Get the free Form 6478

Show details

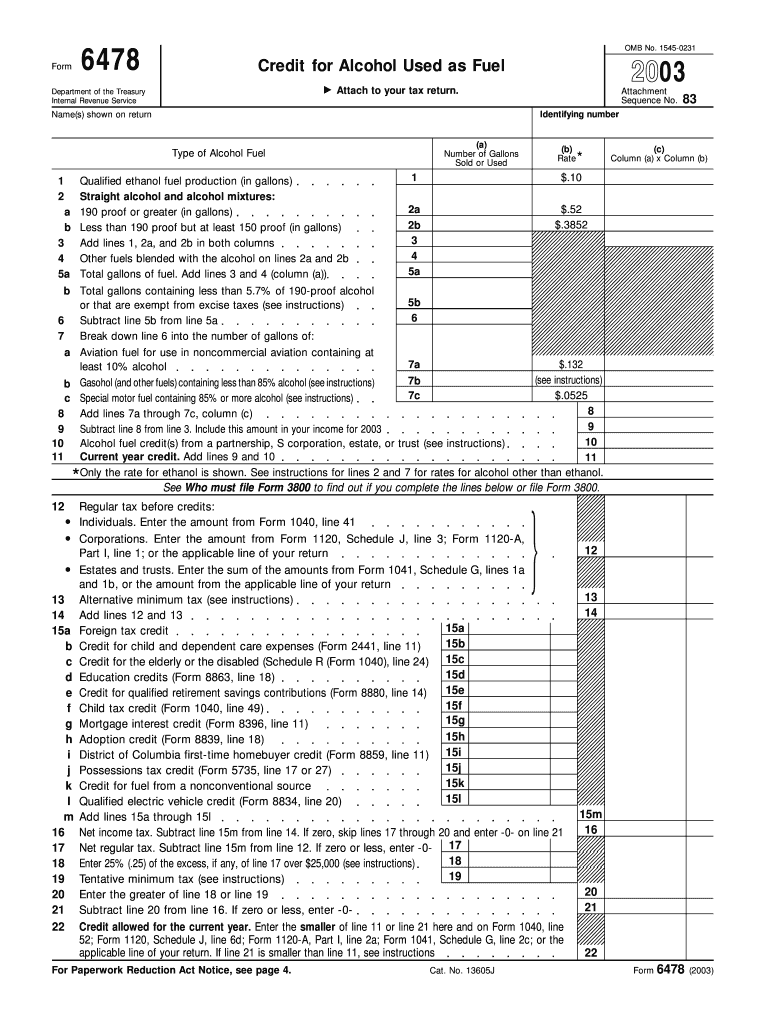

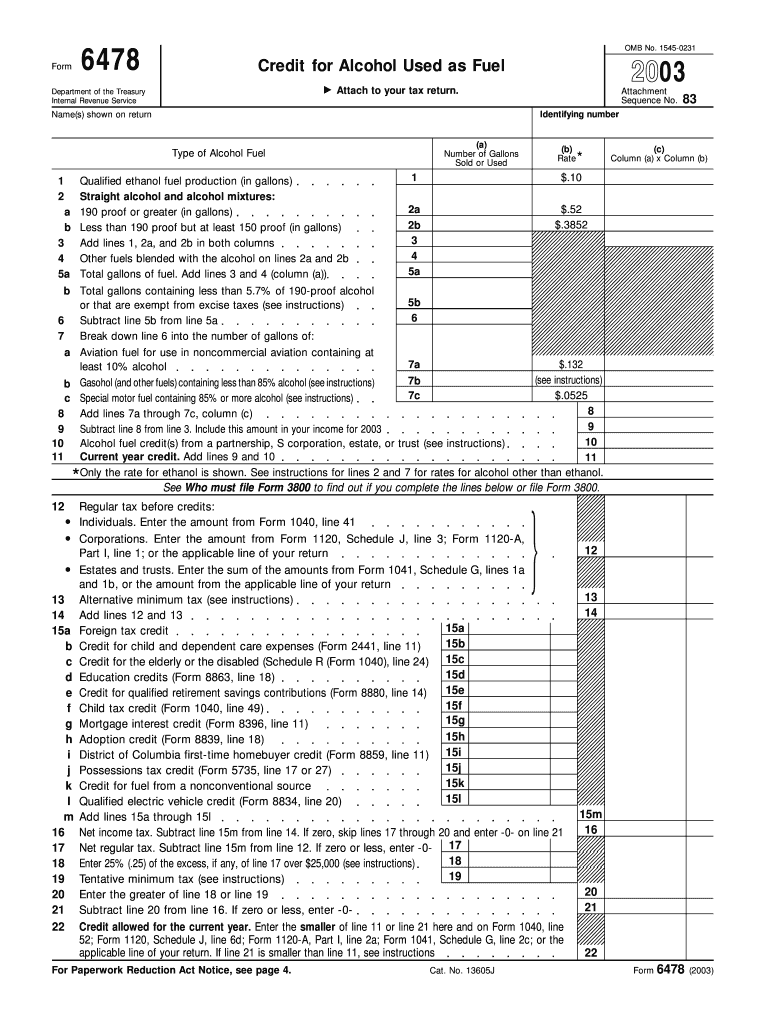

Use Form 6478 to figure your credit for alcohol used as fuel. This credit consists of the alcohol mixture credit, alcohol credit, and small ethanol producer credit, applicable for the tax year in

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 6478

Edit your form 6478 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 6478 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 6478 online

Follow the guidelines below to use a professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 6478. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 6478

How to fill out Form 6478

01

Obtain Form 6478 from the IRS website or your tax preparer.

02

Enter your name, address, and taxpayer identification number at the top of the form.

03

In Part I, calculate your eligible biofuel mixtures by entering the volume of biofuel used.

04

Calculate the tax credit amount based on the applicable rates for the biofuel used.

05

Complete Part II if you were involved in certain transactions, like reselling the biofuel.

06

Review the instructions on the form for any specific guidance related to your situation.

07

Sign and date the form before submitting it with your tax return.

Who needs Form 6478?

01

Businesses and individuals who blend biofuels with traditional fuels to produce fuel mixtures.

02

Taxpayers eligible for the biofuel mixture credit under Section 6426 of the Internal Revenue Code.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax credit for second generation biofuel producers?

Under current law, a second-generation biofuel producer may be eligible for a tax incentive in the amount of up to $1.01 per gallon of second-generation biofuel. The incentive is allowed as a credit against the producer's income tax liability.

What is the 30% IRS tax credit for biomass stoves?

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation: 2022: 30%, up to a lifetime maximum of $500. 2023 through 2032: 30%, up to a maximum of $1,200 (heat pumps, biomass stoves and boilers have a separate annual credit limit of $2,000), no lifetime limit.

What is the biodiesel producer tax credit for 2025?

January 19, 2025 Effective since January 1, 2025, the 45Z regime provides a credit of up to: $1.00 per gallon for the production of over-the-road biofuels (e.g., biodiesel, renewable diesel) $1.75 for the production of sustainable aviation fuel.

What is tax form 6478?

IRS Form 6478 is used to calculate the section 40 biofuel producer credit for tax years beginning after 2017. The credit is claimed for the tax year in which the sale or use occurs. This credit consists of the second generation biofuel producer credit.

What is the second-generation of biofuel production?

Second-generation biofuel feedstocks include specifically grown inedible energy crops, cultivated inedible oils, agricultural and municipal wastes, waste oils, and algae. Nevertheless, cereal and sugar crops are also used as feedstocks to second-generation processing technologies.

What is the 40a tax credit for biodiesel?

(A) In general. The biodiesel mixture credit of any taxpayer for any taxable year is $1.00 for each gallon of biodiesel used by the taxpayer in the production of a qualified biodiesel mixture. (ii) is used as a fuel by the taxpayer producing such mixture. (ii) for the taxable year in which such sale or use occurs.

What is form 8859?

Use Form 8859 to claim a carryforward of the District of Columbia first-time homebuyer credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 6478?

Form 6478 is a tax form used by taxpayers to calculate the biodiesel and renewable diesel fuel credit under the Internal Revenue Code.

Who is required to file Form 6478?

Taxpayers who blend, sell, or use biodiesel or renewable diesel in their trade or business are required to file Form 6478 to claim the fuel tax credit.

How to fill out Form 6478?

To fill out Form 6478, taxpayers must provide information regarding the types and amounts of biodiesel or renewable diesel they used or produced, along with calculations of the applicable credits, and submit it to the IRS with their tax return.

What is the purpose of Form 6478?

The purpose of Form 6478 is to allow taxpayers to claim credits for the use of biodiesel and renewable diesel, promoting the use of renewable fuels and reducing carbon emissions.

What information must be reported on Form 6478?

Form 6478 requires taxpayers to report the total gallons of biodiesel and renewable diesel used or produced, the type of fuel used, as well as any previous credits claimed and any adjustments to prior claims.

Fill out your form 6478 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 6478 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.