Get the free 706-QDT

Show details

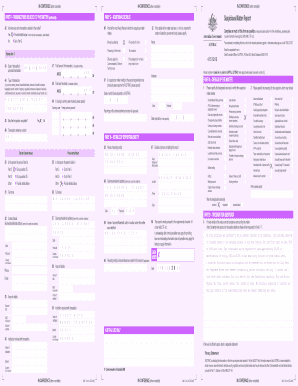

This form is used to report the estate tax for qualified domestic trusts in the United States, detailing information such as beneficiaries, property valuations, and tax computations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 706-qdt

Edit your 706-qdt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 706-qdt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 706-qdt online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 706-qdt. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 706-qdt

How to fill out 706-QDT

01

Start by gathering all necessary information, including the decedent's name, date of death, and social security number.

02

Obtain the IRS 706-QDT form from the official IRS website or relevant tax authority.

03

Fill out Part I by entering the preliminary information about the trust and the deceased.

04

Complete Part II by reporting the fair market value of the assets on the date of death.

05

If applicable, fill out any additional schedules required for specific assets or deductions.

06

Review the completed form for accuracy and ensure all parts are filled out.

07

Sign and date the return, and include any required attachments.

08

Submit the form to the IRS by the specified deadline, typically within nine months of the decedent's death.

Who needs 706-QDT?

01

Estate executors and trustees responsible for filing estate and trust tax returns when the decedent had a Qualified Domestic Trust (QDT).

02

Beneficiaries of a trust who are affected by the federal estate tax obligations.

03

Financial advisors and tax professionals managing estates with QDTs.

Fill

form

: Try Risk Free

People Also Ask about

How long after 971 notice from IRS?

If the dates beside code 571 or 572 are the same as code 971, your tax refund will likely be received within 3 to 6 weeks. A different date next to these codes typically indicates a delay.

What does code 706 mean on an IRS transcript?

This code indicates that Form 706, which is used to determine the amount of the estate tax, has been accepted as filed and an examination has been concluded.

How long does it take to get an estate tax closing letter?

Historically, it took about 4-6 months after filing Form 706 for the IRS to issue the letter. However, recent experiences suggest it might take longer, sometimes exceeding six months. It's crucial to note that you can't even request the closing letter until four months have passed since filing Form 706.

What does 706 mean on a tax transcript?

Each line shows a transaction code with an explanation of the code, the date of the transaction, and the dollar amount, if appropriate. Transaction Code 421 indicates an Estate Tax Return (Form 706) has been accepted as filed or that the examination is complete.

What are 706 returns?

Federal Form 706, also known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is used to report the value of a deceased person's estate and determine the amount of estate tax due, if any. A “snapshot” of the value of the decedent's assets and liabilities is taken on the day of death.

What is the IRS Code 706?

The executor of a decedent's estate uses Form 706 to figure the estate tax imposed by chapter 11 of the Internal Revenue Code. This tax is levied on the entire taxable estate and not just on the share received by a particular beneficiary.

What are the requirements for a Qdot trust?

To legally be a QDOT, a trust must be a US trust that meets the following requirements: It must be structured as a power of appointment trust, a qualified terminable interest property trust (QTIP trust), a qualified charitable remainder trust (qualified CRT), or an estate trust.

What is form 706 QDT?

(Rev. September 2021) U.S. Estate Tax Return for Qualified Domestic Trusts. Department of the Treasury.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 706-QDT?

706-QDT is a tax return form used to report the estate of a deceased person for which a qualified domestic trust (QDT) has been established.

Who is required to file 706-QDT?

The executor or administrator of the decedent's estate is required to file Form 706-QDT if the estate includes a qualified domestic trust.

How to fill out 706-QDT?

To fill out Form 706-QDT, you need to provide information about the decedent's estate, valuation of the assets, details of the QDT, and other pertinent financial information as specified in the form's instructions.

What is the purpose of 706-QDT?

The purpose of Form 706-QDT is to report the assets held in a qualified domestic trust and to compute any applicable estate tax for which the trust may be liable.

What information must be reported on 706-QDT?

Information that must be reported on Form 706-QDT includes the decedent's personal information, details of the qualified domestic trust, valuations of estate assets, deductions, and tax computations.

Fill out your 706-qdt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

706-Qdt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.