Get the free 943A-PR

Show details

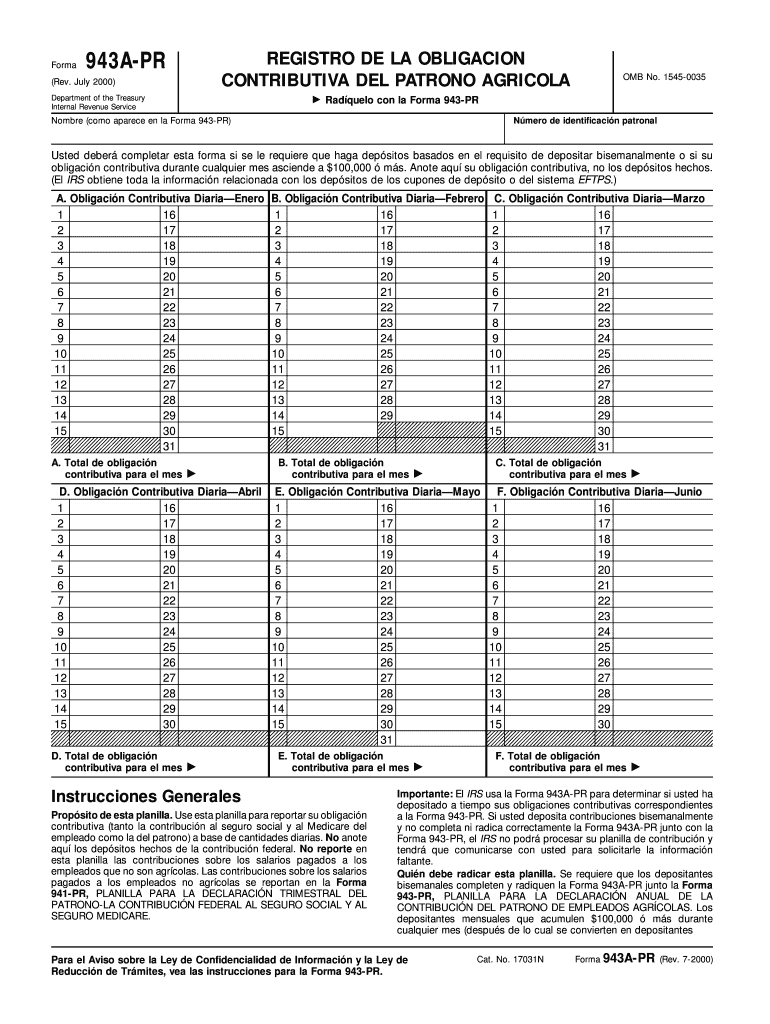

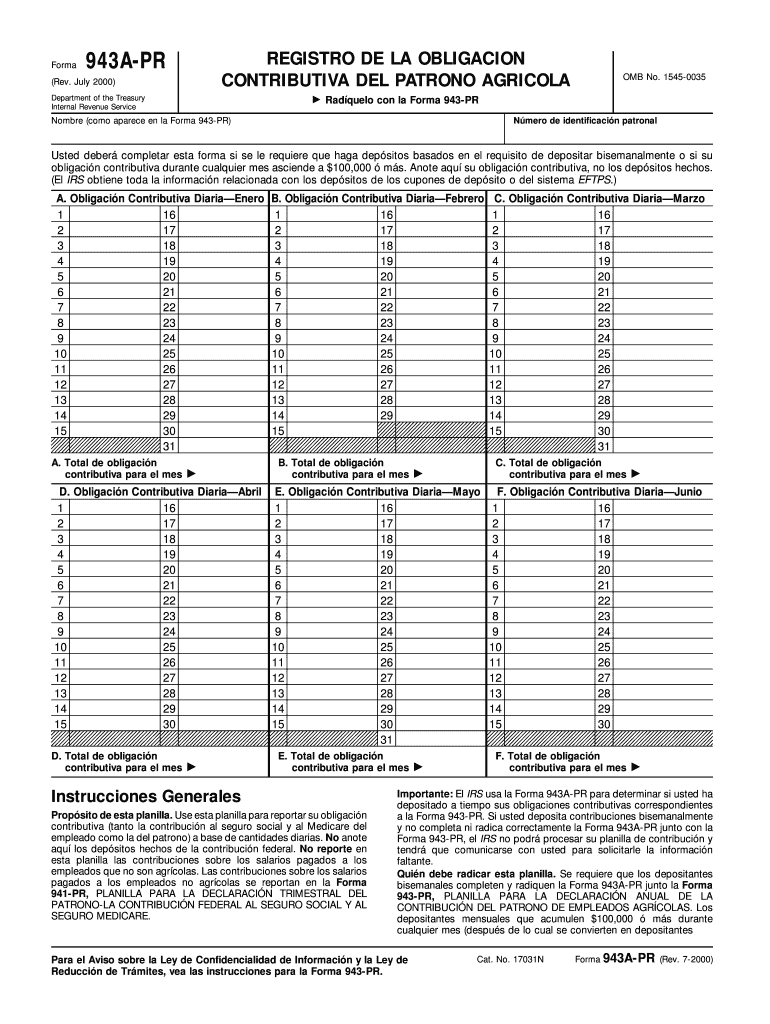

Esta forma se utiliza para reportar la obligación contributiva de los empleadores agrícolas, incluyendo las contribuciones al seguro social y al Medicare. Se requiere para aquellos que deben hacer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 943a-pr

Edit your 943a-pr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 943a-pr form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 943a-pr online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 943a-pr. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 943a-pr

How to fill out 943A-PR

01

Gather all necessary personal information such as your name, address, and Social Security Number.

02

Complete the identifying information section at the top of Form 943A-PR.

03

Enter the calendar year for which you are filing in the relevant section.

04

Report your total agricultural wage payments in the designated area.

05

Calculate and enter the total taxes withheld from agricultural employees on the form.

06

Provide details about any adjustments or corrections if applicable.

07

Check the form thoroughly for accuracy and completeness.

08

Sign and date the form before submission.

Who needs 943A-PR?

01

Employers who are engaged in agricultural production and pay wages to farmworkers.

02

Businesses that are required to report taxes withheld from agricultural employees.

03

Producers who need to file their annual return for income taxes withheld.

Fill

form

: Try Risk Free

People Also Ask about

What kind of employer is a church?

Religious Organizations must be recognized by the Internal Revenue Service (IRS) as a church. Employees of a church or religious order are not subject to Unemployment Insurance (UI), Employment Training Tax (ETT), and State Disability Insurance (SDI) but are subject to Personal Income Tax (PIT) withholding.

What kind of payer is 943?

About Form 943, Employer's Annual Federal Tax Return for Agricultural Employees | Internal Revenue Service.

What is a 943 payer?

Who Must File Form 943? File Form 943 if you paid wages to one or more farmworkers and the wages were subject to federal income tax withholding or social security and Medicare taxes under the tests discussed next. For more information on farmworkers and wages, see Pub.

Who uses form 943?

Employers who paid wages to agricultural employees (farmworkers) that are subject to federal income tax withholding or Social Security and Medicare taxes must file a Form 943, Employer's Annual Federal Tax Return for Agricultural Employees.

What is the difference between a 941 and 943?

It's designed to be used in place — or in addition to Form 941 — for businesses that routinely pay farm workers. Form 943 is only used by companies that employ and pay farmworkers wages by cash, checks, or money orders. Non-cash wages are food and lodging, or payment for services other than farm work.

What is a 943a?

About Form 943-A, Agricultural Employer's Record of Federal Tax Liability | Internal Revenue Service.

What does 943 agricultural employee mean in the IRS?

Employers who paid wages to agricultural employees (farmworkers) that are subject to federal income tax withholding or Social Security and Medicare taxes must file a Form 943, Employer's Annual Federal Tax Return for Agricultural Employees.

What kind of payer is 941 or 944?

Generally, employers are required to file Forms 941 quarterly. However, some small employers (those whose annual liability for Social Security, Medicare, and withheld federal income taxes is $1,000 or less for the year) may file Form 944 annually instead of Forms 941.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 943A-PR?

Form 943A-PR is a tax form used by agricultural employers in Puerto Rico to report annual payroll taxes for employees.

Who is required to file 943A-PR?

Employers who pay wages to farmworkers and who are subject to federal employment taxes must file Form 943A-PR.

How to fill out 943A-PR?

To fill out Form 943A-PR, employers must provide information such as the total wages paid, tax withheld, and the number of employees. Detailed instructions are provided on the IRS website.

What is the purpose of 943A-PR?

The purpose of Form 943A-PR is to report the amount of federal income tax withheld and the employer's share of Social Security and Medicare taxes for agricultural employees.

What information must be reported on 943A-PR?

Form 943A-PR must include information on total agricultural wages paid, total tax withheld, employer identification number, and details about the employer and employees.

Fill out your 943a-pr online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

943a-Pr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.