Get the free Forms 668-W, 668-W(c), & 668-W(c)(DO)

Show details

Este documento proporciona tablas para determinar la cantidad exenta de gravámenes sobre salarios, sueldos y otros ingresos, incluyendo diversas situaciones de presentación fiscal y excepciones

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign forms 668-w 668-wc 668-wcdo

Edit your forms 668-w 668-wc 668-wcdo form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your forms 668-w 668-wc 668-wcdo form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit forms 668-w 668-wc 668-wcdo online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit forms 668-w 668-wc 668-wcdo. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out forms 668-w 668-wc 668-wcdo

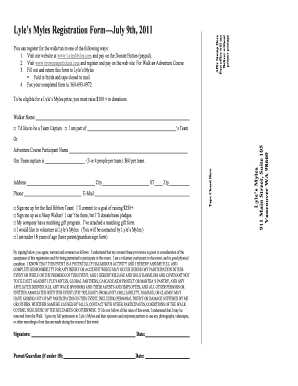

How to fill out Forms 668-W, 668-W(c), & 668-W(c)(DO)

01

Gather your personal information including name, address, and Social Security number.

02

Read the instructions on the form carefully to understand what information is required.

03

Fill in the debtor's information in the appropriate sections.

04

Provide details regarding the tax liability or payment plan, including amounts owed.

05

Ensure that all required fields are completed accurately.

06

Review the form for any errors or missing information.

07

Sign and date the form as required.

08

Submit the forms to the appropriate agency or department as instructed.

Who needs Forms 668-W, 668-W(c), & 668-W(c)(DO)?

01

Individuals or entities who have outstanding tax liabilities.

02

Taxpayers entering into a payment agreement with the IRS.

03

Those who want to request a release of a federal tax lien.

Fill

form

: Try Risk Free

People Also Ask about

Can you get out of a levy?

If you act quickly, you may be able to get some or all of the money back. You have only 10 days from the date of the levy to file a claim of exemption (plus 5 days if the notice was sent by mail) with the sheriff. You must show that the funds taken came from a source of income that is exempt from collection.

How do you get a levy lifted?

Share: When the IRS takes money out of your bank account (levy) or your paycheck (wage garnishment), you have options. You can get the IRS to remove the levy, but only after you pay off all the back taxes you owe, or set up a payment agreement with the IRS.

What happens when the IRS puts a lien on your bank account?

If the IRS levies your bank, funds in the account are held and after 21 days sent to the IRS. Learn more about bank and similar levies here.

What is the difference between Form 668 A and 668 W?

Form 668-W(ICS) and/or 668-W(ACS) also provides notice of levy on a taxpayer's benefit or retirement income. The IRS generally uses Form 668–A to levy other property that a third party is holding. For example, this form is used to levy bank accounts and business receivables.

How do you settle a levy?

How to resolve a tax levy You pay the amount you owe. The statute of limitation expired before the levy was issued. The levy would create an economic hardship so that you can't meet your basic and reasonable living expenses. Releasing the levy will help you pay your taxes.

What does a levy notice mean?

A notice of levy is the IRS's primary tool to alert a taxpayer of their intent to seize specific assets or property, like bank accounts, wages, or real estate, for the elimination of tax dues. The final notice of intent to levy is a last warning before the IRS enforces a levy.

How do you respond to a notice of levy?

You must send a Claim of Exemption within 15 days of when you received the Notice of Levy (20 days if you received it in the mail). If you wait longer than this, the sheriff will give the other side the money and you won't get it back.

What is form 668 C?

IRS Form 668-W(c) states that it is a "Notice of Levy on Wages, Salary, and Other Income". The IRS uses Form 668-W(c) to notify your employer and you of a levy against your wages. This can be a very difficult situation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Forms 668-W, 668-W(c), & 668-W(c)(DO)?

Forms 668-W, 668-W(c), and 668-W(c)(DO) are IRS forms used for wage garnishments. Specifically, these forms are employed to notify employers of the requirement to withhold a portion of an employee's wages for the payment of delinquent federal taxes.

Who is required to file Forms 668-W, 668-W(c), & 668-W(c)(DO)?

Forms 668-W, 668-W(c), and 668-W(c)(DO) are filed by the IRS against taxpayers who have unpaid federal taxes, and the IRS requires employers to complete these forms to initiate the wage garnishment process.

How to fill out Forms 668-W, 668-W(c), & 668-W(c)(DO)?

To fill out Forms 668-W, 668-W(c), and 668-W(c)(DO), one must provide required information such as the taxpayer's name, Social Security number, the amount to be withheld, the employer's details, and any necessary attachments. It is crucial to follow the instructions provided with the forms to ensure accurate completion.

What is the purpose of Forms 668-W, 668-W(c), & 668-W(c)(DO)?

The purpose of Forms 668-W, 668-W(c), and 668-W(c)(DO) is to establish a legal mechanism for the IRS to collect unpaid taxes through wage garnishment, ensuring that the owed amounts are withheld directly from the taxpayer's wages by their employer.

What information must be reported on Forms 668-W, 668-W(c), & 668-W(c)(DO)?

Forms 668-W, 668-W(c), and 668-W(c)(DO) must report information such as the taxpayer's name and Social Security number, the withholding amount, the employer's name and address, and any specific exemptions or adjustments that apply to the garnishment.

Fill out your forms 668-w 668-wc 668-wcdo online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Forms 668-W 668-Wc 668-Wcdo is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.