T.C. Form 5 2008 free printable template

Show details

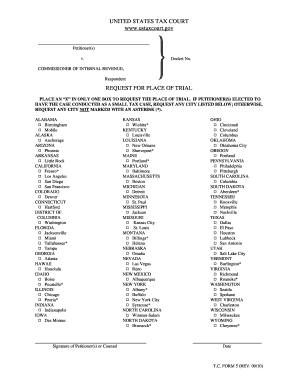

UNITED STATES TAX COURT www.ustaxcourt.gov Petitioner(s) v. COMMISSIONER OF INTERNAL REVENUE, Respondent Docket No. REQUEST FOR PLACE OF TRIAL Place an X” in only one box to request your place of

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign request for place of

Edit your request for place of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for place of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing request for place of online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit request for place of. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

T.C. Form 5 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out request for place of

How to fill out T.C. Form 5

01

Gather the necessary documents required for T.C. Form 5.

02

Begin by filling out the applicant's personal information, including name and contact details.

03

Specify the purpose of filling the form in the designated section.

04

Provide necessary identification details, such as ID number or passport number.

05

Complete the section regarding the requested information or services.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form at the end.

08

Submit the completed T.C. Form 5 to the appropriate authority or organization.

Who needs T.C. Form 5?

01

Individuals applying for specific services or documents that require T.C. Form 5.

02

Students and parents needing official records related to education.

03

Anyone needing to verify personal information for legal or administrative purposes.

Fill

form

: Try Risk Free

People Also Ask about

Why would a taxpayer want to file a Tax Court petition?

To protect yourself against an unagreed assessment of tax or collection action, you should file a petition within the period set forth in the notice. You may also wish to contact the IRS about the status of your case.

How many days do you have to petition the Tax Court?

Once you receive your notice, you have 90 days (150 days if the notice is addressed to a person who is outside the country) from the date of the notice to file a petition with the Tax Court, if you want to challenge the tax we proposed.

What is the purpose of Tax Court?

The mission of the United States Tax Court is to provide a national forum for the expeditious resolution of disputes between taxpayers and the Internal Revenue Service; for careful consideration of the merits of each case; and to ensure a uniform interpretation of the Internal Revenue Code.

What does it mean to file a petition with the Tax Court?

Congress created the Tax Court as an independent judicial authority for taxpayers disputing certain IRS determinations. The Tax Court's authority to resolve these disputes is called its jurisdiction. Generally, a taxpayer may file a petition in the Tax Court in response to certain IRS determinations.

How do I appeal to Tax Court?

The notice of appeal must be filed with the Tax Court within 90 days after the decision is entered, or 120 days if the IRS appeals first. The cost for filing a notice of appeal depends on the Federal Circuit Court to which the appeal is being made but generally costs $500-$505.

What is the difference between a small case and a regular case in Tax Court?

Small Tax Case or Regular Tax Case “Small tax cases” are handled under simpler, less formal procedures than regular cases. However, the Tax Court's decision in a small tax case cannot be appealed to a Court of Appeals by the IRS or by the taxpayer(s).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete request for place of online?

pdfFiller makes it easy to finish and sign request for place of online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit request for place of online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your request for place of to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I sign the request for place of electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your request for place of in minutes.

What is T.C. Form 5?

T.C. Form 5 is a specific form required by tax authorities that provides detailed information about certain financial transactions or financial statuses for compliance and reporting purposes.

Who is required to file T.C. Form 5?

Individuals or entities engaged in applicable financial activities or transactions that fall under the jurisdiction of the tax authority are required to file T.C. Form 5.

How to fill out T.C. Form 5?

To fill out T.C. Form 5, one must gather the necessary financial information, accurately complete all required fields on the form, and submit it according to the instructions provided by the tax authority.

What is the purpose of T.C. Form 5?

The purpose of T.C. Form 5 is to ensure compliance with tax regulations by reporting necessary financial details, helping the tax authority assess tax liabilities and other compliance-related matters.

What information must be reported on T.C. Form 5?

T.C. Form 5 typically requires reporting of financial transactions, income details, deductions, and any other relevant financial data as specified in the form's instructions.

Fill out your request for place of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Place Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.