Get the free HIGH DEDUCTIBLE HEALTH PLAN APPLICATION - state nj

Show details

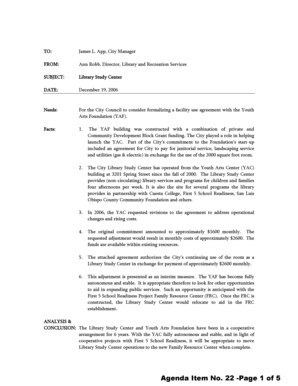

This document serves as an application form for eligible employees to enroll in a High Deductible Health Plan and related Health Savings Account options, detailing coverage levels, dependent information,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign high deductible health plan

Edit your high deductible health plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your high deductible health plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing high deductible health plan online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit high deductible health plan. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out high deductible health plan

How to fill out HIGH DEDUCTIBLE HEALTH PLAN APPLICATION

01

Gather required personal information such as your name, address, and Social Security number.

02

Provide details about your current health insurance plan, if applicable.

03

Indicate your preferred coverage start date.

04

Fill in information about your dependents, if any, including their names and Social Security numbers.

05

Review and sign the application, confirming that all information is accurate.

06

Submit the application to the designated health insurance provider, either online or via mail.

Who needs HIGH DEDUCTIBLE HEALTH PLAN APPLICATION?

01

Individuals or families looking for lower monthly premiums with higher out-of-pocket costs.

02

People who are generally healthy and may not require frequent medical care.

03

Employers seeking to offer employees a cost-effective health insurance option.

04

Those eligible for Health Savings Accounts (HSAs), as HDHPs allow contributions to these accounts.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of high-deductible health plan?

For example, let's say you have a high deductible health plan with a network deductible of $1,700. After a surgery and a hospital stay, maybe you reached that network deductible. If that happens, you'd start to split the cost of covered services with your health plan and pay 20% of the bill from now on.

Is $5000 a high-deductible health plan?

On average, single Americans with a high-deductible health plan (HDHP) have an annual premium of $7,170, while those with a more traditional type of health plan (like an HMO or PPO) have an average premium of $8,162. For families, the premium comparison is $21,079 with an HDHP versus $23,003 without.

What are the requirements for a high-deductible health plan?

Per IRS guidelines in 2026, an HDHP is a health insurance plan with a deductible of at least $1,700 if you have an individual plan or a deductible of at least $3,400 if you have a family plan. The deductible is the amount you'll pay out of pocket for medical expenses before your insurance pays anything.

What is a high-deductible health plan example?

Per IRS guidelines in 2026, an HDHP is a health insurance plan with a deductible of at least $1,700 if you have an individual plan or a deductible of at least $3,400 if you have a family plan. The deductible is the amount you'll pay out of pocket for medical expenses before your insurance pays anything.

Who is a good candidate for an HDHP plan?

An HDHP is best for younger, healthier people who don't expect to need health care coverage except in the face of a serious health emergency. Wealthy individuals and families who can afford to pay the high deductible out of pocket and want the benefits of an HSA may benefit from HDHPs.

Can I get a HDHP on my own?

Yes! You can purchase an HSA-qualified high-deductible health plan (HDHP) in the individual market, which is where people buy coverage if they don't have access to an employer-sponsored plan or a government plan like Medicare or Medicaid.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is HIGH DEDUCTIBLE HEALTH PLAN APPLICATION?

A High Deductible Health Plan (HDHP) application is a form used to apply for a health insurance plan that features higher deductibles and lower premiums, meant to offer coverage after the deductible is met.

Who is required to file HIGH DEDUCTIBLE HEALTH PLAN APPLICATION?

Individuals or families looking to enroll in a High Deductible Health Plan or those wanting to open a Health Savings Account (HSA) are required to file this application.

How to fill out HIGH DEDUCTIBLE HEALTH PLAN APPLICATION?

To fill out the HDHP application, individuals must provide personal information, health history, and select the plan options that meet their needs, ensuring they meet the HDHP criteria.

What is the purpose of HIGH DEDUCTIBLE HEALTH PLAN APPLICATION?

The purpose of the HDHP application is to facilitate the enrollment process in a health plan that allows for lower monthly premiums and eligibility for a Health Savings Account (HSA).

What information must be reported on HIGH DEDUCTIBLE HEALTH PLAN APPLICATION?

The application typically requires reporting personal information, income level, any pre-existing conditions, household size, and employment details.

Fill out your high deductible health plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

High Deductible Health Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.