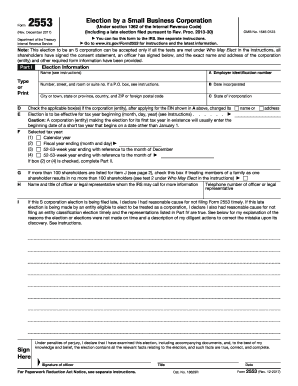

IRS 2553 2002 free printable template

Instructions and Help about IRS 2553

How to edit IRS 2553

How to fill out IRS 2553

About IRS 2 previous version

What is IRS 2553?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 2553

What should I do if I realize I made a mistake after submitting my irs form 2553 fill?

If you discover an error after filing, you can submit an amended irs form 2553 fill to correct it. Be sure to clearly indicate that it is an amended form and include a detailed explanation of the changes. It's also advisable to keep documentation of your original submission and any correspondence regarding the amendment.

How can I check the status of my irs form 2553 fill after submission?

To verify the receipt and processing of your irs form 2553 fill, you can contact the IRS directly or check their online tools if available. Common rejection codes for e-filing can also be found through the IRS website, which may help you understand any issues with your submission.

Are there specific data security measures I should consider when submitting my irs form 2553 fill electronically?

When e-filing your irs form 2553 fill, ensure that you are using secure internet connections and trusted software. Check if the e-filing service complies with IRS data security standards, as this will protect your personal information during submission.

What should I do if I receive a notice from the IRS regarding my irs form 2553 fill?

If you receive a notice, it is crucial to read it carefully and understand what issues may have arisen with your irs form 2553 fill. Prepare any necessary documentation and respond within the specified timeframe to avoid penalties or further complications.

See what our users say