Get the free Notice 1036

Show details

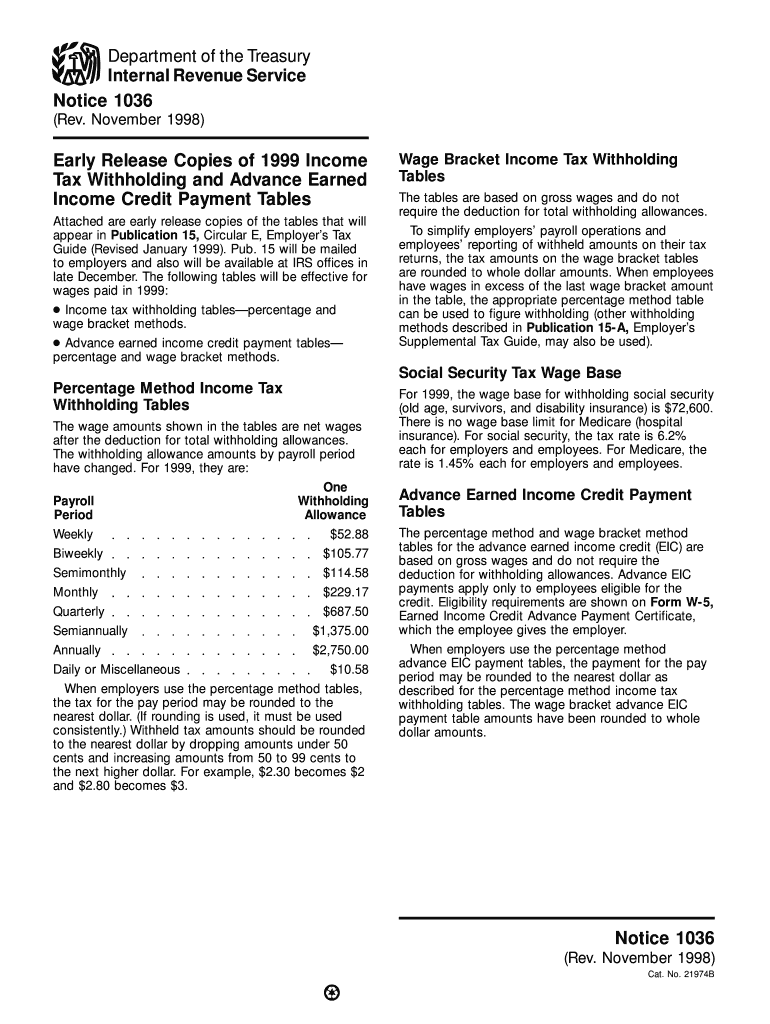

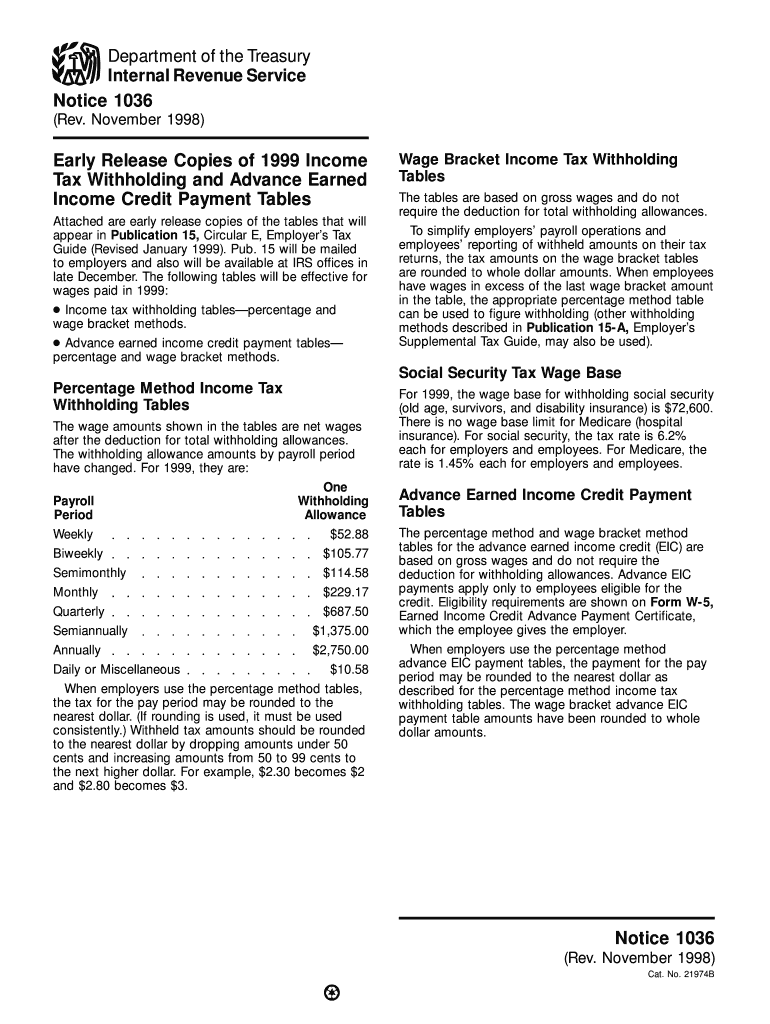

This document provides early release copies of the income tax withholding tables and advance earned income credit payment tables that will be included in IRS Publication 15, effective for wages paid

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice 1036

Edit your notice 1036 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice 1036 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit notice 1036 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit notice 1036. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice 1036

How to fill out Notice 1036

01

Obtain a copy of Notice 1036 from the appropriate agency or website.

02

Read the instructions carefully to understand the requirements.

03

Fill out your personal information including name, address, and identification number.

04

Provide details about the reason for filing the Notice 1036.

05

Sign and date the form where indicated.

06

Review the completed form for accuracy.

07

Submit the form to the designated office or online portal as instructed.

Who needs Notice 1036?

01

Individuals or entities who are required to notify a government agency of a specific situation or event.

02

Those seeking to make formal requests or changes regarding their status or information.

03

People involved in matters that require official documentation of notice.

Fill

form

: Try Risk Free

People Also Ask about

Is it better to have taxes withheld or not?

When too much money is withheld from your paychecks, it's like you're giving Uncle Sam an interest-free loan. You eventually get a tax refund when you file your tax return, but the government holds on to your money in the meantime. On the other hand, if not enough tax is withheld, you might get an unexpected tax bill.

Why is my federal income tax withheld so low?

The amount of tax withheld from your pay depends on what you earn each pay period. It also depends on what information you gave your employer on Form W-4 when you started working. This information, like your filing status, can affect the tax rate used to calculate your withholding.

Why is my federal withholding so low even though I claim 0?

If you were claiming 0 allowances and still owed, it usually means you have multiple sources of income. Another possibility is that you received supplemental income (like bonuses), which were withheld at a specific rate that was lower than your marginal rate.

Why is my federal withholding so low when I claim 0?

The amount of income you and your spouse earn combined goes too close to the standard deduction, which does not contribute to under-withholding. With two W2s, a doubling of the tax bracket occurs, resulting in insufficient tax credits when claiming 0 allowances.

What does IRS mean by whole dollar amount?

You can round off cents to whole dollars on your return and schedules. Any amounts under $. 50 would be rounded down to the nearest dollar. Amounts that are $. 50 and over are rounded up to the nearest dollar.

Why is my federal withholding so high?

The amount of tax withheld from your pay depends on what you earn each pay period. It also depends on what information you gave your employer on Form W-4 when you started working. This information, like your filing status, can affect the tax rate used to calculate your withholding.

Does claiming zero withhold the most taxes?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

How do I increase my federal tax withholding?

Change your withholding To change your tax withholding you should: Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Notice 1036?

Notice 1036 is a form used by taxpayers to report certain information related to their tax obligations as required by the IRS.

Who is required to file Notice 1036?

Taxpayers who engage in specific activities or transactions that necessitate the reporting as outlined by the IRS are required to file Notice 1036.

How to fill out Notice 1036?

To fill out Notice 1036, taxpayers must provide accurate information in the fields specified, including identifying information and the relevant tax-related data as required by IRS guidelines.

What is the purpose of Notice 1036?

The purpose of Notice 1036 is to ensure compliance with tax reporting requirements and to collect necessary information for the IRS to assess tax liabilities accurately.

What information must be reported on Notice 1036?

Information that must be reported on Notice 1036 includes taxpayer identification information, details of the specific transactions, and any other relevant financial data as required by IRS directives.

Fill out your notice 1036 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice 1036 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.