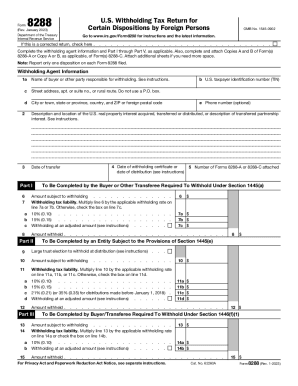

IRS 8288 1998 free printable template

Instructions and Help about IRS 8288

How to edit IRS 8288

How to fill out IRS 8288

About IRS 8 previous version

What is IRS 8288?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

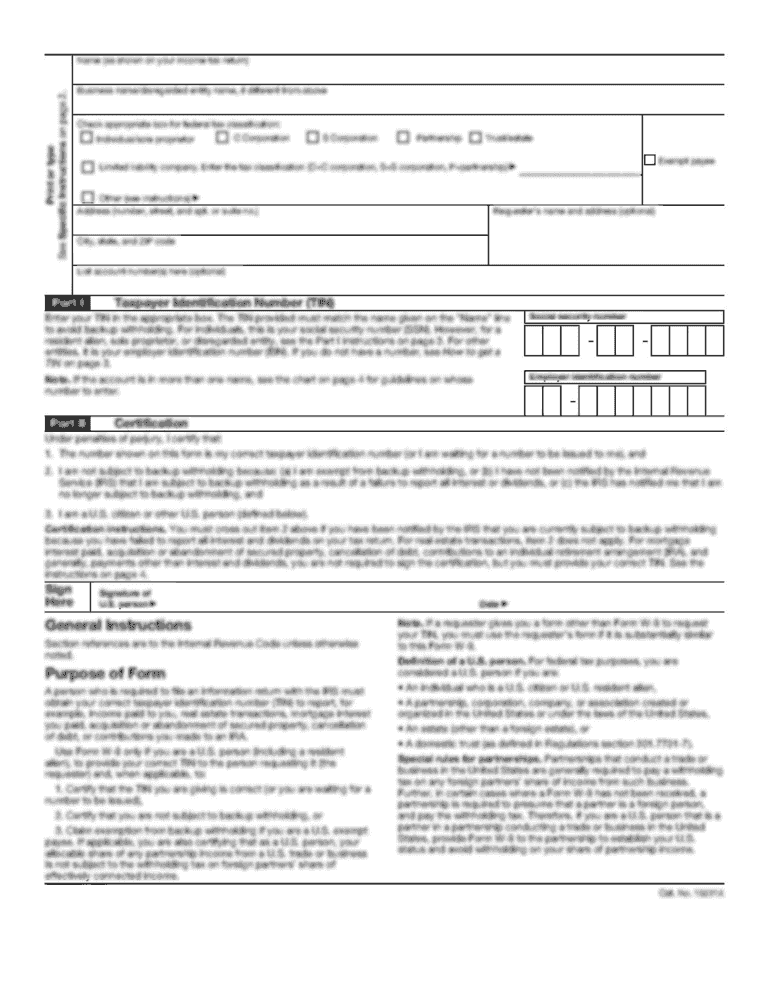

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8288

What should I do if I realize I made a mistake on form 8288 rev august after submission?

If you discover an error after filing form 8288 rev august, you should submit an amended form to correct the mistakes. Ensure you clearly indicate that it's a correction and provide necessary documentation to support the changes being made.

How can I track the status of my form 8288 rev august after I’ve filed it?

To verify the receipt or processing of your form 8288 rev august, you can use the online tracking system of the relevant tax authority. If you encounter issues or receive rejection codes, review the guidelines for common errors linked to this form.

Are there specific record retention periods I should be aware of after filing form 8288 rev august?

Yes, after submitting form 8288 rev august, it's important to retain a copy along with any supporting documents for the prescribed record retention period as advised by the tax authority. Generally, this period lasts for several years, and maintaining these records ensures clarity in case of inquiries.

What might happen if my e-filed form 8288 rev august gets rejected?

If your e-filed form 8288 rev august is rejected, you will usually receive an error message detailing the reason for the rejection. To proceed, review the rejection codes, correct the identified issues, and resubmit your form as soon as possible to avoid penalties.

Can I e-sign my form 8288 rev august, or do I need to print it out?

E-signatures are generally acceptable for form 8288 rev august as long as you comply with the guidelines set by the tax authority. Be sure to verify the requirements for electronic submissions to ensure your filing is valid.

See what our users say