Get the free Form 8882

Show details

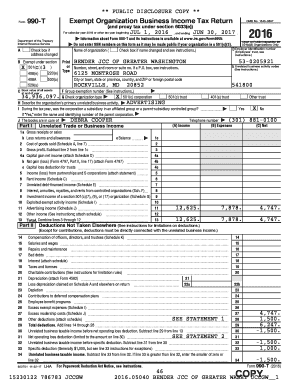

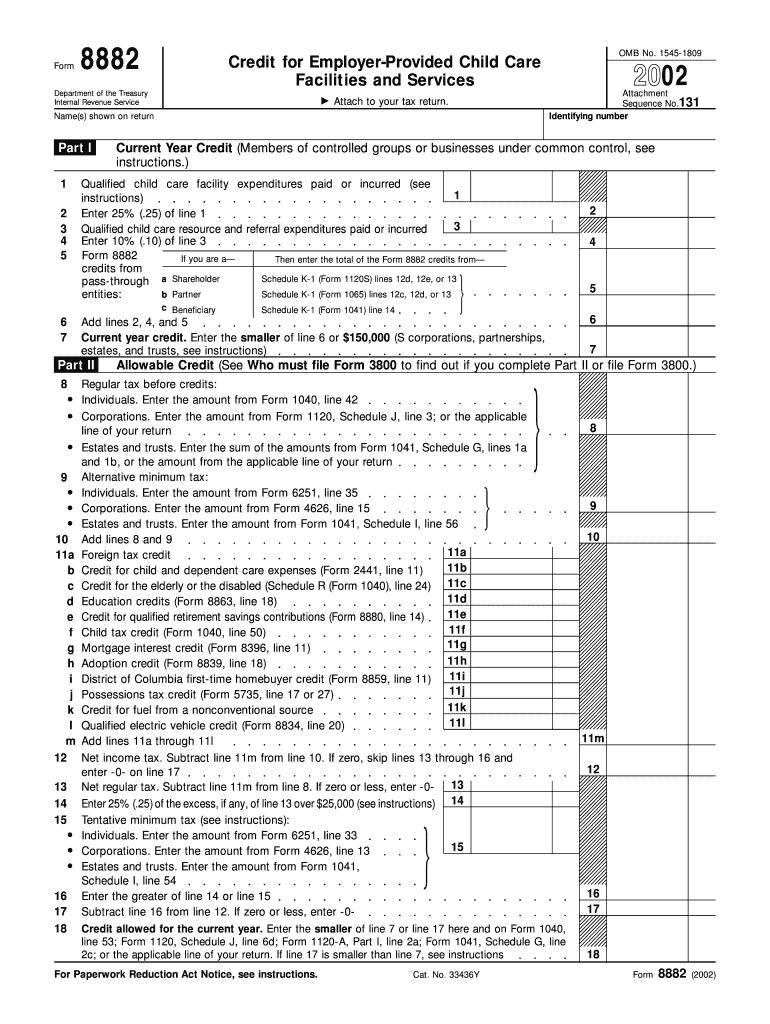

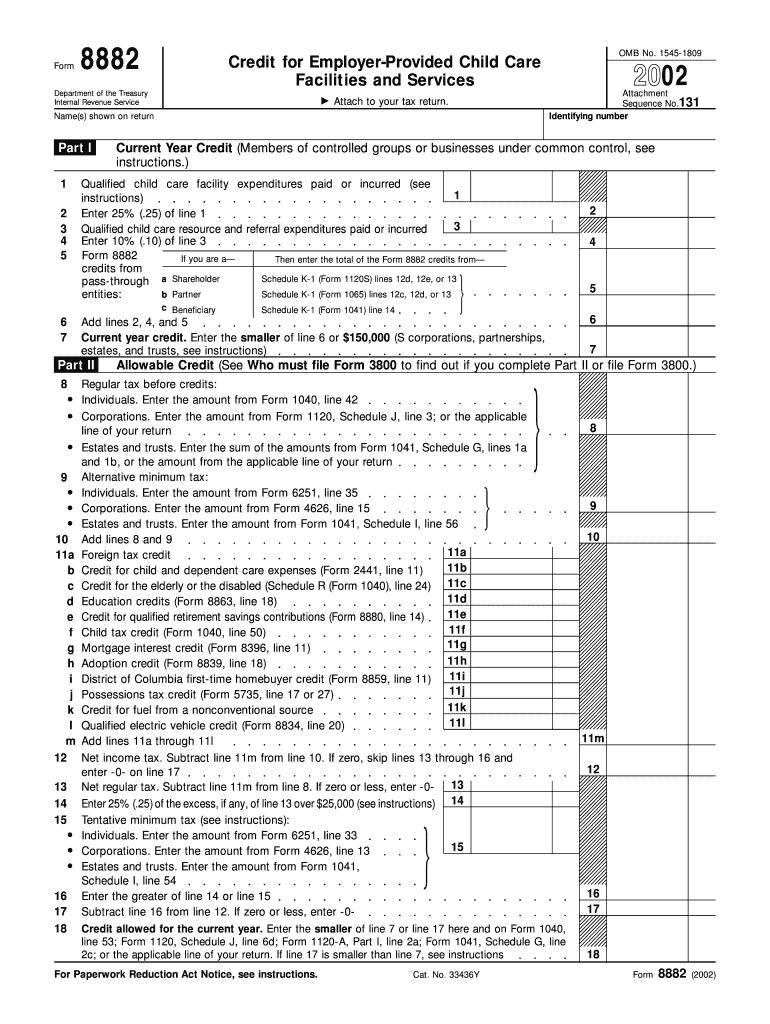

Employers use Form 8882 to claim the credit for qualified child care facility and resource and referral expenditures. The credit is part of the general business credit, allowing employers to deduct

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 8882

Edit your form 8882 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8882 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 8882 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 8882. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 8882

How to fill out Form 8882

01

Obtain a copy of Form 8882 from the IRS website or a tax professional.

02

Enter your personal information in the top section, including your name, address, and Social Security number.

03

Follow the instructions to report your qualified expenses in the designated sections.

04

Make sure to provide any required documentation to support your claims for expenses.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form before submission.

Who needs Form 8882?

01

Individuals who are claiming the credit for qualified adoption expenses.

02

Taxpayers who have adopted a child and are seeking tax benefits for related costs.

Fill

form

: Try Risk Free

People Also Ask about

What is 8882?

To claim the employer-provided childcare credit, businesses must fill out and file Form 8882. This form details the expenditures incurred and calculates the credit amount.

How do I notify the IRS of a change of address for my business?

Also, any entities that change their address or identity of their responsible party must file Form 8822-B, whether or not they are engaged in a trade or business. If you are a representative signing for the taxpayer, attach to Form 8822-B a copy of your power of attorney.

What form do I use to change my federal business address?

Form 8822-B is for businesses and other entities with an Employer Identification Number application on file. Use Form 8822-B to notify the Internal Revenue Service if you changed: Business mailing address. Business location.

What is form 8882 used for?

Employers use Form 8882 to claim the credit for qualified childcare facility and resource and referral expenditures. The credit is part of the general business credit. You may claim the credit any time within 3 years from the due date of your return on either an original or amended return.

How do I update my business address?

U.S. Postal Service Just visit the USPS official change-of-address site and follow the prompts to fill in your old information and new business address. (If you use your home address as your LLC's address and you move to a new home, you'll need to fill out a separate change-of-address form with your new contact info.)

What form do I need to change my address with the IRS?

You can use Form 8822 to notify the Internal Revenue Service if you changed your home mailing address. If this change also affects the mailing address for your children who filed income tax returns, complete and file a separate Form 8822 for each child.

What form do I need to change my business address with the IRS?

Use Form 8822-B to notify the Internal Revenue Service if you changed your business mailing address, your business location, or the identity of your responsible party.

What is the tax credit for employer-provided childcare?

The Employer-Provided Childcare Credit offers employers a tax credit up to $150,000 per year to offset 25% of qualified childcare facility expenditures and 10% of qualified childcare resource and referral expenditures. Find details in Internal Revenue Code (IRC) Section 45F. Paid someone to care for your child?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 8882?

Form 8882 is a tax form used to claim a credit for the cost of qualified electric vehicles, including certain hybrids, under Section 30D of the Internal Revenue Code.

Who is required to file Form 8882?

Taxpayers who purchase a qualified electric vehicle and wish to claim the electric vehicle tax credit are required to file Form 8882.

How to fill out Form 8882?

To fill out Form 8882, taxpayers must provide their personal information, details of the purchased vehicle, the amount of the credit they are claiming, and any relevant calculations, ensuring that they follow the instructions provided by the IRS.

What is the purpose of Form 8882?

The purpose of Form 8882 is to allow eligible taxpayers to claim a tax credit for the purchase of qualified electric vehicles, thereby promoting the use of environmentally friendly transportation.

What information must be reported on Form 8882?

Form 8882 requires taxpayers to report their identification information, the details of the vehicle including make and model, the date of purchase, and the amount of the credit being claimed based on the vehicle's specifications.

Fill out your form 8882 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8882 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.