Get the free Homeowner Incentives for Energy Efficient Repairs and Renovations

Show details

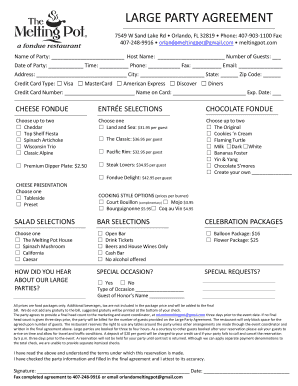

This document provides instructions and information for homeowners seeking incentives for energy-efficient repairs and renovations, primarily targeting those affected by tornado damage.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign homeowner incentives for energy

Edit your homeowner incentives for energy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your homeowner incentives for energy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing homeowner incentives for energy online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit homeowner incentives for energy. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out homeowner incentives for energy

How to fill out Homeowner Incentives for Energy Efficient Repairs and Renovations

01

Gather all necessary documentation, including proof of home ownership and energy efficiency upgrade receipts.

02

Review the eligibility criteria for the program to ensure your renovations qualify.

03

Fill out the application form, providing details about your home and renovations.

04

Include supporting documents, such as photographs of the renovations and energy efficiency ratings.

05

Submit the completed application by the specified deadline, ensuring you keep a copy for your records.

06

Follow up with the program administrator if you do not receive confirmation of your application.

Who needs Homeowner Incentives for Energy Efficient Repairs and Renovations?

01

Homeowners seeking financial assistance for making energy-efficient upgrades to their homes.

02

Individuals looking to reduce their energy consumption and utility bills through renovations.

03

Property owners interested in increasing the value of their homes with energy-efficient improvements.

Fill

form

: Try Risk Free

People Also Ask about

How to qualify for the full $7500 federal electric vehicle tax credit?

Vehicles meeting both the critical mineral and the battery component requirements are eligible for a total tax credit of $7,500. Vans, sport utility vehicles, and pickup trucks must not have an MSRP above $80,000, and all other vehicles may not have an MSRP above $55,000.

What qualifies for 5695?

exterior windows and skylights, central A/C units, electric panels and related equipment, natural gas, propane and oil water heaters, furnaces or hot water boilers: $600. heat pumps and biomass stoves and boilers: $2,000 (this one category qualifies to go above the $1,200 annual limit)

What is the $8000 inflation reduction act rebate?

The HEEHRA Phase I Program provides rebates for qualifying, energy saving appliances and equipment to income-eligible, single-family households and multifamily properties across the state. Single-family households may qualify for a rebate up to $8,000 and multifamily properties may qualify for rebates up to $14,000.

How to qualify for ITC?

Follow these 7 steps to ensure your business qualifies for the Your business falls into eligible sectors. You installed eligible solar PV technology. Installed solar PV equipment must meet performance and quality standards. You meet usage guidelines. You own your solar energy system. You must complete IRS Tax Form 3468.

Which of the following improvements can qualify for the energy efficient home improvement credit?

Energy Efficient Home Improvement Credit Exterior doors, windows, skylights and insulation materials. Central air conditioners, water heaters, furnaces, boilers and heat pumps. Biomass stoves and boilers.

Who qualifies for residential energy credit?

If you invest in renewable energy for your home such as solar, wind, geothermal, fuel cells or battery storage technology, you may qualify for an annual residential clean energy tax credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Homeowner Incentives for Energy Efficient Repairs and Renovations?

Homeowner Incentives for Energy Efficient Repairs and Renovations are financial programs or tax credits that encourage homeowners to make energy-efficient improvements to their homes, such as installing better insulation, energy-efficient appliances, or renewable energy sources.

Who is required to file Homeowner Incentives for Energy Efficient Repairs and Renovations?

Homeowners who wish to claim benefits or tax deductions related to energy-efficient repairs and renovations are typically required to file these incentives.

How to fill out Homeowner Incentives for Energy Efficient Repairs and Renovations?

To fill out the Homeowner Incentives for Energy Efficient Repairs and Renovations, homeowners should gather all relevant documentation regarding the repairs made, complete the necessary forms provided by the incentive program, and submit the forms along with proof of expenses.

What is the purpose of Homeowner Incentives for Energy Efficient Repairs and Renovations?

The purpose of these incentives is to promote energy conservation, reduce energy costs for homeowners, and lessen the environmental impact of energy consumption through support for energy-efficient upgrades.

What information must be reported on Homeowner Incentives for Energy Efficient Repairs and Renovations?

Homeowners must report information including the type of energy-efficient improvements made, the costs associated with these improvements, and any receipts or documentation supporting the expenditures.

Fill out your homeowner incentives for energy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Homeowner Incentives For Energy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.