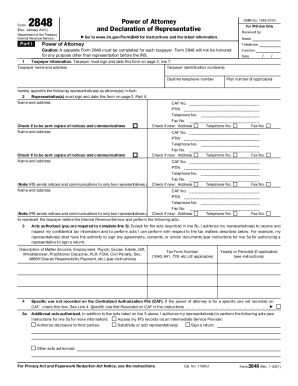

IRS 2848 2004 free printable template

Show details

Revenue for the following tax matter(s) (specify the type(s) of tax and year(s) or period(s) (date of ... You may file a power of attorney without using Form M-2848,

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 2848

How to edit IRS 2848

How to fill out IRS 2848

Instructions and Help about IRS 2848

How to edit IRS 2848

To edit IRS Form 2848, utilize the features provided by pdfFiller, which allows you to seamlessly modify the form. You can adjust any incorrect or outdated information directly in the PDF format. After making the necessary edits, ensure to save your changes before printing or electronically submitting the form.

How to fill out IRS 2848

Filling out IRS Form 2848 involves detailing the taxpayer's basic information and designating the authorized individuals. Follow these steps for accurate completion:

01

Begin by entering the taxpayer's name, address, and taxpayer identification number (TIN).

02

Provide the representative's name and contact information, ensuring accurate representation.

03

List the specific tax matters and tax periods for which representation is requested.

04

Sign and date the form at the bottom to validate the information provided.

About IRS 2 previous version

What is IRS 2848?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 2 previous version

What is IRS 2848?

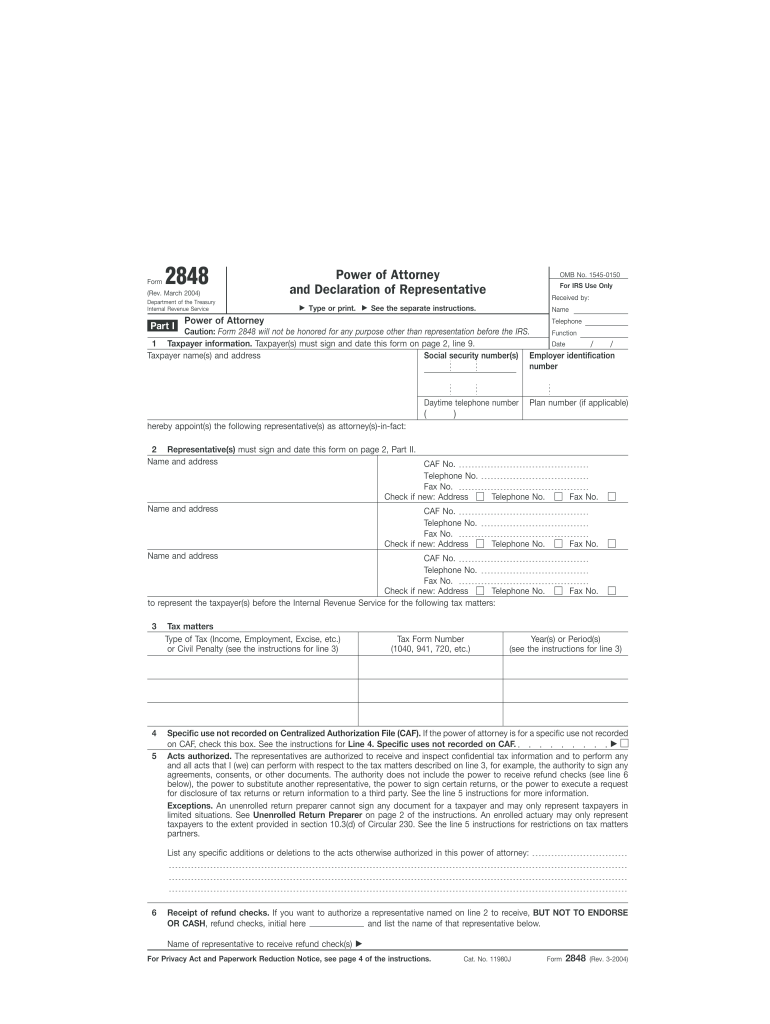

IRS Form 2848 is the Power of Attorney and Declaration of Representative. This form allows taxpayers to authorize individuals to represent them before the IRS in tax matters. It effectively grants authority to designated representatives to act on behalf of the taxpayer during interactions with the IRS.

What is the purpose of this form?

The primary purpose of IRS Form 2848 is to formally establish a representative-client relationship. This enables the representative to receive and discuss tax information with the IRS, manage tax matters, and perform duties like filing returns or making payments on behalf of the taxpayer.

Who needs the form?

Taxpayers who wish to designate someone, such as a tax professional or attorney, to handle their tax affairs should use IRS Form 2848. This is particularly relevant for individuals needing assistance with audits, tax returns, or responding to IRS inquiries.

When am I exempt from filling out this form?

Exemptions from filing IRS Form 2848 include situations where representation is not required, such as when taxpayers handle their own tax matters or when the IRS is directly contacted without the need for a representative.

Components of the form

IRS Form 2848 comprises several critical components, including the taxpayer's personal information, details of the designated representative, specific tax issues involved, and signatures for authorization. Each section must be accurately filled to ensure effective representation.

Due date

There is no specific due date for submitting IRS Form 2848, as it is typically filed whenever representation is needed. However, it is advisable to submit the form before engaging the representative in any discussions with the IRS to ensure proper authorization.

What are the penalties for not issuing the form?

Failing to issue IRS Form 2848 when necessary may result in the inability of the representative to act on behalf of the taxpayer. This could lead to complications in handling tax matters, including missed deadlines or miscommunication with the IRS.

What information do you need when you file the form?

When filing IRS Form 2848, collect the following information: the taxpayer's name, address, TIN, a detailed description of the tax matters, the name and contact information of the representative, and both parties' signatures. This information is essential for proper authorization and representation.

Is the form accompanied by other forms?

Typically, IRS Form 2848 does not need to be accompanied by additional forms; however, it can be helpful to submit it with any pertinent tax documents related to the specific matters being addressed by the representative.

Where do I send the form?

Send IRS Form 2848 to the individual IRS office that corresponds with the taxpayer's primary tax matters. This may vary based on the type of tax issues at hand and the representative's location. Always verify the current mailing addresses on the IRS website for accuracy.

See what our users say