Get the free W-8ECI

Show details

This form is used by foreign persons to claim an exemption from U.S. withholding tax on income that is effectively connected with the conduct of a trade or business in the United States. The beneficial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign w-8eci

Edit your w-8eci form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w-8eci form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit w-8eci online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit w-8eci. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

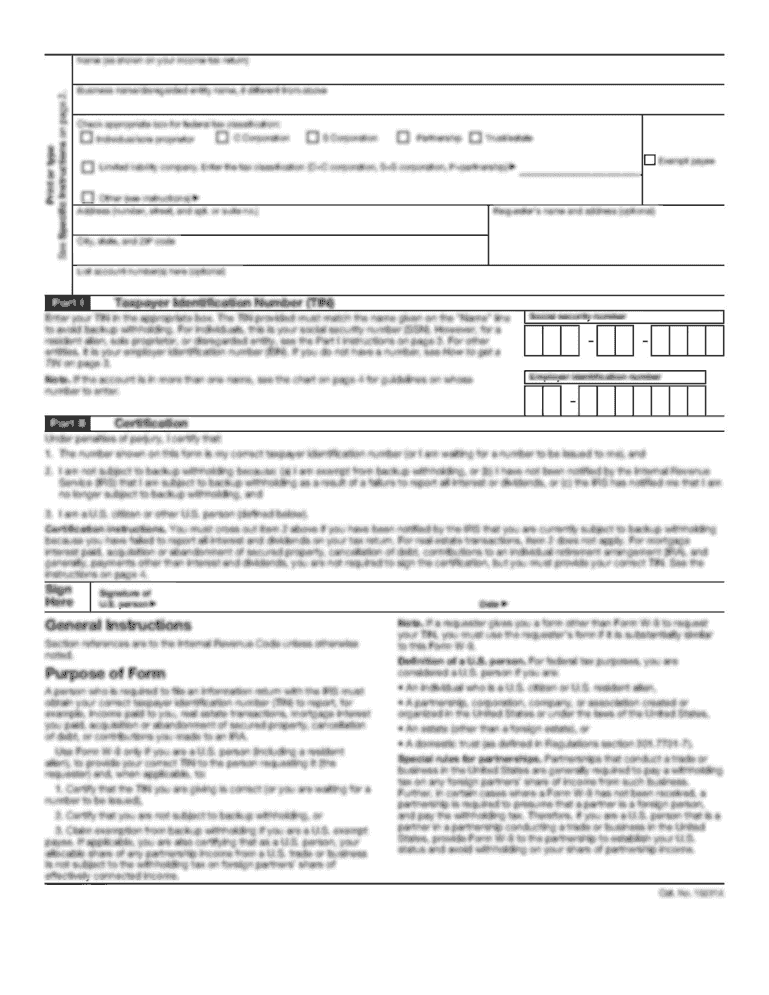

How to fill out w-8eci

How to fill out W-8ECI

01

Obtain a Form W-8ECI from the IRS website or your tax advisor.

02

Fill in your name in line 1 of the form.

03

In line 2, enter your country of citizenship.

04

Fill in your permanent address in line 3, ensuring it's outside the United States.

05

If applicable, fill in your mailing address in line 4.

06

Complete lines 5 and 6, providing your U.S. taxpayer identification number (if applicable) and foreign tax identifying number.

07

In line 7, specify the type of income you are receiving that is effectively connected with a U.S. trade or business.

08

Sign and date the form at the bottom.

Who needs W-8ECI?

01

Foreign individuals or entities that receive income effectively connected with a U.S. trade or business.

02

Non-U.S. businesses that want to claim a reduced withholding rate under a tax treaty.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between w8 Ben E and w8 ECI?

Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding. Form W-8ECI, Certificate of Foreign Person's Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States.

Who should use the W-8ECI?

You must give Form W-8ECI to the withholding agent or payer if you are a foreign person and you are the beneficial owner of U.S. source income that is (or is deemed to be) effectively connected with the conduct of a trade or business within the United States or are an entity (including a foreign partnership or foreign

What does w-8ECI mean?

Form W-8ECI is the "Certificate of Foreign Person's Claim for Exemption that Income Is Effectively Connected with the Conduct of a Trade or Business in the United States." It is filed by foreign individuals who engage in a trade or business in the United States and receive income from U.S. sources. 9.

What is an NFFE w-8BEN E?

FFI = Foreign financial institution • NFFE = Non-financial foreign entity • Active NFFE = an NFFE that has less than 50% of its gross income from the preceding calendar year from passive income and less than 50% of the assets held by the NFFE are assets that produce or are held for the production of passive income.

What is an ECI certificate?

Technical Certification Program An Environmental Compliance Inspector (ECI) inspects industrial, commercial and municipal activities to ensure compliance with U.S. Environmental Protection Agency (EPA), State Water Board, Regional Water Quality Control Board (RWQCB,) and local regulations and ordinances.

Who needs to fill out form w-8BEN e?

Who Must Provide Form W-8BEN-E. You must give Form W-8BEN-E to the withholding agent or payer if you are a foreign entity receiving a withholdable payment from a withholding agent, receiving a payment subject to chapter 3 withholding, or if you are an entity maintaining an account with an FFI requesting this form.

Does a W-8ECI expire?

Generally, a Form W-8ECI will remain in effect for a period starting on the date the form is signed and ending on the last day of the third succeeding calendar year, unless a change in circumstances makes any information on the form incorrect.

Who needs to fill out W-8BEN E?

Who Must Provide Form W-8BEN-E. You must give Form W-8BEN-E to the withholding agent or payer if you are a foreign entity receiving a withholdable payment from a withholding agent, receiving a payment subject to chapter 3 withholding, or if you are an entity maintaining an account with an FFI requesting this form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is W-8ECI?

W-8ECI is a form used by foreign entities to certify that the income they receive is effectively connected with the conduct of a trade or business in the United States.

Who is required to file W-8ECI?

Foreign entities that receive income effectively connected with a U.S. trade or business must file W-8ECI.

How to fill out W-8ECI?

To fill out W-8ECI, provide the foreign entity's name, address, and taxpayer identification number, and specify the nature of the income being received.

What is the purpose of W-8ECI?

The purpose of W-8ECI is to establish a foreign entity's claim for a reduced withholding tax rate on income that is effectively connected with a U.S. trade or business.

What information must be reported on W-8ECI?

The information that must be reported on W-8ECI includes the name of the foreign entity, its address, taxpayer identification number, and the type of income being received.

Fill out your w-8eci online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

W-8eci is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.