Get the free Form 6252

Show details

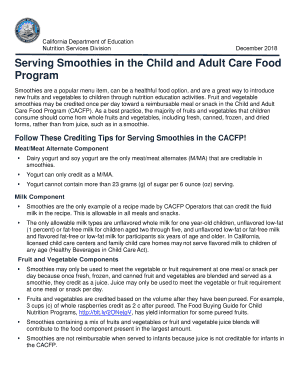

Este formulario se usa para informar los ingresos de ventas a plazos de propiedad personal o inmobiliaria, recibiendo pagos en años fiscales posteriores al año de la venta. Incluye instrucciones

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 6252

Edit your form 6252 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 6252 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 6252 online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 6252. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 6252

How to fill out Form 6252

01

Obtain a copy of Form 6252 from the IRS website or tax preparation software.

02

Fill in your name and Social Security number at the top of the form.

03

Provide details about the sale of the property including the date of sale and amount received.

04

Calculate the gross profit percentage and fill in the appropriate sections for installment sales.

05

Report the amounts received in the current tax year and any prior payments.

06

Complete the section for interest received and any adjustments needed.

07

Review the entire form for accuracy before submission.

Who needs Form 6252?

01

Sellers of real estate or personal property who receive payment in installments.

02

Taxpayers who sold property and need to report the income from the sale over several years.

03

Individuals involved in transactions that qualify for installment reporting under IRS rules.

Fill

form

: Try Risk Free

People Also Ask about

Does TurboTax support Form 6252?

Yes, TurboTax will fill out the 6252 and then carry the numbers to any other necessary forms including schedule D.

What qualifies for installment sale treatment?

For federal income tax purposes, an installment sale is when at least one payment of proceeds from an eligible sale is deferred until after the end of the tax year in which the sale occurs. This setup can be beneficial for a buyer that doesn't have enough available cash to immediately pay the full purchase price.

What is Form 6252 TurboTax?

Form 6252 helps you figure out how much of the money you received during a given tax year was a return of capital, how much was a gain and how much was interest. You can then report the proper amounts on your tax return.

What does not qualify for an installment sale?

Certain types of sales don't qualify as installment sales, including: Sale of inventory items. Sales made by dealers who regularly sell the same type of property. Sale of stocks or other investment securities.

Which types of sales are reported on IRS Form 6252?

Generally, you will use Form 6252 to report installment sale income from casual sales of real or personal property during the tax year. You will also have to report the installment sale income on Schedule D (Form 1040), Form 4797, or both.

How do I report a rental property installment sale?

What Tax Form Should I Use to Report Interest Income From an Installment Sale? You will use Form 6252, Installment Sale Income, to report installment sale interest income. The information from Form 6252 flows through to Schedule D, Capital Gains and Losses, which flows through to your Form 1040.

What is IRS Form 6252 used for?

Use Form 6252 to report an installment sale under the installment method. File Form 6252 for the year of the disposition and all subsequent years, regardless of whether a payment is received in such year, until and including the year final payment is received or the obligation is disposed of.

Who benefits from an installment sale?

One of the biggest benefits of an installment sale is that it helps the buyer place themselves into a lower tax bracket. The sale of some sizable property or property of sizable value—whether it's commercial real estate or residential real estate—can bump an investor into a tax bracket they'd like to avoid.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 6252?

Form 6252 is used to report income from the sale of property when the seller receives at least one payment after the tax year of the sale. It is related to installment sales.

Who is required to file Form 6252?

Taxpayers who sell property and choose to report the sale on an installment basis are required to file Form 6252.

How to fill out Form 6252?

To fill out Form 6252, you need to provide information about the property sold, the selling price, payments received, and any associated costs. Follow the instructions provided on the form.

What is the purpose of Form 6252?

The purpose of Form 6252 is to report income from installment sales and to calculate the gain from such sales for tax purposes.

What information must be reported on Form 6252?

Form 6252 requires reporting the property description, selling price, total gain, payments received, and any expenses related to the sale.

Fill out your form 6252 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 6252 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.