Get the free 8861

Show details

Use Form 8861 to claim the welfare-to-work credit for wages paid or incurred to long-term family assistance recipients during the tax year. The credit is 35% of qualified first-year wages and 50%

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 8861

Edit your 8861 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 8861 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 8861 online

To use our professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 8861. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

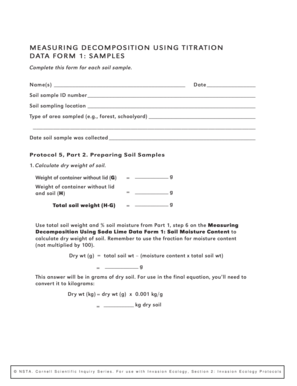

How to fill out 8861

How to fill out 8861

01

Obtain Form 8861 from the IRS website or your tax preparation software.

02

Fill in your name and Social Security number at the top of the form.

03

Section A: Indicate the tax year for which you are filing the claim.

04

Section B: List the total amount of eligible expenses you incurred.

05

Section C: Calculate the amount of credit you're claiming based on the instructions.

06

Complete any additional sections related to your specific eligibility.

07

Review the instructions carefully to ensure all necessary information is included.

08

Sign and date the form before submitting it with your tax return.

Who needs 8861?

01

Taxpayers who are eligible for the Mortgage Interest Credit.

02

Individuals who received a mortgage credit certificate from a state or local government.

03

Those who want to claim the credit to lower their tax liability related to mortgage interest.

Fill

form

: Try Risk Free

People Also Ask about

How to write 86000 in words?

Therefore, 86000 in words is written as Eighty-Six Thousand. Thus, the word form of the number 86000 is Eighty-Six Thousand.

How to write eighty eight thousand in words?

88000 in Words 88000 in Words = Eighty Eight Thousand. Eighty Eight Thousand in Numbers = 88000.

How to write out 84000 in words?

84000 in words is written as Eighty Four Thousand.

How to write 85000 in money?

85000 in words is written as Eighty Five Thousand.

How to connect cisco 8861 to wifi?

Cisco 8861 Wifi phone set up Plug in the power adapter. Press Information and settings (gear icon). Navigate to Network Configuration. Select Wi-Fi configuration. Select the Service Set Identifier (SSID) of the network. Enter the network Passphrase/password. Press Connect.

How do you say 870 000 in English?

Generally numbers in words are written with the help of the English alphabet. So, 87000 in English can be read as “Eighty-seven thousand”.

What is 86000 in English?

86000 = Eighty-Six Thousand. Thus, the word form of 86000 is Eighty-Six Thousand.

How to write 85000 in words in English?

Therefore, 85000 in words is Eighty-five thousand.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 8861?

Form 8861 is a tax form used to claim the refundable credit for the purchase of a new commercial truck or van.

Who is required to file 8861?

Taxpayers who have purchased qualifying new commercial trucks or vans and wish to claim the credit should file Form 8861.

How to fill out 8861?

To fill out Form 8861, taxpayers must provide information regarding the vehicle purchased, including the make, model, and date of purchase, and calculate the credit based on these details.

What is the purpose of 8861?

The purpose of Form 8861 is to allow taxpayers to claim a tax credit for the purchase of qualifying new commercial trucks and vans.

What information must be reported on 8861?

Form 8861 requires reporting the vehicle's description, purchase date, and the amount of credit being claimed.

Fill out your 8861 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

8861 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.