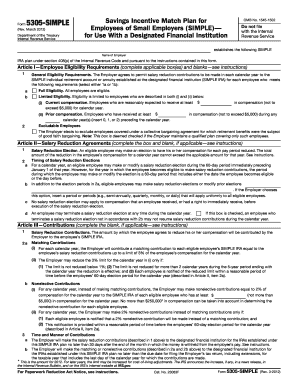

IRS 5305-SIMPLE 1996 free printable template

Instructions and Help about IRS 5305-SIMPLE

How to edit IRS 5305-SIMPLE

How to fill out IRS 5305-SIMPLE

About IRS 5305-SIMPLE 1996 previous version

What is IRS 5305-SIMPLE?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 5305-SIMPLE

What should I do if I need to correct a mistake on my filed 1996 5305 simple form?

If you discover an error after submitting your 1996 5305 simple form, you will need to file an amended form. Ensure you clearly indicate the corrections and provide any necessary documentation explaining the changes. It’s important to do this promptly to avoid potential penalties or complications.

How can I verify the receipt or processing status of my 1996 5305 simple form?

To verify the receipt or processing status of your submitted 1996 5305 simple form, you may contact the relevant authority directly or use online tracking tools if available. Keep your submission confirmation details handy, as this will assist in quickly locating your record.

What are some common errors that filers encounter with the 1996 5305 simple form?

Common errors when completing the 1996 5305 simple form include incorrect taxpayer identification numbers, misreporting payment amounts, and failing to sign the form. To avoid such mistakes, double-check all entries against your records before submission, and ensure that all required fields are filled out accurately.

Can I e-file the 1996 5305 simple form, and what should I consider for software compatibility?

Yes, you can e-file the 1996 5305 simple form, but it’s crucial to ensure that the software you’re using is compatible with the form’s requirements. Check for updates, user reviews, and support documentation to avoid issues during the e-filing process.