Get the free 3903-F

Show details

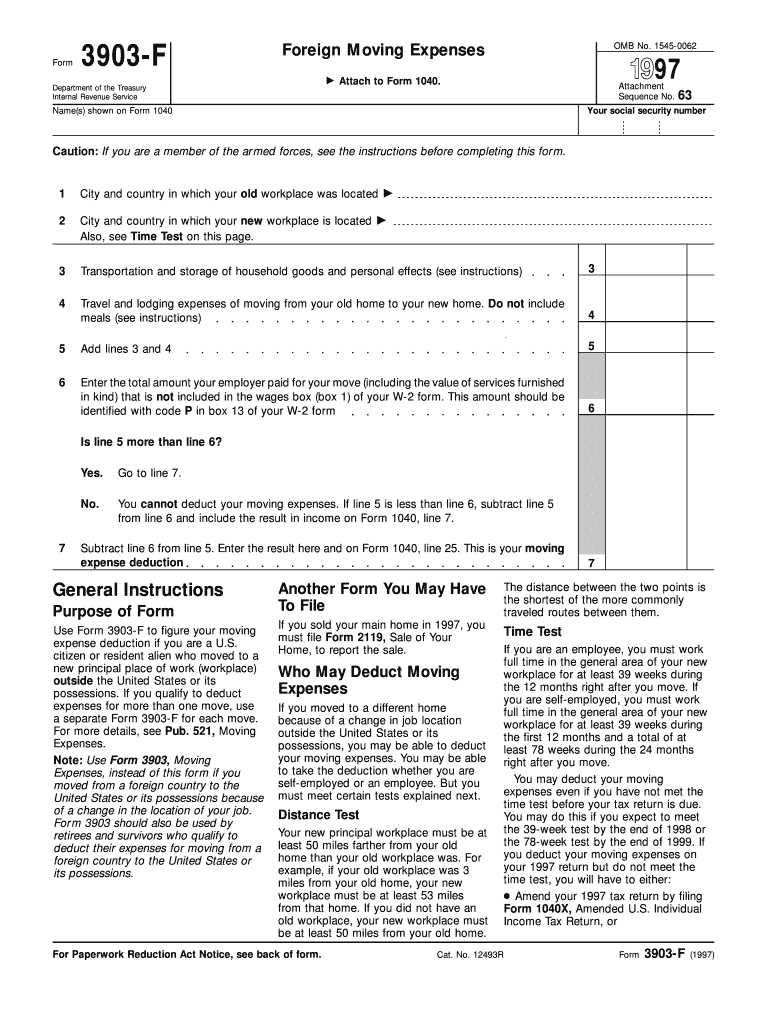

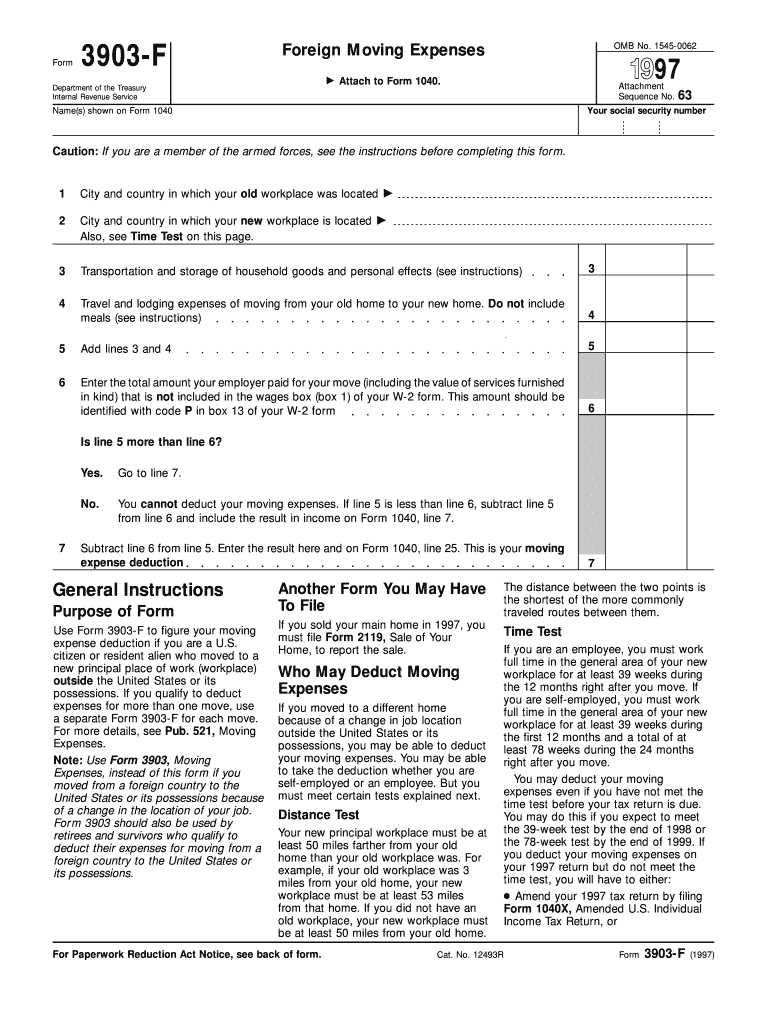

This form is used to figure your moving expense deduction if you are a U.S. citizen or resident alien who moved to a new principal place of work outside the United States or its possessions. It requires

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 3903-f

Edit your 3903-f form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 3903-f form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 3903-f online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 3903-f. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 3903-f

How to fill out 3903-F

01

Gather necessary documentation, including your most recent tax return.

02

Download Form 3903-F from the official IRS website or obtain a hard copy from your local IRS office.

03

Fill in your personal details at the top of the form, including your name, address, and taxpayer identification number.

04

Provide the details regarding the property for which you are claiming the deduction.

05

Enter the applicable expenses incurred during the tax year related to the property.

06

Calculate the total and ensure that all required fields are completed accurately.

07

Review the form for any errors or omissions.

08

Sign and date the form.

09

Submit the completed form either electronically or by mail as per IRS guidelines.

Who needs 3903-F?

01

Individuals who had to relocate due to their job or business and are claiming expenses related to the move.

02

Employees or self-employed individuals who are eligible for tax deductions related to their moving expenses.

Fill

form

: Try Risk Free

People Also Ask about

Is relocation assistance taxable income?

Are Corporate Relocation Packages & Relocation Assistance Taxable to the Employee? Corporate relocation packages and managed relocation assistance are also taxable to the employee. In the case of managed relocation benefits, the employee is required to include the value of these benefits in their taxable income.

Is relocation reported on W-2?

The Tax Cuts and Jobs Act of 2017 requires reimbursed and qualified moving expenses of household goods to be reported on an employee's Form W-2. Qualified moving expenses are reported in the year an employee is reimbursed or in the year a payment is made on behalf of an employee.

What is a 3903 form for military?

Military personnel should use Form 3903 to report their moving expenses: Shipping and storage costs for packing and moving your household goods and personal effects go on line 1 of Form 3903. Travel, lodging, and gas costs go on line 2. Reimbursements from your employer for any moving expenses are reported on line 4.

Can the military write off haircuts on taxes?

No, you cannot claim haircuts and shaving expenses while in the military. These are considered personal expenses and are not deductible.

How to report relocation assistance on taxes?

To put it simply, any amount an employer pays a relocating employee to help cover moving expenses is added to the employee's W2 statement. Therefore, the employee will need to pay taxes on the total amount given, in addition to their annual salary.

What is Form 3903 moving expenses?

Use Form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace). If the new workplace is outside the United States or its possessions, you must be a U.S. citizen or resident alien to deduct your expenses.

What is the 3903 form used for?

More In Forms and Instructions Use Form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace).

What is the English translation of deduct?

Meaning of deduct in English. to take away an amount or part from a total: deduct points The player had points deducted from his score for arguing with the referee.

Who qualifies for moving expense deduction?

If you move because of a permanent change of station, you can deduct the reasonable unreimbursed expenses of moving you and members of your household. See Specific Line Instructions, later, for how to report this deduction.

What moving expenses are deductible for the military?

Deductible moving expenses - You can deduct expenses that are reasonable for the circumstances of your move. Your eligible moving expenses include household goods, personal effects, storage and traveling expenses (including lodging) to your new home. You can't deduct any expenses for meals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 3903-F?

Form 3903-F is a tax form used in the United States for reporting certain travel expenses incurred by individuals for business purposes.

Who is required to file 3903-F?

Individuals who have incurred deductible travel expenses related to their business activities are required to file Form 3903-F.

How to fill out 3903-F?

To fill out Form 3903-F, taxpayers need to provide details about the nature of their travel, expenses incurred, the dates of travel, and any supporting documentation.

What is the purpose of 3903-F?

The purpose of Form 3903-F is to allow individuals to report and deduct certain travel-related expenses on their tax returns.

What information must be reported on 3903-F?

Information that must be reported on Form 3903-F includes travel dates, destinations, purpose of travel, detailed expense breakdown, and any necessary payment receipts.

Fill out your 3903-f online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

3903-F is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.