Get the free Form 8818

Show details

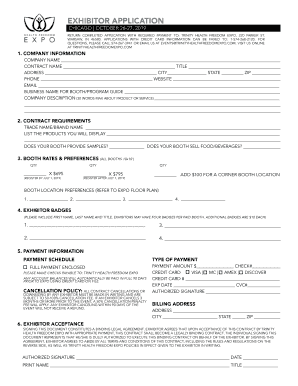

This form is used to keep a record of the series EE and I U.S. savings bonds cashed after 1989, which may allow for exclusion of interest from income when filing tax returns, given qualified higher

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 8818

Edit your form 8818 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8818 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 8818 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 8818. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 8818

How to fill out Form 8818

01

Obtain a copy of Form 8818 from the IRS website or your tax preparer.

02

Start by entering your name and Social Security Number (SSN) at the top of the form.

03

Indicate the tax year for which you are claiming the additional child tax credit.

04

In Part I, provide information about your qualifying children, including their names and SSNs.

05

Calculate the total number of qualifying children in Part II.

06

Complete Part III to determine the amount of the additional child tax credit you're eligible for.

07

Review all entered information for accuracy.

08

Sign and date the form.

09

Attach the completed Form 8818 to your income tax return before submission.

Who needs Form 8818?

01

Taxpayers who have qualifying children and are claiming the additional child tax credit.

02

Individuals who have received advance payments of the child tax credit and need to reconcile those payments.

03

Parents or guardians who are filing their taxes and want to claim benefits for dependents.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of form 888?

When applying for a partner or prospective marriage visa (SC 820, SC 309 and SC 300), the couple must provide at least two Form 888. The purpose of the Form 888 is for the Department of Home Affairs to consider the social aspects of the relationship.

Do I need to report I bonds on my tax return?

Interest from your bonds goes on your federal income tax return on the same line with other interest income.

Do I qualify to exclude series EE or I bond interest?

To qualify for the exclusion, the bonds must be series EE or I U.S. savings bonds issued after 1989 in your name, or, if you are married, they may be issued in your name and your spouse's name. Also, you must have been age 24 or older before the bonds were issued.

What is a 8818 tax form?

About Form 8818, Optional Form To Record Redemption of Series EE and I U.S. Savings Bonds Issued After 1989 | Internal Revenue Service.

What is form 8995 on tax returns?

Use Form 8995 to figure your qualified business income (QBI) deduction.

What is the tax form for annuity payout?

Form 1099-R is used to report the distribution of retirement benefits such as pensions, annuities or other retirement plans.

What is the IRS form 8898?

You may need to file Form 8898, Statement for Individuals Who Begin or End Bona Fide Residence in a U.S. Possession if you became or ceased to be a bona fide resident of one of the following U.S. Territories (also called Possessions): American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, the

Do I qualify to exclude series EE or I bond interest?

To qualify for the exclusion, the bonds must be series EE or I U.S. savings bonds issued after 1989 in your name, or, if you are married, they may be issued in your name and your spouse's name. Also, you must have been age 24 or older before the bonds were issued.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 8818?

Form 8818 is a tax form used by taxpayers to report the amount of the tax credit for the adoption of a child with special needs.

Who is required to file Form 8818?

Individuals who are claiming the adoption tax credit for a child with special needs are required to file Form 8818.

How to fill out Form 8818?

To fill out Form 8818, provide your personal information, details about the adoption, including the child's information, and any relevant tax credit calculations required by the IRS instructions for the form.

What is the purpose of Form 8818?

The purpose of Form 8818 is to claim the adoption tax credit for taxpayers who adopt a child with special needs, allowing for financial relief in the form of a tax credit.

What information must be reported on Form 8818?

Information that must be reported on Form 8818 includes the taxpayer's identification details, the date of the adoption, the name and details of the adopted child, and any related expenses incurred during the adoption process.

Fill out your form 8818 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8818 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.