Get the free Fiscal Year 2006 Application Form

Show details

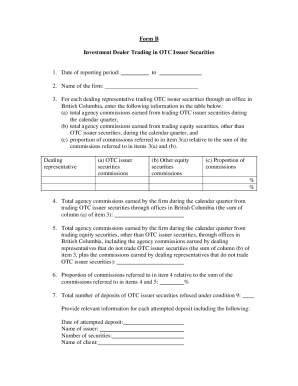

This document is an application form for funding under the Capital Improvements Program for fiscal year 2006, detailing application requirements, budget projections, and assurances for compliance.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiscal year 2006 application

Edit your fiscal year 2006 application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiscal year 2006 application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fiscal year 2006 application online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fiscal year 2006 application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fiscal year 2006 application

How to fill out Fiscal Year 2006 Application Form

01

Begin by downloading the Fiscal Year 2006 Application Form from the official website.

02

Read the instructions provided in the form carefully.

03

Fill out the applicant's name and address in the required fields.

04

Provide the date of application at the top of the form.

05

Complete all sections related to your financial status.

06

Attach any necessary documentation, such as income verification.

07

Review the form for any errors or missing information.

08

Sign and date the application at the designated place.

09

Submit the application via the specified method (mail, email, or online portal).

Who needs Fiscal Year 2006 Application Form?

01

Individuals or businesses seeking funding or grants for projects during Fiscal Year 2006.

02

Organizations that are applying for federal or state assistance.

03

Non-profits and community groups looking to receive financial support.

Fill

form

: Try Risk Free

People Also Ask about

What are the correct dates for a fiscal year?

In the United States, the federal government's fiscal year is the 12-month period beginning 1 October and ending 30 September the following year.

What is the difference between form 8716 and 1128?

An existing S corporation generally uses Form 1128, Application to Adopt, Change, or Retain a Tax Year, to apply for a change in a permitted fiscal year. However, Form 8716, Election to Have a Tax Year Other Than a Required Tax Year, is used to apply for a change under Sec. 444.

How do you choose your fiscal year?

Choosing your fiscal year depends on when your business receives most of its income. If your busiest time of year is the spring, an option is to end the fiscal year right after that, on June 30. This makes it easier to know your financial standing since you just received most of your revenue that quarter.

How do you designate fiscal year?

The designation of fiscal years typically includes the 365 days in which most of the period falls. For example, a company's Fiscal Year 2025 (often abbreviated as FY2025 or FY25) may run from Feb. 1, 2025, to Jan. 31, 2026.

Can I print a 1040 SR form?

Get, Create, Make and Sign 1040sr form Email, fax, or share your 1040 sr instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How do I set my fiscal year?

If you filed your last return using the calendar year and want to switch to a fiscal year, or you run a sole proprietorship, you have to get IRS approval to use a fiscal year by filing Form 1128. If you run an S corporation or a partnership, you'll have to file Form 8716 to switch to a fiscal year.

How do I know my LLC fiscal year?

A calendar year is twelve consecutive months, running from January 1st and ending December 31st. Most small businesses use a calendar year as their tax year. Fiscal tax year. A fiscal tax year is twelve consecutive months ending on the final day of any month other than December (i.e. July 31st).

What is the form for fiscal year change?

File Form 1128 to request a change in tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Fiscal Year 2006 Application Form?

The Fiscal Year 2006 Application Form is a document used to apply for funding or financial assistance for the fiscal year that runs from October 1, 2005, to September 30, 2006. It typically includes information about the applicant's organization and proposed projects.

Who is required to file Fiscal Year 2006 Application Form?

Organizations or entities seeking federal funding, grants, or financial assistance for projects that fall within the Fiscal Year 2006 budget may be required to file this application form.

How to fill out Fiscal Year 2006 Application Form?

To fill out the Fiscal Year 2006 Application Form, applicants should carefully review the instructions provided, complete all required sections with accurate and complete information, and ensure that all necessary documentation is attached before submission.

What is the purpose of Fiscal Year 2006 Application Form?

The purpose of the Fiscal Year 2006 Application Form is to provide a standardized way for organizations to request funding or resources from the government for specific projects or initiatives planned for that fiscal year.

What information must be reported on Fiscal Year 2006 Application Form?

The Fiscal Year 2006 Application Form typically requires information such as the applicant's organizational details, project descriptions, funding requirements, budget estimations, and any other details pertinent to the proposed project.

Fill out your fiscal year 2006 application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiscal Year 2006 Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.