IRS SS-4 1998 free printable template

Show details

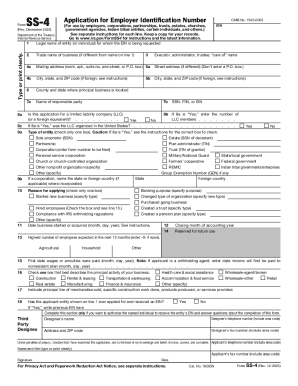

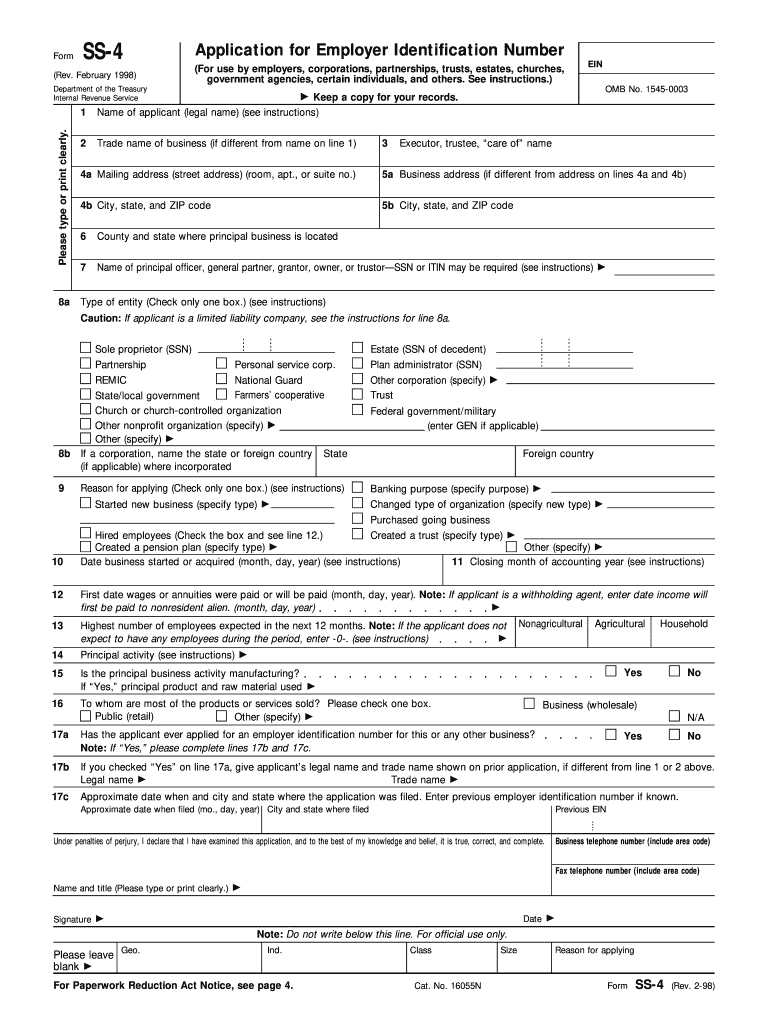

Form SS-4 1 Application for Employer Identification Number (For use by employers, corporations, partnerships, trusts, estates, churches, government agencies, certain individuals, and others. See instructions.)

pdfFiller is not affiliated with IRS

Instructions and Help about IRS SS-4

How to edit IRS SS-4

How to fill out IRS SS-4

Instructions and Help about IRS SS-4

How to edit IRS SS-4

To edit the IRS SS-4 form, you should start with a digital copy in a compatible format. Utilize pdfFiller’s easy-to-use tools to modify fields as needed. Ensure that any changes maintain compliance with requirements set forth by the IRS.

How to fill out IRS SS-4

To fill out the IRS SS-4 form correctly, follow these steps:

01

Gather necessary information about your business, such as the entity type and reason for applying.

02

Complete all required fields in the form accurately to avoid delays.

03

Review the filled form carefully for any errors or omissions.

About IRS SS-4 1998 previous version

What is IRS SS-4?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS SS-4 1998 previous version

What is IRS SS-4?

The IRS SS-4 form is the Application for Employer Identification Number (EIN). This form is essential for businesses that need to establish a federal tax identification number.

What is the purpose of this form?

The primary purpose of the IRS SS-4 form is to assign an EIN to businesses and organizations for tax purposes. The EIN functions as a unique identifier for entities when filing taxes and opening bank accounts.

Who needs the form?

Any entity conducting business in the U.S., including sole proprietors, partnerships, corporations, and nonprofits, must file the IRS SS-4 form to obtain an EIN. Additionally, entities that are required to file tax returns or pay federal taxes need to complete this form.

When am I exempt from filling out this form?

You may be exempt from filling out the IRS SS-4 form if you are a sole proprietor with no employees who does not need to comply with federal tax requirements. However, if you plan to hire employees or establish a business account for your operations, you will need an EIN.

Components of the form

The IRS SS-4 form consists of several key sections, including business name, address, and legal structure. You'll also provide information regarding the reason for applying and other business activities.

What are the penalties for not issuing the form?

Failing to obtain an EIN may lead to penalties such as late filing fees for your business and complications in tax compliance. It may also hinder your ability to open business bank accounts or secure loans.

What information do you need when you file the form?

When filing the IRS SS-4 form, gather the following information:

01

Legal name of the business entity.

02

Mailing address of the business.

03

Type of entity (e.g., corporation, partnership).

04

Reason for applying for the EIN.

05

Date the business was started or acquired.

Is the form accompanied by other forms?

The IRS SS-4 form is typically submitted on its own. However, if your business structure requires additional filings for tax status or benefits, prepare those separately according to IRS guidelines.

Where do I send the form?

You should send the completed IRS SS-4 form to the appropriate IRS address, which varies based on your business location. Alternatively, you can apply online through the IRS website if you prefer.

See what our users say