Get the free 8302

Show details

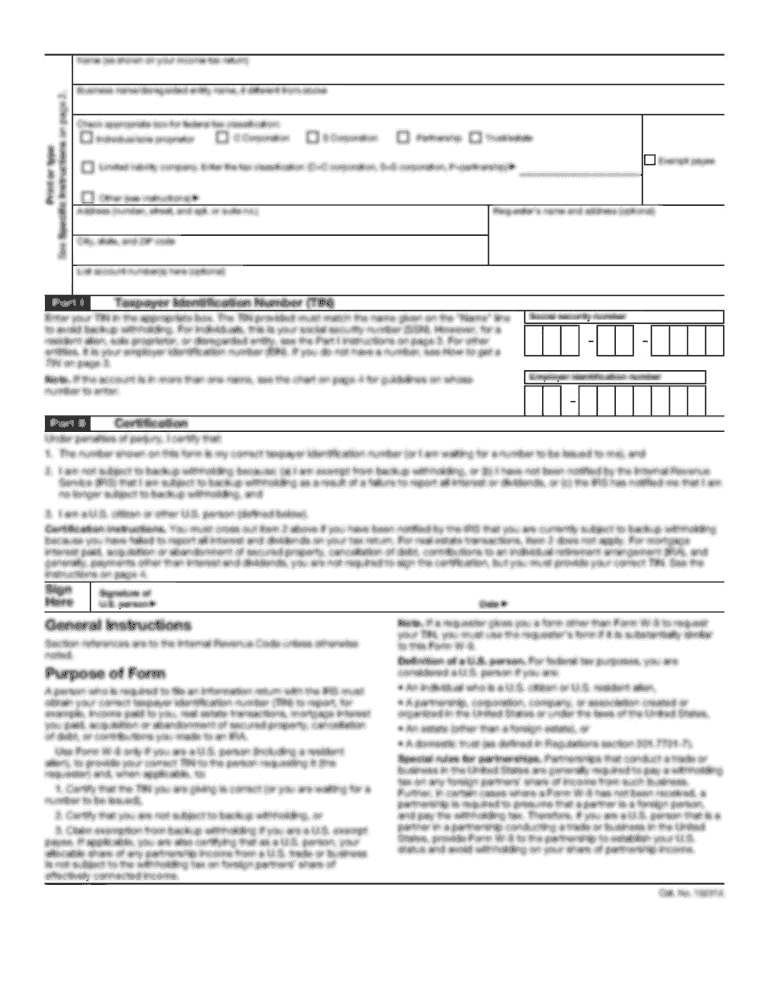

File Form 8302 to request that the IRS deposit a tax refund of $1 million or more directly into an account at any U.S. bank or financial institution. The form ensures a faster refund and added security

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 8302

Edit your 8302 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 8302 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 8302 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 8302. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

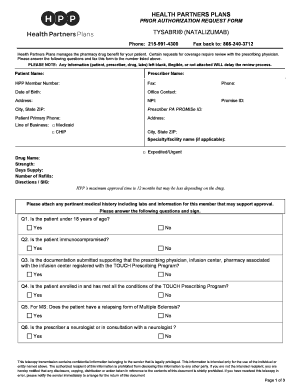

How to fill out 8302

How to fill out 8302

01

Obtain Form 8302 from the IRS website or your local tax office.

02

Fill out your personal information in the identification section, including your name and taxpayer identification number.

03

Complete the section for the IRS office where you are submitting the form.

04

Provide the specific details about the payment you are making or receiving.

05

Sign and date the form at the bottom.

06

Make a copy of the filled-out form for your records before submitting it.

Who needs 8302?

01

Any taxpayer who is receiving a refund from the IRS and wants to receive it through a direct deposit to their bank account.

02

Individuals or businesses who need to correct previous refund issues or change their banking information with the IRS.

Fill

form

: Try Risk Free

People Also Ask about

Is IRS direct deposit safe?

Benefits of choosing IRS direct deposit: Taxpayers who file a paper return can also choose direct deposit, but it will take longer to process the return and get a refund. It's secure. Since refunds are electronically deposited, there's no risk of having a paper check stolen or lost in the mail.

What happens if I put the wrong direct deposit information on my tax return?

If you enter your information incorrectly, you can call the IRS at 1-800-829-1040 to stop your direct deposit. This option only works if your refund has not yet been posted. If your refund has already been posted, learn what to do to recover your funds.

Can I update my direct deposit information with the IRS?

If you've already filed your return, you can review your direct deposit information on a copy of your return. If the IRS has accepted your return already, you won't be able to change your bank and routing number for your tax refund.

Why didn't I get my refund via direct deposit?

If you haven't received a tax refund recently, there would be no reason for the IRS to have your direct deposit on file. Therefore, if your direct deposit isn't listed, or you don't have a checking account, the refund will be mailed to the address on your tax form.

What happens if IRS sends a refund to a closed bank account?

If you were set up for a direct deposit of your refund and your bank account closed before the funds were direct deposited, your bank will return the funds to the IRS. The IRS will then issue you a paper check, resulting in a tax refund delay of up to 10 weeks. Was this topic helpful?

What is form 8302?

File Form 8302 to request that the IRS electronically deposit a tax refund of $1 million or more directly into an account at any U.S. bank or other financial institution (such as a mutual fund, credit union, or brokerage firm) that accepts electronic deposits.

Can I change my direct deposit information with the IRS online?

Can I Change My Bank Account With IRS Online? Once the IRS has accepted your e-filed tax return, there is no way to change your bank account information.

Can I change my bank account with IRS online for taxes?

There's no way to change your bank information once the IRS has accepted your e-filed tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 8302?

Form 8302 is a tax form used by businesses to report expenditures that are subject to the requirements of a specific accounting method.

Who is required to file 8302?

Businesses and organizations that have certain financial transactions or contributions subject to IRS reporting requirements are required to file Form 8302.

How to fill out 8302?

To fill out Form 8302, you need to provide your business's identifying information, details about the financial transactions, and any applicable financial data required by the IRS.

What is the purpose of 8302?

The purpose of Form 8302 is to report specific types of transactions that help the IRS track compliance with tax laws and ensure accurate reporting by businesses.

What information must be reported on 8302?

Information required on Form 8302 includes the taxpayer’s identification number, business name, nature of the transactions, and relevant dollar amounts associated with those transactions.

Fill out your 8302 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

8302 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.