Get the free Form 1116

Show details

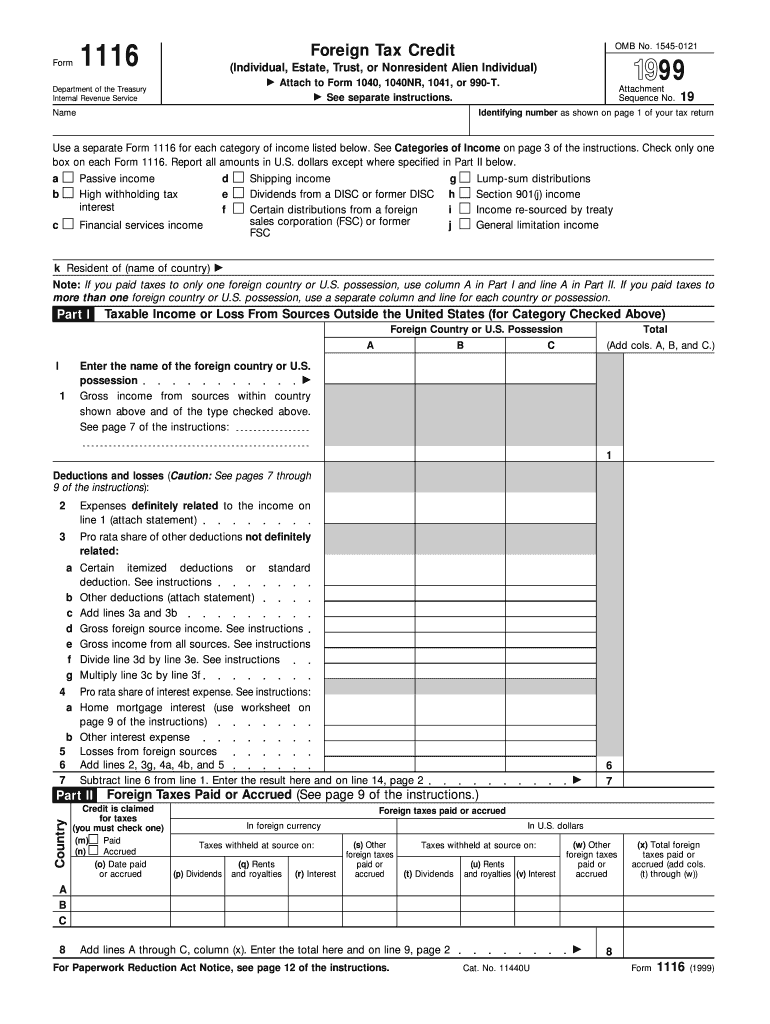

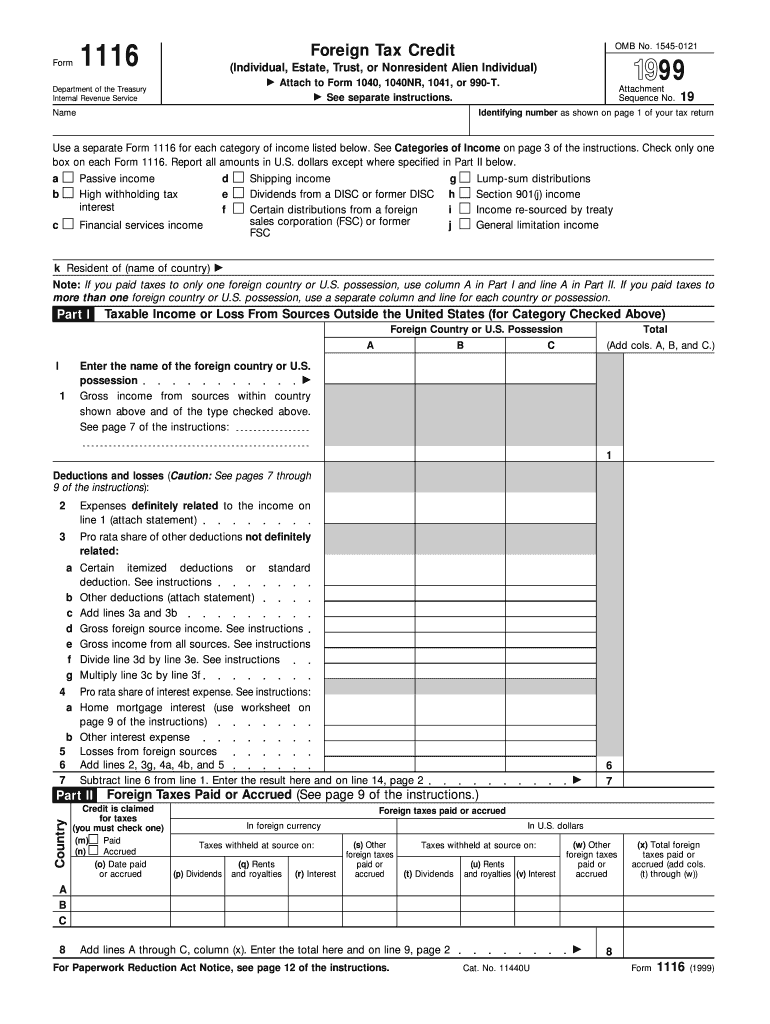

This form is used to claim the Foreign Tax Credit for individuals, estates, trusts, or nonresident alien individuals. It helps to reduce double taxation on income earned abroad by allowing taxpayers

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 1116

Edit your form 1116 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1116 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 1116 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 1116. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 1116

How to fill out Form 1116

01

Obtain a copy of Form 1116 from the IRS website or tax preparation software.

02

Fill out your personal information at the top of the form including name, address, and Social Security number.

03

Determine the foreign taxes you paid or accrued during the tax year.

04

Complete Part I to report your foreign income. Indicate the type of income and the amount earned.

05

In Part II, enter the foreign tax paid or accrued that corresponds to the income reported.

06

Complete Part III to calculate the allowable foreign tax credit, including any limitations.

07

Review the form for accuracy and ensure all relevant sections are filled out.

08

Attach Form 1116 to your tax return when filing.

Who needs Form 1116?

01

U.S. citizens and residents who have paid foreign taxes on income earned abroad.

02

Individuals claiming a foreign tax credit on their U.S. tax return.

03

Taxpayers with foreign income sources that do not qualify for automatic credits based on other forms.

Fill

form

: Try Risk Free

People Also Ask about

Can you switch between foreign tax credit and foreign income exclusion?

Once you choose to exclude foreign earned income and/or foreign housing costs, you cannot take a foreign tax credit or deduction for taxes on income you excluded or could have excluded. If you do, one or both choices may be considered revoked.

Do I need IRS form 1116?

Who should file. File Form 1116 to claim the foreign tax credit if the election, earlier, doesn't apply and: You are an individual, estate, or trust; and. You paid or accrued certain foreign taxes to a foreign country or U.S. territory.

Can I skip Form 1116?

Single filers who paid $300 or less in foreign taxes, and married joint filers who paid $600 or less, can omit filing Form 1116. But using the form enables you to carry forward any unused credit balance to future tax years; without filing Form 1116, you give up this carryover tax break.

Do US citizens pay tax on foreign capital gains?

It will be reported as income — if you made a profit, of course — and hence it is taxable. Gains from selling property abroad are also taxable, because the US taxes their citizens on worldwide income.

What happens if you don't report foreign income?

Specified foreign financial assets If the IRS mails you a notice about failing to file a Form 8938 and you don't file the form within 90 days, an additional continuation penalty of $10,000 for each 30-day period after the 90-day period has expired may apply.

How do I avoid double taxation on foreign capital gains?

International tax treaties, the Foreign Earned Income Exclusion (FEIE), and Foreign Tax Credits (FTC) can help reduce double taxation. US expats must report their worldwide income, but credits and exclusions can bring the taxes down significantly.

What are the methods to eliminate double taxation?

Avoiding double taxation This is typically achieved through specific provisions that either exempt the income from tax in one country or allow a credit for the tax paid in the other country.

How to avoid getting double taxed?

To avoid double taxation, one option is to structure the business as a “flow-through” or “pass-through” entity. In this setup, profits bypass corporate taxation and go directly to the business owners. The owners then report and pay taxes on their share of the income at their tax rates.

How do I avoid double taxation on foreign capital gains?

International tax treaties, the Foreign Earned Income Exclusion (FEIE), and Foreign Tax Credits (FTC) can help reduce double taxation. US expats must report their worldwide income, but credits and exclusions can bring the taxes down significantly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 1116?

Form 1116 is a form used by U.S. taxpayers to claim the Foreign Tax Credit, which allows them to reduce their U.S. tax liability on income that has already been taxed by a foreign government.

Who is required to file Form 1116?

Taxpayers who have paid or accrued foreign taxes on income and wish to claim the Foreign Tax Credit must file Form 1116.

How to fill out Form 1116?

Form 1116 is filled out by providing details of foreign income, the amount of foreign taxes paid, and calculating the allowable credit. Taxpayers need to fill in sections related to the type of income and taxes claimed.

What is the purpose of Form 1116?

The purpose of Form 1116 is to allow U.S. taxpayers to claim a credit for foreign taxes paid, preventing double taxation on the same income.

What information must be reported on Form 1116?

Form 1116 requires reporting of the taxpayer's foreign income, the amount of foreign taxes paid or accrued, and the type of income upon which the taxes were paid.

Fill out your form 1116 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1116 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.