Get the free Form 8082

Show details

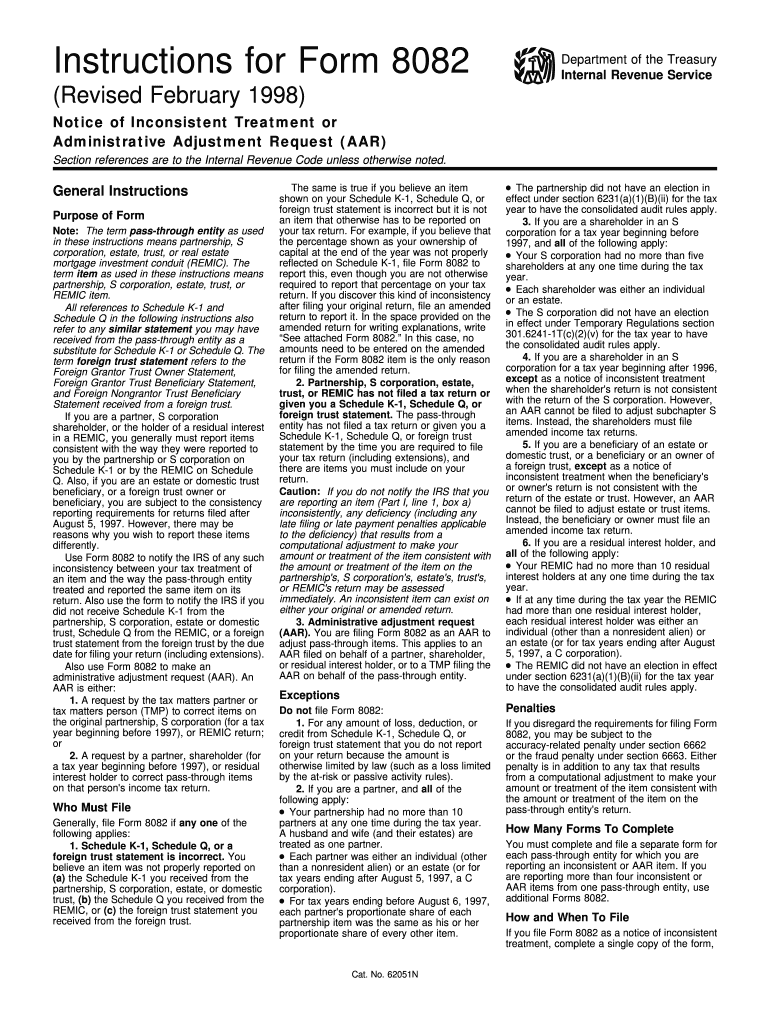

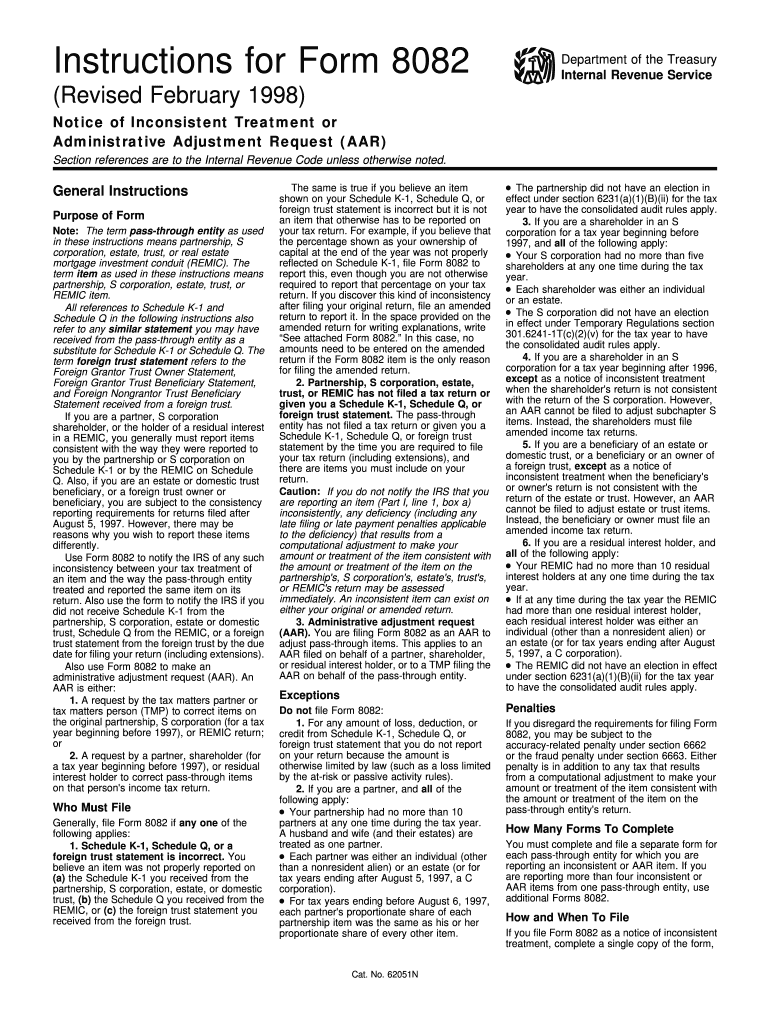

Form 8082 is used to notify the IRS of any inconsistency between your tax treatment of an item and the way the pass-through entity treated and reported the same item on its return. It can also be

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 8082

Edit your form 8082 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8082 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 8082 online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 8082. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 8082

How to fill out Form 8082

01

Obtain Form 8082 from the IRS website or your tax professional.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill out your personal information at the top section, including your name, address, and taxpayer identification number.

04

Indicate the tax year for which you are filing the form.

05

Complete Part I to provide details about the item you are reporting.

06

In Part II, specify the type of entity involved and any relevant details.

07

Attach any necessary documentation that supports the information provided.

08

Review the form for accuracy and completeness.

09

Sign and date the form before submitting it to the IRS.

Who needs Form 8082?

01

Individuals or entities reporting a partnership item that needs to be adjusted or an adjustment to a tax return.

02

Taxpayers who are involved in partnerships or S corporations and need to report adjustments.

03

Anyone who receives a notice from the IRS concerning adjustments or issues related to partnership items.

Fill

form

: Try Risk Free

People Also Ask about

Can Schedule C be filed electronically?

IRS Schedule C is a tax form for reporting profit or loss from a business. You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040.

Can you electronically file an amended partnership return?

If you need to make changes to your Partnership Form 1065 U.S. Return of Partnership Income return after it has been filed, you may need to file an amended return. The IRS supports both paper-filing and e-filing for amended returns. To complete the amendment process: Locate a copy of your originally-filed return.

What is form 8082 for K-1 not received?

Notice of inconsistent treatment. For example, if you believe that the percentage shown as your ownership of capital at the end of the year wasn't properly reported on Schedule K-1, file Form 8082 to report this, even though you aren't otherwise required to report that percentage on your tax return.

Can IRS forms be submitted online?

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer, and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

Can you paper file 8082?

For electronic filing, use Form 8082 in conjunction with Form 1065 or 1065-B, as applicable. If paper filing, 1065-X and 8985/8986 would be prepared. 8082 is not required unless efiling.

What tax forms can be filed electronically?

Accepted forms Forms you can e-file for an individual: Form 540 , California Resident Income Tax Return. Form 540 2EZ , California Resident Income Tax Return. Form 540NR , California Nonresident or Part-Year Resident Income Tax Return.

What is IRS form 8082?

File Form 8082 if you're the PR or DI requesting an administrative adjustment to correct a previously filed partnership return on behalf of the BBA partnership. When a partnership's federal return is changed for any reason, it may affect its state return.

Can form 8082 be filed electronically?

Form 8082 is electronically fillable however, it does not have a separate export option. By following the instructions below, you will suppress the export of Form 1065 pages 1-5 for electronic filing. Only Form 8082 and the amended K-1s will be exported.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 8082?

Form 8082 is a tax form used by taxpayers to report a transaction that affects partnership or S corporation interests.

Who is required to file Form 8082?

Taxpayers who have a partnership or S corporation interest and need to report specific information about their share of income, deductions, or credits are required to file Form 8082.

How to fill out Form 8082?

To fill out Form 8082, taxpayers must provide information about the entity, their share of income, deductions, and credits, and any other required disclosures as instructed on the form.

What is the purpose of Form 8082?

The purpose of Form 8082 is to ensure that the IRS receives accurate information regarding a taxpayer's interest in partnerships and S corporations, especially when there are discrepancies.

What information must be reported on Form 8082?

Form 8082 requires reporting of the entity's name and EIN, the taxpayer's share of income and deductions, credits, and relevant attachments or statements.

Fill out your form 8082 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8082 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.