Get the free Michigan Department of Treasury 496 Auditing Procedures Report

Show details

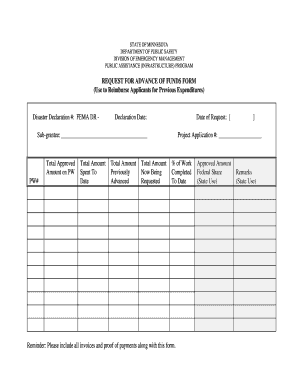

This document is an auditing report concerning the financial statements and auditing procedures for the Kalkaska Public Transit Authority for the fiscal year ended September 30, 2007.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign michigan department of treasury

Edit your michigan department of treasury form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your michigan department of treasury form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing michigan department of treasury online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit michigan department of treasury. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out michigan department of treasury

How to fill out Michigan Department of Treasury 496 Auditing Procedures Report

01

Download the Michigan Department of Treasury 496 Auditing Procedures Report form from the official website.

02

Read the instructions carefully to understand the requirements.

03

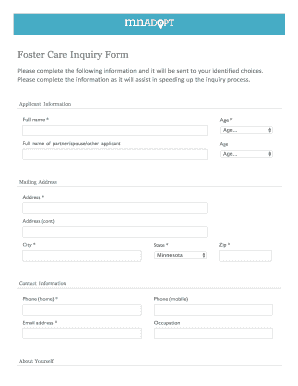

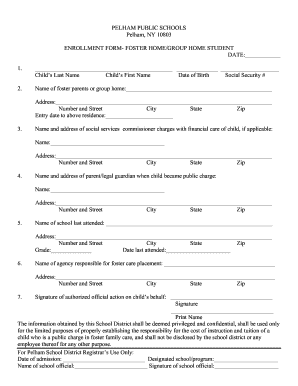

Fill out the entity information section with the name, address, and contact details.

04

Provide the fiscal year information for the audit you are reporting on.

05

Complete the narrative section detailing the audit procedures conducted.

06

Include any findings or observations made during the audit.

07

Attach supporting documentation as required by the form.

08

Review the report for accuracy and completeness.

09

Sign and date the report.

10

Submit the completed form to the Michigan Department of Treasury by the specified deadline.

Who needs Michigan Department of Treasury 496 Auditing Procedures Report?

01

Entities that are required to report financial audits, including local governments and public authorities in Michigan.

Fill

form

: Try Risk Free

People Also Ask about

What is a CAS 805?

CAS 805, Special Considerations – Audits of Single Financial Statements and Specific Elements, Accounts or Items of a Financial Statement. CAS 800, Special Considerations – Audits of Financial Statements Prepared in ance with Special Purpose Frameworks. Canadian Auditing Standards. Projects.

What is the purpose of the Cass audit?

They ensure the protection of client assets through rigorous compliance with the FCA's rules. By understanding and adhering to CASS audit requirements, firms can maintain high standards of client asset protection, build trust with clients, and mitigate risks associated with financial mismanagement.

How to do proper audit?

Audit Process Step 1: Planning. The auditor will review prior audits in your area and professional literature. Step 2: Notification. Step 3: Opening Meeting. Step 4: Fieldwork. Step 5: Report Drafting. Step 6: Management Response. Step 7: Closing Meeting. Step 8: Final Audit Report Distribution.

What is a CDTFA audit?

A sales tax audit occurs when the CDTFA suspects a business's reported sales have been understated. Most commonly, this occurs in situations where there is a “mismatch” or an incongruency between the sales tax returns filed with CDTFA and what was reported to other agencies (like the IRS).

What is a CAS 805 audit?

CAS 805, Special Considerations – Audits of Single Financial Statements and Specific Elements, Accounts or Items of a Financial Statement. CAS 800, Special Considerations – Audits of Financial Statements Prepared in ance with Special Purpose Frameworks. Canadian Auditing Standards.

What does CAS stand for in audit?

While it has been around for a long time, it recently witnessed a surge in demand from businesses due to the effects of the COVID-19 pandemic on small businesses. These businesses turned to accounting firms offering Client Accounting Services (CAS) (or advisory services) to help them stay afloat.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Michigan Department of Treasury 496 Auditing Procedures Report?

The Michigan Department of Treasury 496 Auditing Procedures Report is a document that outlines specific auditing standards and procedures for organizations to follow to ensure compliance with state regulations.

Who is required to file Michigan Department of Treasury 496 Auditing Procedures Report?

Entities that are subject to financial audits conducted under Michigan law, including non-profit organizations and governmental entities, are typically required to file the Michigan Department of Treasury 496 Auditing Procedures Report.

How to fill out Michigan Department of Treasury 496 Auditing Procedures Report?

To fill out the Michigan Department of Treasury 496 Auditing Procedures Report, organizations must provide detailed financial information, supporting documentation, and adhere to the prescribed formats and guidelines provided by the Michigan Department of Treasury.

What is the purpose of Michigan Department of Treasury 496 Auditing Procedures Report?

The purpose of the Michigan Department of Treasury 496 Auditing Procedures Report is to ensure transparency and accountability in financial reporting, helping to safeguard public funds and maintain the integrity of financial practices among reporting entities.

What information must be reported on Michigan Department of Treasury 496 Auditing Procedures Report?

The report must include information such as financial statements, descriptions of internal controls, notes on significant accounting policies, and any findings or recommendations from the audit process.

Fill out your michigan department of treasury online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Michigan Department Of Treasury is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.