Get the free Form 6088

Show details

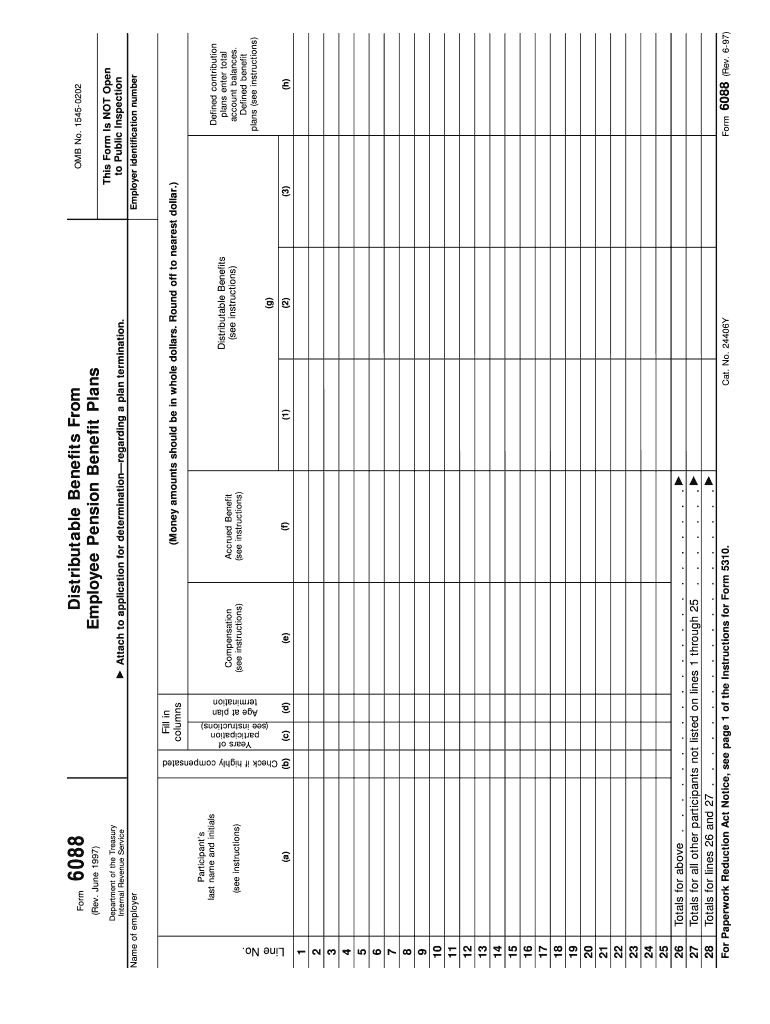

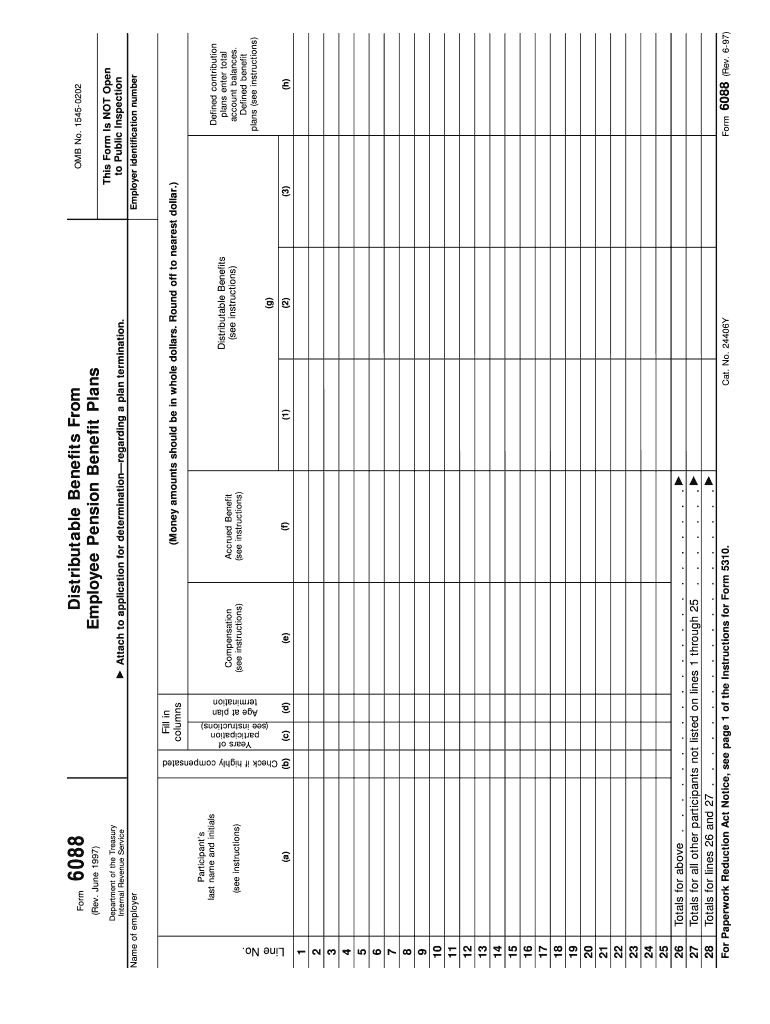

Form 6088 is used by the Internal Revenue Service to analyze applications for determination letters regarding the qualification of pension plans upon termination, specifically for defined benefit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 6088

Edit your form 6088 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 6088 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 6088 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 6088. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 6088

How to fill out Form 6088

01

Obtain Form 6088 from the official website or relevant office.

02

Read the instructions carefully before starting.

03

Fill in your personal information in the designated fields.

04

Provide any required identification numbers or references.

05

Complete any sections relevant to your situation.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the form as instructed, either online, by mail, or in-person.

Who needs Form 6088?

01

Individuals or entities applying for specific benefits or services that require Form 6088.

02

Anyone who needs to declare eligibility for assistance programs linked to the form.

Fill

form

: Try Risk Free

People Also Ask about

What is Form 6088?

The Internal Revenue Service (IRS) uses the information on Form 6088 to analyze an application for a determination letter on the qualification of the plan upon termination.

How to fill out Employee Withholding Certificate form?

How to fill out a W-4 form Step 1: Enter your personal information. Fill in your name, address, Social Security number and tax filing status. Step 2: Account for all jobs or spousal income. Step 3: Claim dependents, including children. Step 4: Refine your withholdings. Step 5: Sign and date your W-4.

What is form g28 for?

Use Form 8828 to figure and report the recapture tax on the mortgage subsidy if you sold or otherwise disposed of your federally subsidized home.

What is 8828 form used for?

Use Form 8898 to notify the IRS that you became or ceased to be a bona fide resident of a U.S. territory in ance with section 937(c).

What is form 8898?

You must file Form 5500-EZ for a retirement plan if the plan is a one-participant plan or a foreign plan that is required to file an annual return under section 6058(a). 3. Does not provide benefits for anyone except you (or you and your spouse) or one or more partners (or partners and their spouses).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 6088?

Form 6088 is a tax form used in the United States, primarily for reporting certain financial transactions and information to the Internal Revenue Service (IRS).

Who is required to file Form 6088?

Individuals and entities that meet specific criteria regarding their financial activities or transactions may be required to file Form 6088. Typically, this includes those involved in certain financial reporting obligations.

How to fill out Form 6088?

To fill out Form 6088, individuals or entities must provide accurate financial information as required by the form's guidelines, carefully following the instructions provided by the IRS for each section of the form.

What is the purpose of Form 6088?

The purpose of Form 6088 is to ensure compliance with tax regulations by reporting specific financial information, thus aiding the IRS in tracking and verifying tax obligations.

What information must be reported on Form 6088?

Form 6088 requires reporting detailed information about financial transactions, including amounts, dates, and the nature of the transactions, as well as additional identifying information about the filing individual or entity.

Fill out your form 6088 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 6088 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.