Get the free 1041-ES

Show details

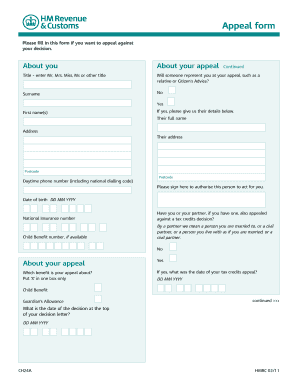

2001 Form 1041-ES on the check or money order. Do not include any balance due on the Form 1041 with the check for 2001 estimated tax. Return this voucher with check or money order payable to United States Treasury. Write the estate s or trust s EIN and 2001 Form 1041-ES on the check or money order. Form 1041-ES Department of the Treasury Internal Revenue Service Estimated Income Tax for Estates and Trusts OMB No. 1545-0971 Section references are ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1041-es

Edit your 1041-es form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1041-es form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1041-es online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 1041-es. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1041-es

How to fill out 1041-ES

01

Gather necessary financial documents, including income sources and expenses.

02

Obtain Form 1041-ES from the IRS website or your tax professional.

03

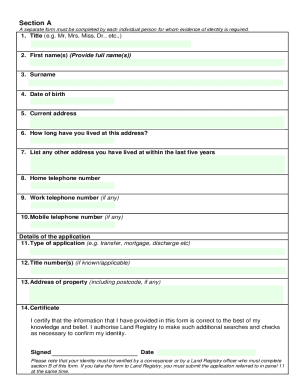

Complete the form by entering the estate's or trust's name, address, and Employer Identification Number (EIN).

04

Estimate the total income for the year to determine the expected tax liability.

05

Divide the estimated tax liability by four to calculate the quarterly payment amount.

06

Fill out the payment voucher for each quarter, including any additional adjustments if necessary.

07

Mail the completed 1041-ES forms and vouchers to the appropriate IRS address.

Who needs 1041-ES?

01

Executors of estates that are required to file Form 1041.

02

Trustees of trusts that generate income and need to pay estimated taxes.

03

Individuals responsible for managing estates or trusts that expect to owe tax.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of form 1041?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

Can I opt out of estimated tax payments?

Estimated tax payments are typically due on April 15, June 15, and September 15 of the current year and then January 15 of the following year. You can skip the final (January 15) estimated tax payment if you will file your return and pay all the tax due by February 1.

Who must file 1040 se?

You must pay SE tax if you had net earnings of $400 or more as a self-employed person. If you are in business (farm or non- farm) for yourself, you are self-employed. You must also pay SE tax on your share of certain partner- ship income and your guaranteed payments. See Partnership Income or Loss, later.

Can 1041 ES be paid online?

E-pay federal taxes via the internet or phone 24/7. with Form 1041-ES, Estimated Income Tax for Estates and Trusts, should be submitted ing to Form 1041-ES instructions. . Send after the return's e-filed, but by the return due date.

Who generally does not need to pay estimated taxes?

If your federal income tax withholding (plus any timely estimated taxes you paid) amounts to at least 90 percent of the total tax that you will owe for this tax year, or at least 100 percent of the total tax on your previous year's return (110 percent for AGIs greater than $75,000 for single and separate filers and

Who should file a 1040 ES tax form?

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

What happens if I don't pay 1040-ES?

If you don't pay your estimated taxes on time (or if you don't pay enough), the IRS can charge you a penalty. The amount you owe increases the longer you go without payment. The failure to pay penalty is 0.5% of the unpaid taxes for each month or part of a month you don't pay, up to 25% of your unpaid taxes.

Who must file an estate tax return 1041?

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes. See Form 1041 instructions for information on when to file quarterly estimated taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1041-ES?

Form 1041-ES is a tax form used by estates and trusts to make estimated tax payments on income that is not subject to withholding.

Who is required to file 1041-ES?

Estates and trusts that expect to owe tax of $1,000 or more when filing Form 1041 must file Form 1041-ES to pay estimated taxes.

How to fill out 1041-ES?

To fill out Form 1041-ES, gather the estate or trust's income information, estimate the tax liability for the year, and complete the form providing details like the name and taxpayer identification number, and payment amounts.

What is the purpose of 1041-ES?

The purpose of Form 1041-ES is to allow estates and trusts to pay their estimated federal income taxes throughout the year, rather than a lump sum at the end of the tax year.

What information must be reported on 1041-ES?

Form 1041-ES must report the estate or trust's name, address, taxpayer identification number, as well as the estimated tax payment amounts for the taxable year.

Fill out your 1041-es online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1041-Es is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.