MI MIDAP Application Form 2013 free printable template

Show details

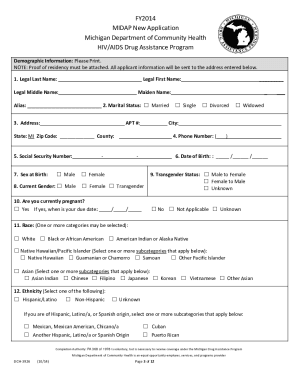

FY2013 MIDAP Application Michigan Department of Community Health HIV/AIDS Drug Assistance Program Clear Form New NEVER on MIDAP previously v.13. Am agreeing to abide by all MIDAP policies and procedures. The information that I have provided on this application is complete and true to the best of my knowledge. Case Manager Signature of Applicant Date Signed PLEASE MAIL OR FAX APPLICATION AND ANY SUPPORTING DOCUMENTATION TO MIDAP 109 Michigan Avenue 9th Floor Lansing Michigan 48913 Phone 888...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI MIDAP Application Form

Edit your MI MIDAP Application Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI MIDAP Application Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MI MIDAP Application Form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MI MIDAP Application Form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI MIDAP Application Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI MIDAP Application Form

How to fill out MI MIDAP Application Form

01

Obtain the MI MIDAP Application Form from the official website or contact the relevant office.

02

Read the instructions carefully to understand the requirements.

03

Fill out the personal information section including your name, address, and contact details.

04

Provide any necessary identification or documentation as specified in the application guidelines.

05

Complete the sections related to your financial status or eligibility as required.

06

Review all entered information for accuracy and completeness.

07

Sign and date the application where indicated.

08

Submit the application form either online or via mail, following the submission instructions provided.

Who needs MI MIDAP Application Form?

01

Individuals seeking financial assistance for specific programs related to MI MIDAP.

02

Applicants who qualify based on income or other eligibility criteria outlined by the program.

03

Residents of Michigan looking for support in specific areas as defined by MI MIDAP.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to pay Michigan business tax?

Michigan's Corporate Income Tax (CIT) is at a flat rate of 6%. The tax applies to C Corporations and any entity that elects to be taxed as a C corporation. Income is apportioned based 100% on the sales factor.

What is a MI-1040 form?

2022 Michigan Individual Income Tax Return MI-1040.

What is a Michigan form 461?

Taxpayers who have a federal excess business loss limitation must file Form MI-461 to determine the Michigan portion of federal business income or loss included in AGI.

Do I need to file a Michigan tax return as a non resident?

You were a non-resident of Michigan. You had income earned in Michigan and/or attributable to Michigan. You must file a Michigan Individual Income Tax return. Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR, and Schedule W.

Where can I get my MI tax form?

Commonly used Michigan income tax forms are also available at Michigan Department of Treasury offices, most public libraries, Northern Michigan post offices, and Michigan Department of Health and Human Services (MDHHS) county offices.

Why is Michigan in two pieces?

A skirmish with Ohio known as the Toledo War delayed Michigan's statehood and led to a trade: Toledo remained in Ohio, while the Upper Peninsula became part of Michigan. Today, Michigan is the only state in the nation comprised of two peninsulas.

Why would someone have a DNR?

Generally, a DNR is executed when an individual has a history of chronic disease or terminal illness, such as chronic lung disease or heart disease, that has in the past or may in the future necessitate cardiopulmonary resuscitation (CPR), and the patient no longer wishes to be revived because of concerns that the use

What does DNR mean in Michigan?

DNR. Department of Natural Resources. Things to do. Things to do collapsed link. Places to go.

How do I speak to someone at DHS Michigan?

If you have questions about your case, you can call 1-844-4MI-DHHS (1-844-464-3447).

What does the Michigan DNR do?

DNR Mission. The Michigan Department of Natural Resources is committed to the conservation, protection, management, use and enjoyment of the state's natural and cultural resources for current and future generations.

How to do taxes yourself step by step?

How to File Your Taxes This Year: 6 Simple Steps Step 1: Determine if You Need to File. First things first. Step 2: Gather Your Tax Documents. Step 3: Pick a Filing Status. Step 4: Choose Between the Standard Deduction or Itemizing. Step 5: Choose How to File. Step 6: File Your Taxes.

Who needs to file a Michigan tax return?

You must file a Michigan return if you file a federal return or your income exceeds your Michigan exemption allowance. A return must be filed even if you do not owe Michigan tax.

What are the tax residency rules for Michigan?

Michigan residents are subject to income tax on all taxable income from any source (MCL 206.110). You are a Michigan resident if your domicile is in Michigan. Your domicile is where you have your permanent home. It is the place you plan to return to whenever you go away.

How do I write a check to the state of Michigan for taxes?

Make your check payable to the "State of Michigan". Always write your unique identifier or federal identification number on your check. Write the type of tax and the tax year(s) you are paying on the check: Michigan Business tax (MBT); Income tax (IIT); Sales, Use or Withholding tax.

What are filing requirements for Michigan?

You must file a Michigan Individual Income Tax Return if your Michigan income exceeds your prorated exemption allowance. Note: For the 2022 tax year, each Michigan personal and dependent exemption allowance is $5,000 plus $2,900 for each eligible special exemption. You had Michigan tax withheld from your wages.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the MI MIDAP Application Form in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your MI MIDAP Application Form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit MI MIDAP Application Form on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share MI MIDAP Application Form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete MI MIDAP Application Form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your MI MIDAP Application Form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is MI MIDAP Application Form?

The MI MIDAP Application Form is a document required for participants applying to the MI MIDAP program, which may facilitate access to services or benefits related to specific programs or assistance.

Who is required to file MI MIDAP Application Form?

Individuals or entities that are seeking to participate in or receive benefits from the MI MIDAP program are required to file the MI MIDAP Application Form.

How to fill out MI MIDAP Application Form?

To fill out the MI MIDAP Application Form, one must provide accurate personal and financial information as required, ensure all sections are completed, and submit the form according to the guidelines provided by the governing body of the MI MIDAP program.

What is the purpose of MI MIDAP Application Form?

The purpose of the MI MIDAP Application Form is to formally request access to the MI MIDAP program, allowing participants to demonstrate eligibility and apply for the desired services or benefits.

What information must be reported on MI MIDAP Application Form?

The MI MIDAP Application Form must include personal identification details, contact information, financial status, and any other required documentation that illustrates eligibility for the program.

Fill out your MI MIDAP Application Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI MIDAP Application Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.