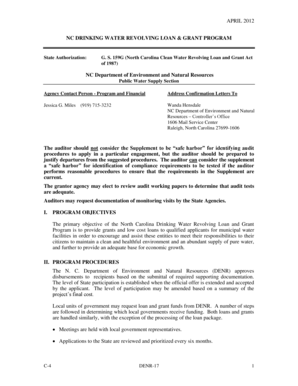

Get the free NEW JERSEY STATE EMPLOYEES DEFERRED COMPENSATION PLAN - state nj

Show details

This document provides information and instructions for New Jersey State Employees to request a distribution from the Deferred Compensation Plan, including options for lump-sum payments and rollovers.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new jersey state employees

Edit your new jersey state employees form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new jersey state employees form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new jersey state employees online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit new jersey state employees. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new jersey state employees

How to fill out NEW JERSEY STATE EMPLOYEES DEFERRED COMPENSATION PLAN

01

Review the eligibility requirements for the New Jersey State Employees Deferred Compensation Plan.

02

Obtain a Deferred Compensation Plan enrollment application from the New Jersey Division of Pensions and Benefits website or your agency HR office.

03

Complete the enrollment application by providing personal information such as your name, address, and employee identification number.

04

Select the amount you wish to defer from your paycheck and how you would like it invested within the plan options.

05

Review and sign any required forms acknowledging your understanding of the plan's rules and benefits.

06

Submit the completed application to your HR office or directly to the Deferred Compensation Plan administrator as instructed.

07

Keep copies of your submitted forms and any related documents for your records.

Who needs NEW JERSEY STATE EMPLOYEES DEFERRED COMPENSATION PLAN?

01

State employees in New Jersey looking for a way to save for retirement while benefiting from tax advantages.

02

Individuals seeking additional retirement savings options beyond their regular pension plans.

03

Employees who wish to manage their retirement investments actively through a deferred compensation plan.

Fill

form

: Try Risk Free

People Also Ask about

What is the New Jersey state deferred compensation plan?

The New Jersey State Employees Deferred Compensation Plan The NJSEDCP, also called Deferred Comp, is a voluntary investment program that provides retirement income separate from, and in addition to, your basic pension plan. You can shelter a part of your wages from federal income taxes while saving for retirement.

How does the deferred compensation plan work?

They're more like an agreement between you and your employer to defer a portion of your annual income until a specific date in the future. Depending on the plan, that date could be in 5 years, 10 years, or in retirement.

What is the downside of deferred compensation?

The Risks Of Deferred Compensation Plans As I mentioned before, most plans do not allow the participant to access the money early. If you switch jobs you might lose the entire account or you might have to take all of the money in a lump sum, which would trigger a big tax bill.

What is the 10 year rule for deferred compensation?

If you take your deferred compensation payments over a period of 10 years or more, those payments will be taxed in the state where you reside, rather than in the state in which you earned the compensation, possibly reducing your state income taxes.

What is the downside of deferred compensation?

The Risks Of Deferred Compensation Plans As I mentioned before, most plans do not allow the participant to access the money early. If you switch jobs you might lose the entire account or you might have to take all of the money in a lump sum, which would trigger a big tax bill.

Is it a good idea to have a deferred compensation plan?

Participating in a deferred compensation plan can help a high income person's retirement situation immensely, allowing them to potentially retire much earlier than they otherwise could have. The contributions to the plan are tax-deductible each year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NEW JERSEY STATE EMPLOYEES DEFERRED COMPENSATION PLAN?

The New Jersey State Employees Deferred Compensation Plan is a retirement savings plan that allows state employees to defer a portion of their salary into investment accounts, helping them save for retirement while reducing their taxable income.

Who is required to file NEW JERSEY STATE EMPLOYEES DEFERRED COMPENSATION PLAN?

All state employees who wish to participate in the deferred compensation plan and contribute a portion of their salary toward retirement savings are required to complete the necessary enrollment and filing forms.

How to fill out NEW JERSEY STATE EMPLOYEES DEFERRED COMPENSATION PLAN?

To fill out the New Jersey State Employees Deferred Compensation Plan, employees should complete the enrollment form provided by their employer, indicating their desired contribution amount and investment choices. The completed forms are then submitted to the plan administrator.

What is the purpose of NEW JERSEY STATE EMPLOYEES DEFERRED COMPENSATION PLAN?

The purpose of the New Jersey State Employees Deferred Compensation Plan is to provide state employees with a tax-advantaged way to save for retirement, encouraging long-term financial security and supplementing other retirement benefits.

What information must be reported on NEW JERSEY STATE EMPLOYEES DEFERRED COMPENSATION PLAN?

Employees must report personal identification information, contribution amounts, chosen investment options, and any changes to their participation status in the New Jersey State Employees Deferred Compensation Plan.

Fill out your new jersey state employees online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Jersey State Employees is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.