Get the free Schedule B (Form 5713)

Show details

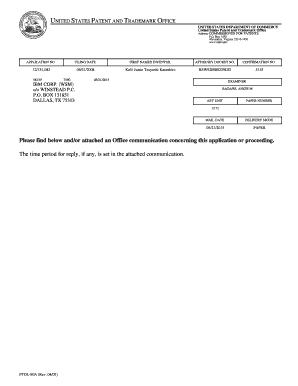

Schedule B (Form 5713) is used to compute specifically attributable taxes and income when participating in or cooperating with an international boycott. It is completed if you are not computing a

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule b form 5713

Edit your schedule b form 5713 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule b form 5713 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule b form 5713 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit schedule b form 5713. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule b form 5713

How to fill out Schedule B (Form 5713)

01

Obtain Schedule B (Form 5713) from the IRS website or your tax professional.

02

Enter your name and taxpayer identification number at the top of the form.

03

List all foreign corporations, partnerships, and other entities you have an interest in during the tax year.

04

For each entity, provide the country of incorporation and the percentage of ownership you hold.

05

Indicate the type of entity (e.g., corporation, partnership) for each entry.

06

Complete any additional sections relevant to your foreign interests as guided by the instructions for Schedule B.

07

Review the information for accuracy, and make sure to keep supporting documentation.

08

Attach Schedule B to your tax return when filing.

Who needs Schedule B (Form 5713)?

01

U.S. taxpayers who have interests in foreign corporations, partnerships, or certain foreign entities must fill out Schedule B (Form 5713).

02

Taxpayers with ownership of at least 10% in a foreign corporation must report this information.

03

People involved in certain transactions with foreign entities may also need to complete the schedule.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file form B?

You do not need to include Form 1095-B with your federal or state tax return. But, the IRS and the California State Franchise Tax Board suggest that you save it with your tax records.

What happens if I don't file my 1099-B?

If you receive a Form 1099-B and do not report the transaction on your tax return, the IRS will likely send you a CP2000, Underreported Income notice. This IRS notice will propose additional tax, penalties and interest on this transaction and any other unreported income.

What is form 5713 Schedule B?

Form 5713 (Schedule B) Accessible is used to figure the loss of tax benefits by specifically attributing taxes and income. It is issued by the IRS and is required for individuals or businesses who participated an international boycott.

Do I have to file a schedule B?

For most taxpayers, a Schedule B is only necessary when you receive more than $1,500 of taxable interest or dividends.

Is Form 1095-B still required?

No. Currently the IRS does not require you to submit Form 1095-B with your federal income tax return, but you will need the information on Part IV in order to report months of coverage for you and your family.

What is a Schedule B tax form used for?

A Schedule B IRS form reports taxable interest and dividend income received during the tax year. Most taxpayers only need to file a Schedule B if they receive more than $1,500 of taxable interest or dividends.

What happens if I don't file my 1095-B?

Form 1095-B is not needed to file your tax return. On the other hand, if you signed up for health insurance through the marketplace, there's more work you'll need to do during tax time. You'll receive Form 1095-A from your marketplace (federal or state).

Does form 5713 need to be signed?

Form 5713 is due when your income tax return is due, including extensions. Attach the original copy of the Form 5713 (and Schedules A, B, and C, if applicable) to your income tax return. Do not sign the copy that is attached to your income tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule B (Form 5713)?

Schedule B (Form 5713) is a form used by U.S. taxpayers to report certain information related to international transactions and foreign income. It is specifically designed for those who have claims of foreign tax credits.

Who is required to file Schedule B (Form 5713)?

Taxpayers who claim the foreign tax credit and have certain foreign income must file Schedule B (Form 5713). This typically includes individuals, corporations, and estates or trusts with foreign income or who meet specific criteria set by the IRS.

How to fill out Schedule B (Form 5713)?

To fill out Schedule B (Form 5713), taxpayers must provide detailed information about their foreign income, foreign taxes paid, and any other relevant details required by the form. The form should be completed accurately and submitted along with the main tax return.

What is the purpose of Schedule B (Form 5713)?

The purpose of Schedule B (Form 5713) is to ensure that taxpayers properly report foreign income and claim any applicable foreign tax credits, thereby preventing double taxation on income earned abroad.

What information must be reported on Schedule B (Form 5713)?

Information that must be reported on Schedule B (Form 5713) includes details about foreign income, the amount of foreign taxes paid or accrued, types of income, foreign financial accounts, and any other information related to foreign transactions and credits.

Fill out your schedule b form 5713 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule B Form 5713 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.