Get the free 1040-ES

Show details

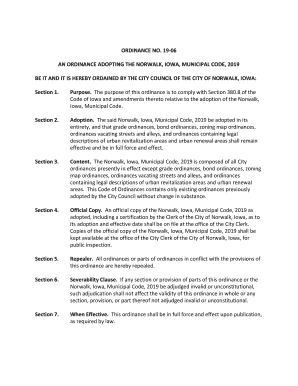

Esta forma está destinada a los residentes de Puerto Rico que deben calcular y pagar contribuciones estimadas del trabajo por cuenta propia y sobre el empleo de empleados domésticos. Incluye instrucciones

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1040-es

Edit your 1040-es form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1040-es form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1040-es online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 1040-es. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1040-es

How to fill out 1040-ES

01

Obtain the 1040-ES form from the IRS website or a tax office.

02

Fill out your personal information including your name, address, and Social Security number.

03

Calculate your expected taxable income for the year.

04

Determine your expected tax liability using the IRS tax tables or tax software.

05

Divide your estimated tax liability by four to find the quarterly payment amount.

06

Complete the payment voucher (Form 1040-ES, Voucher 1, 2, 3, or 4) for the relevant quarter.

07

Mail the voucher along with your payment to the appropriate IRS address.

Who needs 1040-ES?

01

Individuals who expect to owe tax of $1,000 or more when their return is filed.

02

Self-employed individuals who are not subject to withholding.

03

Individuals with income that is not subject to withholding such as rental income or interest income.

04

Taxpayers who had no tax liability in the previous year.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my underpayment penalty waived?

To request a waiver when you file, complete IRS Form 2210 and submit it with your tax return. With the form, attach an explanation for why you didn't pay estimated taxes in the specific time period that you're requesting a waiver for. Also attach documentation that supports your statement.

Why am I getting an underpayment penalty if I'm getting a refund?

tax refund but with penalty? The IRS levies underpayment penalties if you don't withhold or pay enough tax on income received during each quarter. Even if you paid your tax bill in full by the April deadline or are getting a refund, you may still get an underpayment penalty.

What triggers the IRS underpayment penalty?

If you didn't pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax.

Why is there a 1040 ES on my tax return?

Individuals, including sole proprietors, partners, and S corporation shareholders, generally use Form 1040-ES, to figure estimated tax. Nonresident aliens use Form 1040-ES(NR) to figure estimated tax.

What causes an IRS underpayment penalty?

If you didn't pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax.

What are the requirements for the underpayment penalty?

Taxpayers must generally pay at least 90% of their taxes due during the previous year to avoid an underpayment penalty. The fine can grow with the size of the shortfall. Taxpayers can consult IRS instructions for Form 2210 to determine whether they're required to report an underpayment and pay a penalty.

What is a 1040 E?

Use Schedule E (Form 1040) to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in real estate mortgage investment conduits (REMICs).

What happens if I don't pay 1040 ES?

What if I don't pay? You could end up owing the IRS an underpayment penalty in addition to the taxes that you owe. The penalty will depend on how much you owe and how long you have owed it to the IRS. Result: You might have to write a larger check to the IRS when you file your return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1040-ES?

Form 1040-ES is a U.S. Internal Revenue Service (IRS) form used by individuals to estimate and pay their quarterly estimated income taxes.

Who is required to file 1040-ES?

Individuals who expect to owe tax of $1,000 or more when filing their tax return, or those who do not have enough tax withheld from their income are required to file Form 1040-ES.

How to fill out 1040-ES?

To fill out Form 1040-ES, you need to provide your estimated income, tax credits, and other tax liabilities, calculate your expected tax liability for the year, and divide that amount into four equal payments to submit with the form.

What is the purpose of 1040-ES?

The purpose of Form 1040-ES is to ensure taxpayers pay their estimated tax liability on income that is not subject to withholding, preventing underpayment penalties at the end of the tax year.

What information must be reported on 1040-ES?

On Form 1040-ES, taxpayers must report their estimated income, deductions, tax credits, and the amount of estimated tax payment for each quarter.

Fill out your 1040-es online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1040-Es is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.