Get the free IRS e-file Marketing Tools Order Form

Show details

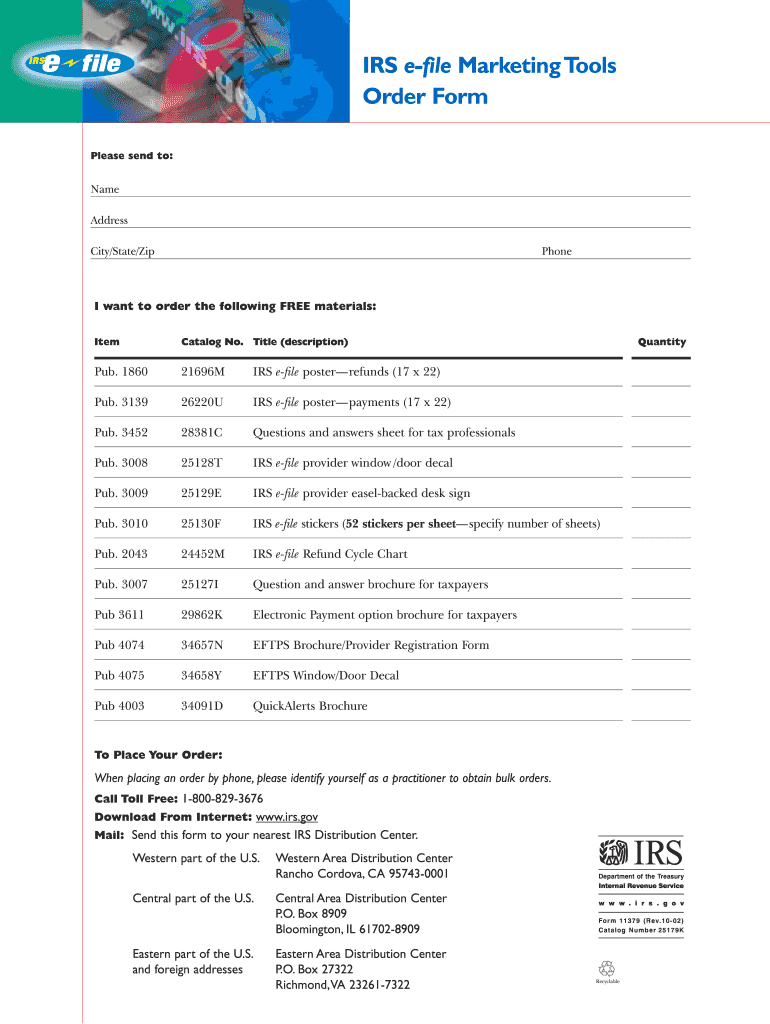

Order form for free IRS e-file marketing materials including posters, brochures, and decals.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs e-file marketing tools

Edit your irs e-file marketing tools form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs e-file marketing tools form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs e-file marketing tools online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit irs e-file marketing tools. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs e-file marketing tools

How to fill out IRS e-file Marketing Tools Order Form

01

Visit the IRS e-file Marketing Tools website.

02

Locate the Marketing Tools Order Form section.

03

Fill in your contact information including name, address, and email.

04

Select the marketing materials you wish to order.

05

Specify the quantity of each item you need.

06

Review your selections for accuracy.

07

Submit the completed order form as instructed.

Who needs IRS e-file Marketing Tools Order Form?

01

Tax preparers and accountants who want to promote their e-filing services.

02

Businesses that offer tax-related services to clients.

03

Non-profit organizations providing tax assistance to individuals.

04

Educational institutions teaching about tax preparation.

Fill

form

: Try Risk Free

People Also Ask about

How should I organize my tax documents?

Use the following tips to easily declutter your space and organize your tax records for better tax preparation next year. Designate an easy-access place for tax documents. Group tax documents by category. Use last year's return. Consider if you'll itemize. Know how to organize receipts for taxes.

Can I download and print a 1099 form?

Please note that Copy B and other copies of this form, which appear in black, may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient. If you have 10 or more information returns to file, you may be required to file e-file.

What order do IRS forms go in?

When assembling your tax return, place the forms in order of their sequence, with Form 1040 (or 1040A) on top. If you have any supporting statements or schedules, attach them all at the end, in the same order as the forms or schedules they refer to.

Which tax refund comes first, federal or state?

Because the IRS is separate from your state's Department of Revenue, you occasionally receive your federal refund before your state refund, or vice versa.

Where can I get IRS forms for free?

Get the current filing year's forms, instructions, and publications for free from the IRS. You can also find printed versions of many forms, instructions, and publications in your community for free at: Libraries. IRS Taxpayer Assistance Centers.

What order do I put IRS forms in?

Each form that you need to attach to your Form 1040 or 1040A has an "attachment sequence number" printed in its upper right-hand corner. When assembling your tax return, place the forms in order of their sequence, with Form 1040 (or 1040A) on top.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRS e-file Marketing Tools Order Form?

The IRS e-file Marketing Tools Order Form is a document used by tax professionals and organizations to order promotional materials that encourage the use of e-filing for tax returns.

Who is required to file IRS e-file Marketing Tools Order Form?

Tax professionals, practitioners, and entities involved in tax preparation that wish to promote e-filing are typically required to file the IRS e-file Marketing Tools Order Form.

How to fill out IRS e-file Marketing Tools Order Form?

To fill out the IRS e-file Marketing Tools Order Form, one must provide their contact information, select the desired marketing materials, and specify the quantity needed before submitting the form.

What is the purpose of IRS e-file Marketing Tools Order Form?

The purpose of the IRS e-file Marketing Tools Order Form is to facilitate the distribution of materials that help promote the e-filing of tax returns, thereby increasing the awareness and usage of e-filing services.

What information must be reported on IRS e-file Marketing Tools Order Form?

The information that must be reported on the IRS e-file Marketing Tools Order Form includes the requester's name, organization name, contact details, and the specific materials and quantities being ordered.

Fill out your irs e-file marketing tools online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs E-File Marketing Tools is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.