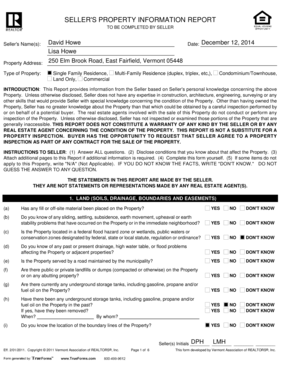

Get the free irs customer service form

Show details

Improving Customer Service The IRS is on its way to achieving a new standard for improved customer service. The employees of the Internal Revenue Service want to provide good service and this annual report demonstrates how we are achieving our goal to become a customer-focused organization. We want to change the way the IRS relates to the American people. Our customer service standards for 1998 are listed below along with our progress report for 1997. Easier Filing Our electronic filing...

We are not affiliated with any brand or entity on this form

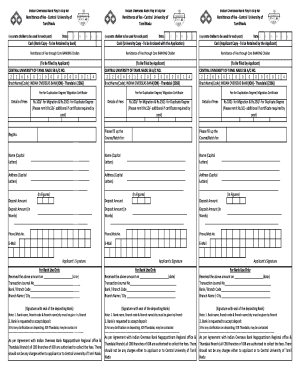

Get, Create, Make and Sign irs customer service form

Edit your irs customer service form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs customer service form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs customer service form online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit irs customer service form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

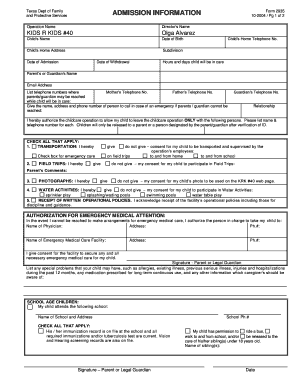

How to fill out irs customer service form

How to fill out IRS customer service form:

01

Start by obtaining the correct form from the IRS website or by visiting the local IRS office.

02

Carefully read the instructions provided with the form to understand the specific requirements and guidelines for completion.

03

Gather all the necessary information and documentation required to fill out the form accurately. This may include personal identification details, financial information, and supporting documents such as W-2s or 1099s.

04

Fill out the form accurately, ensuring that all fields are completed as required. Pay close attention to providing correct and up-to-date information to avoid any delays or issues with your application.

05

Double-check all the information entered on the form before submitting it. Verify that all calculations are accurate and that you have provided all necessary supporting documents.

06

Sign and date the completed form as instructed, making sure that your signature matches the one on file with the IRS.

07

Keep a copy of the completed form and any supporting documentation for your records.

08

Submit the completed form either electronically or by mail, following the instructions provided with the form.

Who needs IRS customer service form:

01

Individuals who have specific inquiries or issues regarding their taxes and require assistance from the IRS.

02

Taxpayers who need to amend previously filed tax returns or request certain tax-related actions from the IRS.

03

Businesses and organizations who have questions or need guidance related to their tax obligations and compliance.

04

Individuals or entities who need to apply for certain tax credits, deductions, or exemptions and seek clarity or guidance in the process.

05

Taxpayers who have concerns related to tax fraud, identity theft, or other security-related matters and need to report the same to the IRS.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

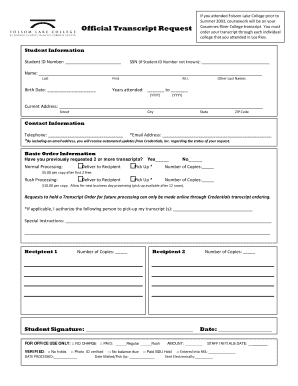

How can I edit irs customer service form from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your irs customer service form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I execute irs customer service form online?

Completing and signing irs customer service form online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit irs customer service form on an Android device?

The pdfFiller app for Android allows you to edit PDF files like irs customer service form. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

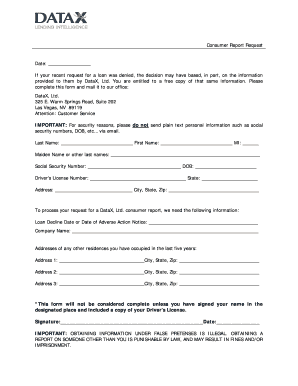

What is irs customer service form?

IRS customer service form, also known as Form 4506-T, is a request for transcript of tax return form. It is used to request copies of previously filed tax returns and other tax documents.

Who is required to file irs customer service form?

Individuals or organizations who need copies of their tax return transcripts or other tax documents are required to file IRS customer service form.

How to fill out irs customer service form?

To fill out IRS customer service form, you need to provide your personal information, such as name, address, and social security number, and specify the tax documents or transcripts you need.

What is the purpose of irs customer service form?

The purpose of IRS customer service form is to request copies of tax return transcripts and other tax documents for various purposes, such as loan applications, mortgage verification, or tax preparation.

What information must be reported on irs customer service form?

IRS customer service form requires you to provide your personal information, including your name, address, social security number, and the specific tax documents or transcripts you need.

Fill out your irs customer service form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Customer Service Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.