Get the free Form 211 CSV

Show details

Dieses Formular wird verwendet, um die Bruttoeinnahmensteuererklärung für Kabel-, Satelliten- und Videoanbieter in Connecticut einzureichen.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 211 csv

Edit your form 211 csv form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 211 csv form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 211 csv online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 211 csv. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 211 csv

How to fill out Form 211 CSV

01

Obtain a blank Form 211 CSV from the appropriate authority or website.

02

Start by filling in your personal information in the designated fields, including your name, address, and contact details.

03

Provide any required identification or tax numbers as specified on the form.

04

Fill out the sections regarding the services or information you are requesting or reporting.

05

Ensure all fields are completed accurately and clearly.

06

Review the form for any errors or omissions before submission.

07

Submit the completed form as per the instructions provided, either electronically or via postal mail.

Who needs Form 211 CSV?

01

Individuals or businesses applying for certain permits or licenses.

02

Entities needing to report specific information to regulatory agencies.

03

Anyone seeking services that require formal documentation.

04

Professionals in need of compliance with local government regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is the 21 CFR Part 11 statement?

Persons who use closed systems to create, modify, maintain, or transmit electronic records shall employ procedures and controls designed to ensure the authenticity, integrity, and, when appropriate, the confidentiality of electronic records, and to ensure that the signer cannot readily repudiate the signed record as

What is 21 CFR Part 11 in csv?

21 CFR Part 11 is a law that ensures companies implement good business practices. Part 11 allows a company to implement computer systems that will greatly increase the efficiency of individuals, reduce errors by identifying risks, and increase overall productivity of the company.

What are the guidelines for CSV?

This Computer Systems Validation Guide is based on the following approaches: Risk-based approach. Approach based on the life cycle of the system. Approach on “V”-model for development and system test. Approach based on the process which serves the system. Approach on GAMP category system.

What is the difference between 21 CFR 210 and 211?

Difference between 21 CFR Part 210 and 211 Where Part 210 covers manufacturing, facilities and controls, Part 211 covers additional areas for finished drug products, such as labeling, production processes, equipment management and personnel.

What is CSV in regulatory affairs?

Computer System Validation (CSV) is a process used in the pharmaceutical, healthcare, and other regulated industries to ensure that computerized systems are designed, developed, and operated in a manner that meets predefined requirements and regulatory guidelines.

What is 21 CFR Part 11 for CSV?

21 CFR Part 11 compliant software plays an important role in helping organizations securely manage electronic records and signatures. Such software ensures compliance with FDA regulations through features like audit trails, data security, electronic signature management, and automated recordkeeping.

What is 21 CFR Part 11 in simple words?

What Is 21 CFR Part 11? 21 CFR Part 11 states that electronic records and electronic signatures are treated the same as paper records and handwritten signatures. Regulated companies with any documents or records in electronic format must comply with the regulation.

What is the CFR 21 Part 11 standard?

21 CFR Part 11 requires regulated businesses to make sure electronic records and signatures are “trustworthy, reliable, and generally equivalent to paper records and handwritten signatures executed on paper” (CFR Part 11.1 (a)).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

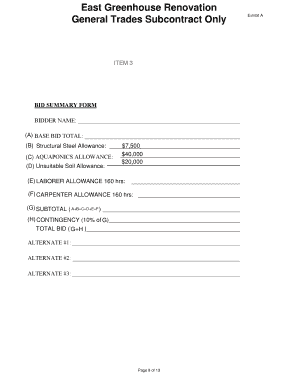

What is Form 211 CSV?

Form 211 CSV is a specific form used to report information related to the submission of claims for tax refund or tax credits in a CSV format.

Who is required to file Form 211 CSV?

Individuals or entities submitting claims for tax refunds or credits that require detailed reporting in a CSV format are required to file Form 211 CSV.

How to fill out Form 211 CSV?

To fill out Form 211 CSV, individuals must enter their identifying information, details of the claim, and any supporting data in the specified CSV format according to the instructions provided for the form.

What is the purpose of Form 211 CSV?

The purpose of Form 211 CSV is to streamline the reporting process for tax refund claims or credits, ensuring accurate and efficient submission of relevant data.

What information must be reported on Form 211 CSV?

Form 211 CSV must report information such as taxpayer identification details, claim amounts, type of credits or refunds being requested, and supporting data necessary for processing the claims.

Fill out your form 211 csv online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 211 Csv is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.