Get the free Form 9465

Show details

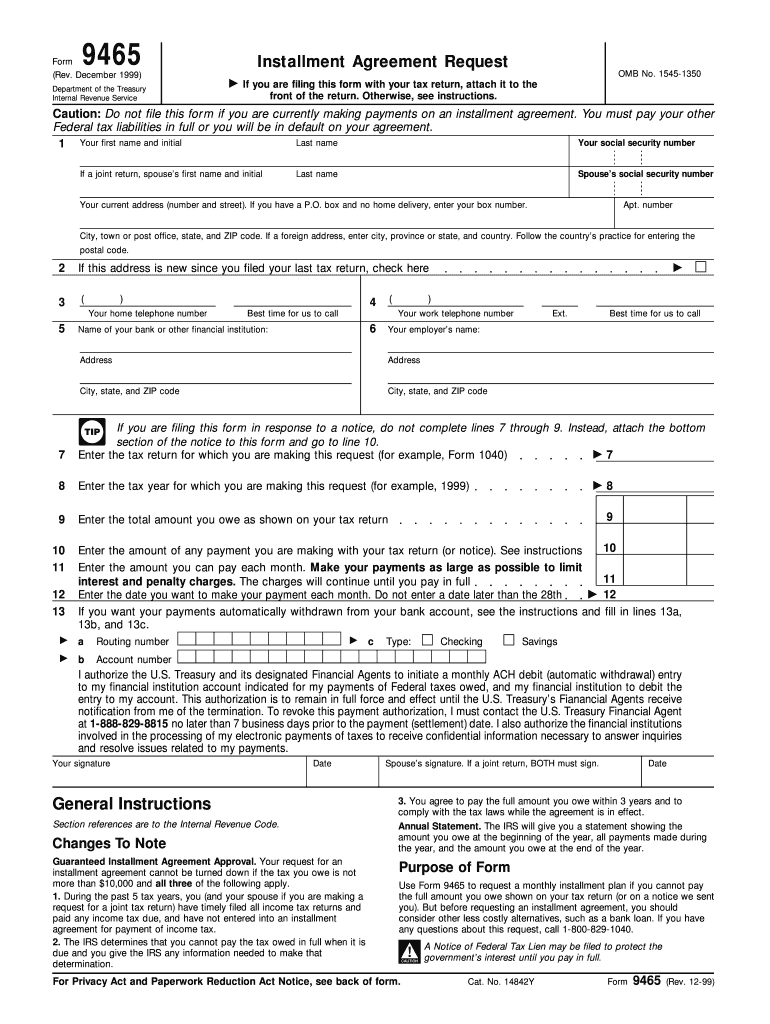

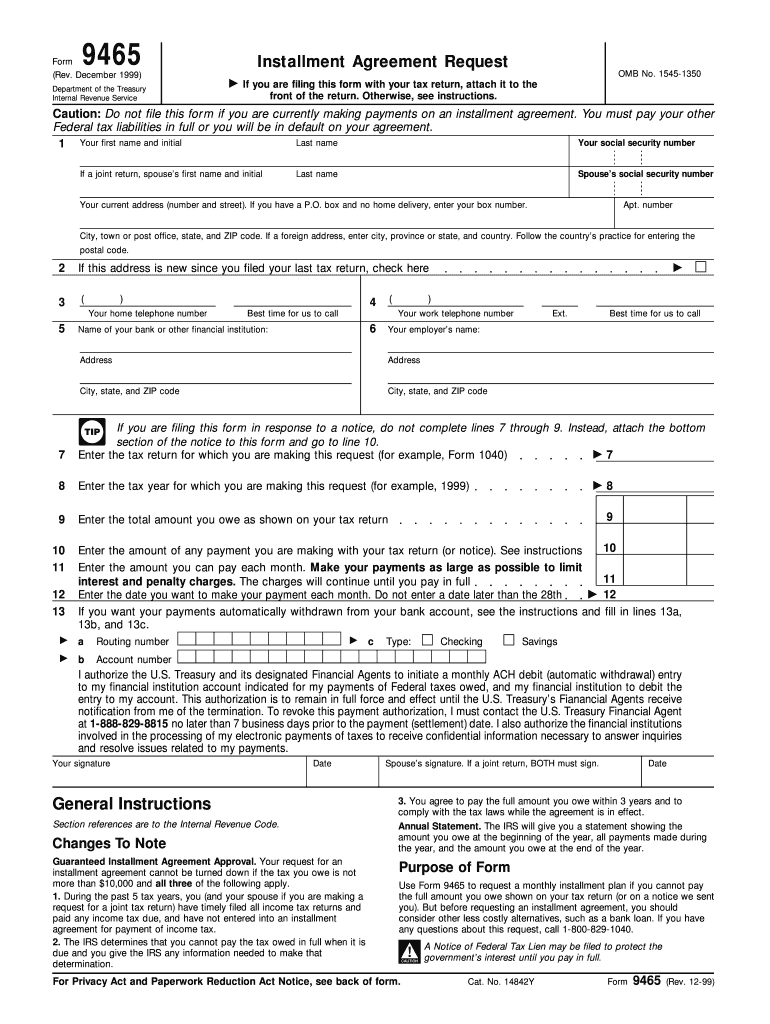

Use Form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return. This form allows you to propose a payment plan to the IRS for your tax liabilities.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 9465

Edit your form 9465 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 9465 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 9465 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 9465. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 9465

How to fill out Form 9465

01

Obtain Form 9465 from the IRS website or a local IRS office.

02

Fill out your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate your filing status by checking the appropriate box.

04

Enter the amount you owe on the form in the provided section.

05

Specify the monthly payment amount you are proposing.

06

Provide your bank information if you choose to set up direct debit payments.

07

Sign and date the form to validate your request.

08

Submit the completed Form 9465 to the address indicated in the instructions.

Who needs Form 9465?

01

Individuals who owe taxes and need to set up a payment plan with the IRS.

02

Taxpayers who cannot pay their tax liability in full by the due date.

03

People who are filing for an extension or need more time to pay.

Fill

form

: Try Risk Free

People Also Ask about

What voids an IRS payment plan?

We can terminate your installment agreement if: You do not make monthly installment payments as agreed. You do not pay any other federal tax debt when due. You do not provide financial information when requested.

Can I make installment payments to IRS online?

Most taxpayers qualify for an IRS payment plan (or installment agreement) and can use the Online Payment Agreement (OPA) to set it up to pay off an outstanding balance over time. Once taxpayers complete the online application, they receive immediate notification of whether the IRS has approved their payment plan.

How long does it take IRS to process form 9465?

If you don't qualify for an IA through OPA, you may also request an IA by submitting Form 9465, Installment Agreement Request, with the IRS. When you request an IA using the form, generally, you'll receive a response from the IRS within 30 days notifying you of whether the IA request was approved or rejected.

What IRS forms can be filed electronically?

The following form types can be e-filed through the MeF Platform: Corporations (Forms 1120, 1120-F and 1120-S) Employment Tax (Forms 940, 940-PR, 941, 941-PR, 941-SS, 943, 943-PR, 944, and 945) 94x Online Signature PIN Registration. Exempt Organizations (Forms 990, 990-EZ, 990-N, 990-PF, 990-T, 1120-POL and 4720)

How much is the fee for form 9465?

The user fee for requesting an installment agreement using Form 9465 is $225 with payment by check and $107 with payment by direct debit from your checking account. To qualify for a lower user fee, you can request an installment agreement using the IRS Online Payment Agreement tool.

How long does it take for the IRS to process form 9465?

If you don't qualify for an IA through OPA, you may also request an IA by submitting Form 9465, Installment Agreement Request, with the IRS. When you request an IA using the form, generally, you'll receive a response from the IRS within 30 days notifying you of whether the IA request was approved or rejected.

How much is the 9465 installment agreement fee?

Below are the options you can choose from, including the costs associated with each method: Check, money order, or credit card: $149 for online payment, $225 for mail. Direct debit: $31 for online payment, $107 for mail. Payroll deduction installment agreement: $120.

How hard is it to get a payment plan with the IRS?

Most taxpayers qualify for an IRS payment plan (or installment agreement) and can use the Online Payment Agreement (OPA) to set it up to pay off an outstanding balance over time. Once taxpayers complete the online application, they receive immediate notification of whether the IRS has approved their payment plan.

Can I file form 9465 electronically?

Form-9465 can be sent to the IRS alongside your tax return, both electronically or via snail mail. Save the trees and your printing costs by setting up your installment agreement online. You'll receive a faster notification of approval too.

What disqualifies you from an IRS payment plan?

The IRS might deny a payment plan if you have incomplete tax filings, owe for multiple periods, or lack consistent compliance with tax laws.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 9465?

Form 9465 is a request for an installment agreement, which allows taxpayers to pay their tax owed in monthly installments if they cannot pay the full amount at once.

Who is required to file Form 9465?

Taxpayers who owe taxes and cannot pay the full amount by the deadline may file Form 9465 to request a monthly payment plan.

How to fill out Form 9465?

To fill out Form 9465, you need to provide your personal information, details about your tax liability, the amount you can pay, and the proposed monthly payment amount.

What is the purpose of Form 9465?

The purpose of Form 9465 is to allow taxpayers to enter into an installment agreement with the IRS to pay their tax liability over time.

What information must be reported on Form 9465?

The form requires taxpayer's personal information, total tax owed, estimated monthly payment the taxpayer can afford, and the preferred payment date.

Fill out your form 9465 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 9465 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.