Get the free ARKANSAS DEVELOPMENT FINANCE AUTHORITY (ADFA) HOME PROGRAM - state ar

Show details

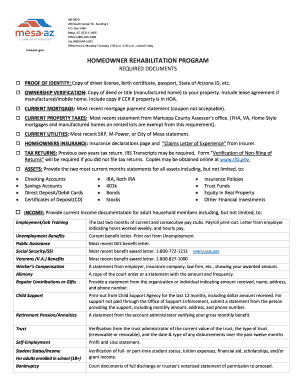

This document serves as an application form for the Tenant-Based Rental Assistance under the HOME program, detailing instructions for submission, required documentation, and guidelines for applicants

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign arkansas development finance authority

Edit your arkansas development finance authority form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arkansas development finance authority form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit arkansas development finance authority online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit arkansas development finance authority. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out arkansas development finance authority

How to fill out ARKANSAS DEVELOPMENT FINANCE AUTHORITY (ADFA) HOME PROGRAM

01

Obtain the ADFA HOME Program application form from the Arkansas Development Finance Authority website or office.

02

Read the instructions and eligibility requirements carefully.

03

Gather necessary documents, including proof of income, household size, and residency.

04

Complete the application form, ensuring all required information is provided accurately.

05

Attach required supporting documents as specified in the application instructions.

06

Review your application for completeness and accuracy.

07

Submit your application by the specified deadline, either online or by mail to the appropriate ADFA office.

08

Follow up with the ADFA to confirm receipt of your application and inquire about the review process.

Who needs ARKANSAS DEVELOPMENT FINANCE AUTHORITY (ADFA) HOME PROGRAM?

01

Low-income families seeking assistance for homeownership or housing rehabilitation.

02

Individuals or organizations needing financial support for affordable housing development.

03

Persons looking for grants or loans to improve existing residential properties.

04

Community organizations involved in housing initiatives or advocacy.

Fill

form

: Try Risk Free

People Also Ask about

What is the start smart program in Arkansas?

The StartSmart First-Time Homebuyer Loan Program by ADFA harnesses the power of IRS tax-exempt mortgage revenue bonds to bring you substantial savings on your home purchase.

Who qualifies for first time home buyer in Arkansas?

Arkansas first-time homebuyer qualifications Have a minimum 640 credit score. Buy a home worth below $424,100 (varies by program) Earn less than $124,040 annually (depending on program county and household size) Use the home as a primary residence.

What are the requirements for first-time home buyers in Arkansas?

To qualify for Arkansas first-time homebuyer programs, applicants typically must: Be a first-time homebuyer. Have a minimum 640 credit score. Buy a home worth below $424,100 (varies by program) Earn less than $124,040 annually (depending on program county and household size) Use the home as a primary residence.

What is the minimum credit score to buy a house in Arkansas?

Lenders also use your credit scores to help set your interest rate and other loan terms. Most conventional mortgages require first-time homebuyers to have a minimum credit score of 620 for approval.

What is the Arkansas Home Assistance Program?

The Arkansas Homeowner Assistance Fund (HAF) is a federally funded program helping Arkansas residents who are behind on their mortgages, electricity, gas and/or internet payments.

What is the minimum income to qualify for first-time home buyers?

Here are some general FHA loan requirements: A credit score of 580 or higher: A lender may accept credit scores of 500 to 579 under certain conditions. However, a credit score lower than 580 will require a larger down payment, typically 10%.

What is an ADFA loan?

ADFA has programs that not only help Arkansas first time homebuyers with down payment assistance, but they also offer a below market interest rate mortgage loan with a lower monthly payment making purchasing a home more affordable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ARKANSAS DEVELOPMENT FINANCE AUTHORITY (ADFA) HOME PROGRAM?

The Arkansas Development Finance Authority (ADFA) HOME Program is a federal initiative designed to provide financial assistance to states for affordable housing projects. It aims to create homeownership opportunities and improve housing conditions for low-income families.

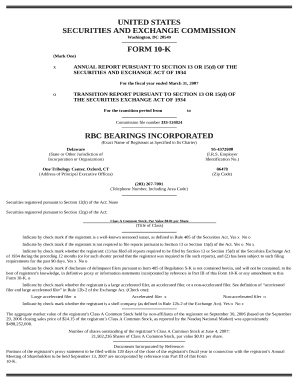

Who is required to file ARKANSAS DEVELOPMENT FINANCE AUTHORITY (ADFA) HOME PROGRAM?

Organizations and developers that receive HOME Investment Partnerships Program (HOME) funds from the ADFA are required to file reports related to the program.

How to fill out ARKANSAS DEVELOPMENT FINANCE AUTHORITY (ADFA) HOME PROGRAM?

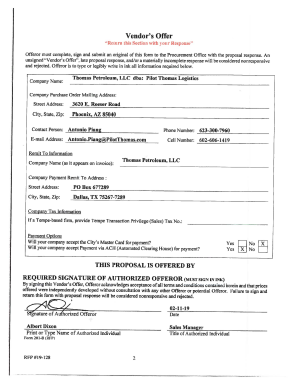

To fill out the ADFA HOME Program forms, applicants must provide detailed information about their housing projects, including budgets, project timelines, compliance with regulations, and the demographic information of the beneficiaries.

What is the purpose of ARKANSAS DEVELOPMENT FINANCE AUTHORITY (ADFA) HOME PROGRAM?

The purpose of the ADFA HOME Program is to increase the availability and affordability of housing for low-income individuals and families, thereby enhancing community development and economic stability.

What information must be reported on ARKANSAS DEVELOPMENT FINANCE AUTHORITY (ADFA) HOME PROGRAM?

Reports must include information on project progress, expenditures of funds, compliance with civil rights and fair housing laws, demographic details of beneficiaries, and any challenges faced during the project implementation.

Fill out your arkansas development finance authority online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arkansas Development Finance Authority is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.