IRS 8848 2002 free printable template

Show details

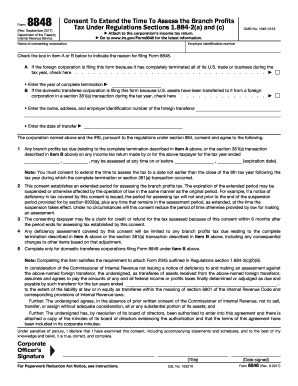

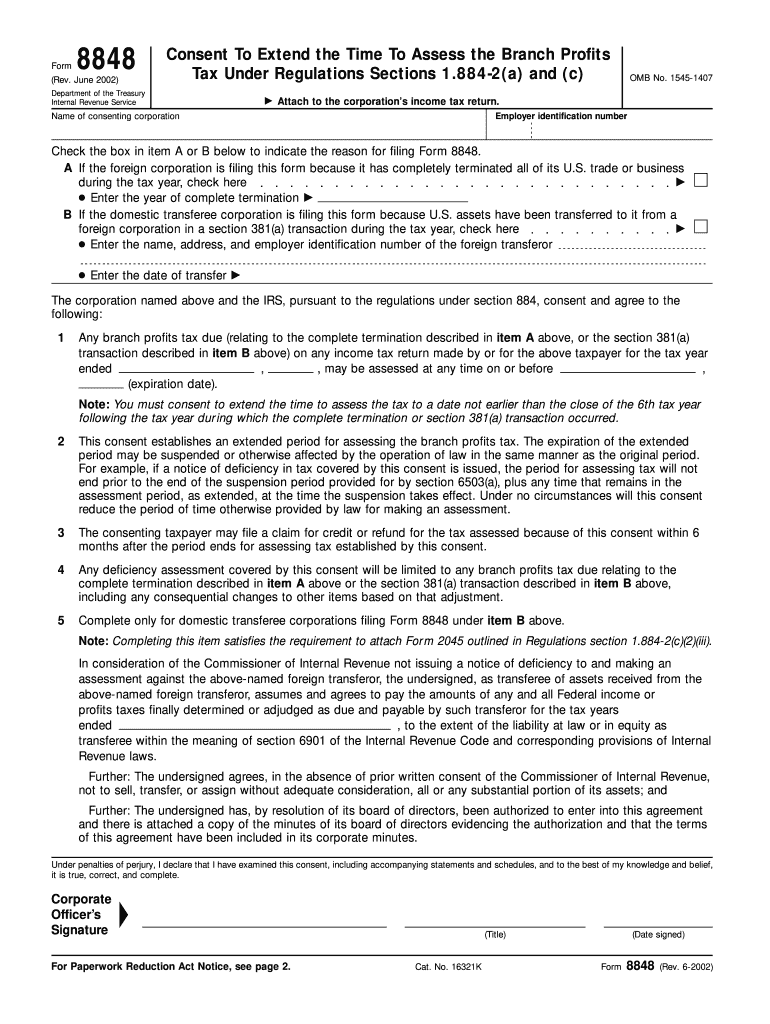

Form 8848 (Rev. June 2002) Consent To Extend the Time To Assess the Branch Profits Tax Under Regulations Sections 1.884-2(a) and Department of the Treasury Internal Revenue Service OMB No. 1545-1407

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8848

Edit your IRS 8848 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8848 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 8848 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 8848. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8848 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8848

How to fill out IRS 8848

01

Obtain IRS Form 8848 from the IRS website or tax office.

02

Fill out your name and address in the designated fields.

03

Provide your taxpayer identification number (TIN) in the appropriate section.

04

Specify the tax year for which you are filing the form.

05

Indicate the type of entity that you are reporting for (e.g., partnership, corporation).

06

Complete the relevant details about the foreign corporation or partnership, including its name and country of incorporation.

07

If applicable, provide information about income or adjusted gross income related to the foreign entity.

08

Review the form for accuracy and completeness.

09

Sign and date the form at the bottom.

10

Submit the form to the IRS by the specific due date outlined in the instructions.

Who needs IRS 8848?

01

U.S. taxpayers with interests in foreign corporations or partnerships.

02

Individuals or entities that have received certain types of income from foreign entities.

03

Taxpayers who need to report foreign partnerships under the provisions of U.S. tax law.

Fill

form

: Try Risk Free

People Also Ask about

What is the branch profits tax?

The purpose of the branch profits tax is to treat US operations of foreign corporations in much the same manner as US corporations owned by foreign persons. With certain exceptions, a 30% (or lower treaty rate) branch profits tax also will be imposed on interest payments by the US branch to foreign lenders.

What is Form 8848 used for?

About Form 8848, Consent to Extend the Time to Assess the Branch Profits Tax Under Regulations Sections 1.884-2T(a) and (c) | Internal Revenue Service.

Is form 8948 required?

If a taxpayer opts to paper file a tax return, or the return is unable to be e-filed, the preparer must include a Form 8948, Preparer Explanation for Not Filing Electronically, with the paper filed submission.

Where do I send my 8843 form?

If you don't have to file a 2022 tax return, mail Form 8843 to the Department of the Treasury, Internal Revenue Service Center, Austin, TX 73301-0215 by the due date (including extensions) for filing Form 1040-NR.

What is a 8843 tax form?

If you are an alien individual, file Form 8843 to explain the basis of your claim that you can exclude days present in the United States for purposes of the substantial presence test because you: Were an exempt individual. Were unable to leave the United States because of a medical condition or medical problem.

What is the IRS form for claiming dependents?

If you are the custodial parent, you can use Form 8332 to do the following. Release a claim to exemption for your child so that the noncustodial parent can claim an exemption for the child.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS 8848 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your IRS 8848 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I execute IRS 8848 online?

With pdfFiller, you may easily complete and sign IRS 8848 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit IRS 8848 straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing IRS 8848.

What is IRS 8848?

IRS Form 8848, also known as the 'Consent to Extend the Time to File a Return for Certain U.S. Citizens and Residents Living Abroad,' is a form used by certain U.S. citizens and resident aliens to request an extension of time to file their income tax returns.

Who is required to file IRS 8848?

U.S. citizens and resident aliens living abroad who need to obtain an extension for filing their tax return are required to file IRS Form 8848.

How to fill out IRS 8848?

To fill out IRS Form 8848, taxpayers need to provide their personal information, including their name, address, taxpayer identification number, and indicate the tax year for which they are requesting the extension.

What is the purpose of IRS 8848?

The purpose of IRS Form 8848 is to allow U.S. taxpayers living abroad to officially request additional time to file their income tax returns, ensuring they comply with U.S. tax regulations even when residing outside the country.

What information must be reported on IRS 8848?

IRS Form 8848 requires taxpayers to report their name, address, taxpayer identification number, the type of return for which the extension is being requested, and the reason for the extension request.

Fill out your IRS 8848 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8848 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.