To Get Forms and Publications Personal computer. You can access the IRS website 24 hours a day 7 days a week at www.irs.gov to Order IRS products online. Specific Instructions Period covered. File the 2003 return for calendar year 2003 and fiscal years that begin fill in the tax year space at the top of the form. Note The 2003 Form 1120-H may also be used 12 months that begins and ends in 2004 and b the 2004 Form 1120-H is not available at the on the 2003...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax 1120 h form

Edit your income tax 1120 h form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your return 1120 h form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing income 1120 h form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit homeowners associations 1120 h form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out associations 1120 h form

How to fill out 1120-H

01

Gather all necessary financial documents for the homeowners association.

02

Calculate total income received by the association during the tax year.

03

Determine deductible expenses such as maintenance costs, utilities, and management fees.

04

Complete Form 1120-H, starting with the basic identification information of the association.

05

Report total income in Part I of the form.

06

List deductible expenses in Part II of the form.

07

Calculate taxable income in Part III; ensure it is zero or less to qualify for tax exemption.

08

Sign and date the form, ensuring that it is filed before the deadline, typically the 15th day of the 4th month after the end of the tax year.

Who needs 1120-H?

01

Homeowners associations that qualify as a tax-exempt entity under Section 528 of the Internal Revenue Code.

02

Community associations that primarily receive income from members and operate on a non-profit basis.

Fill

income return 1120 h

: Try Risk Free

People Also Ask about return 1120 h

What is the difference between form 1120 and form 1120h?

Form 1120 is used by C corporations while 1120-H is a tax form specifically designed for qualifying HOAs. What makes HOAs unique is the ability to file two different tax returns and the ability to change those forms each year. For that tax year the rules of each of the respective forms will govern the tax criteria.

Can form 1120-H be filed electronically?

The 1120H, U.S. Income Tax return for a Homeowners Association, cannot be electronically filed. It can be generated for paper-filing by creating a corporate return, going to the first Other Forms tab, and selecting the H 1120-H Homeowners Associations screen.

Is 1120-H tax exempt?

1) Form 1120-H applies to homeowners association electing to be taxed under this method. These associations pay tax on interest income and non exempt function income. Exempt function income is not taxed.

Is 1120-H taxable income?

Form 1120-H is the income tax return for homeowners associations. Compared to Form 1120, this form allows for a more simplified HOA tax filing process. It also allows HOAs to enjoy certain tax benefits that are outlined in Section 528 of the Internal Revenue Code.

What is an 1120-H form?

A homeowners association files Form 1120-H as its income tax return to take advantage of certain tax benefits. These benefits, in effect, allow the association to exclude exempt function income (defined later) from its gross income. Electing To File Form.

What is the difference between tax form 1120 and 1120H?

Form 1120 is used by C corporations while 1120-H is a tax form specifically designed for qualifying HOAs. What makes HOAs unique is the ability to file two different tax returns and the ability to change those forms each year. For that tax year the rules of each of the respective forms will govern the tax criteria.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send homeowners 1120 h form for eSignature?

When your tax 1120 h is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make edits in return homeowners associations 1120 h without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your tax return 1120 h, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for the associations 1120 h in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your u return 1120 h and you'll be done in minutes.

What is 1120-H?

Form 1120-H is a tax return specifically designed for homeowners associations (HOAs) to report their income, deductions, and tax liability.

Who is required to file 1120-H?

Homeowners associations that meet certain criteria, including being a qualified homeowners association with at least 85% of their income from member assessments and other non-member sources, are required to file Form 1120-H.

How to fill out 1120-H?

To fill out Form 1120-H, the association must complete sections that report income, deductions, and the calculated taxable income. It's important to gather financial records to ensure accurate reporting of all income and expenses.

What is the purpose of 1120-H?

The purpose of Form 1120-H is to provide a simplified way for homeowners associations to report their income and expenses to the IRS and calculate the tax owed on any taxable income.

What information must be reported on 1120-H?

Information that must be reported on Form 1120-H includes total income, allowable deductions, net income, and the tax liability, as well as general information about the association such as its name, address, and Employer Identification Number (EIN).

Fill out your 1120-H online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

U 1120 H Form is not the form you're looking for?Search for another form here.

Keywords relevant to income return 1120h

Related to s tax 1120 h

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.