Get the free FT 1120-FI - tax ohio

Show details

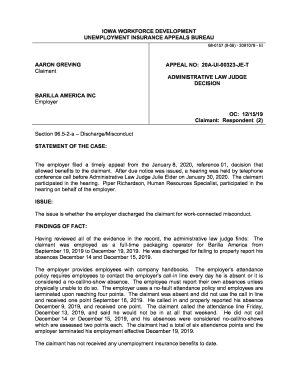

This document serves as the Corporation Franchise Tax Report for financial institutions in Ohio for the tax year 2002, detailing computations for franchise tax, apportionment, and required financial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ft 1120-fi - tax

Edit your ft 1120-fi - tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ft 1120-fi - tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ft 1120-fi - tax online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ft 1120-fi - tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ft 1120-fi - tax

How to fill out FT 1120-FI

01

Begin by entering the name and address of the foreign corporation at the top of the form.

02

Provide the Employer Identification Number (EIN) of the foreign corporation.

03

Indicate the tax year for which you're filing.

04

Fill out the income section, reporting all sources of income that are subject to U.S. taxation.

05

Provide details on deductions and credits that apply.

06

Calculate the total taxable income.

07

Complete the tax calculation section, applying the appropriate tax rates.

08

Include any necessary schedules or attachments that support your filings.

09

Sign and date the form, and provide any additional information requested.

Who needs FT 1120-FI?

01

Foreign corporations that have income effectively connected with a trade or business in the United States need to file Form 1120-FI.

Fill

form

: Try Risk Free

People Also Ask about

How do I change Spanish back to English?

Change your web language settings On your Android device, tap Settings Google. At the top, tap Personal info. Scroll to "General preferences for the web." Tap Language Edit . Search for and select your preferred language. At the bottom, tap Select. If you understand multiple languages, tap + Add another language.

Do you have to pay two city taxes in Ohio?

In Ohio, you have an income tax obligation to both your employment city and your resident city. Your employer is required by law to withhold only your work place city tax. You may request your employer to withhold your resident city tax, but they are not required to do so.

How do I change the language in intuit?

by Intuit• 2• Updated 1 year ago Follow the steps below to change language settings in QuickBooks Online. Select the Gear icon and then select Accounts and settings. Select Advanced and then go to the Language section. Select the pencil icon to edit, and then choose the desired language from the drop-down.

How do I manually edit my tax form in TurboTax?

In TurboTax Desktop, you can view and make changes directly to your tax forms. You can do this by selecting the Forms icon. To switch back, select Step-by-Step (Windows) or EasyStep (Mac). If you want more info on when your tax forms will be ready in TurboTax, check our tool.

How do I change my turbo tax from Spanish to English?

0:00 1:22 If you happen to be on a different language or Spanish. And you want to switch back on the left handMoreIf you happen to be on a different language or Spanish. And you want to switch back on the left hand side sidebar at the very bottom there's going to be something that says switch to English.

Does Ohio have a franchise tax?

Ohio imposes an annual privilege tax (also known as a "franchise tax") on some businesses. In Ohio, this franchise tax is called a "commercial activity tax" (CAT). Some LLCs will need to pay this tax, but most small businesses won't. In 2024, the laws around the CAT changed significantly.

Which states charge franchise tax?

As of 2023, the states that impose franchise tax are Alabama, Arkansas, California, Delaware, Georgia, Illinois, Louisiana, Mississippi, Missouri, Minnesota, Nevada, New Hampshire, New York, North Carolina, Oklahoma, Tennessee, Texas, Vermont, and the District of Columbia.

What is a franchise tax in Ohio?

The corporation franchise tax is a business privilege. tax that dates back to 1902. For most taxpayers, Ohio has completed the process of phasing out the corpora tion franchise tax in favor of the new commercial activity tax (CAT).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FT 1120-FI?

FT 1120-FI is a form used by foreign financial institutions to report certain financial information related to U.S. clients and transactions to the Internal Revenue Service (IRS).

Who is required to file FT 1120-FI?

Foreign financial institutions that have U.S. account holders or engage in transactions with U.S. individuals or entities must file FT 1120-FI.

How to fill out FT 1120-FI?

To fill out FT 1120-FI, financial institutions must provide detailed information about their U.S. accounts, including account holder identities, account balances, and transaction details as required by the IRS.

What is the purpose of FT 1120-FI?

The purpose of FT 1120-FI is to ensure compliance with U.S. tax laws by requiring foreign financial institutions to disclose information about their U.S. clients and accounts to prevent tax evasion.

What information must be reported on FT 1120-FI?

The information that must be reported includes account holder names, addresses, taxpayer identification numbers, account balances, and any amounts paid to the account holders during the reporting period.

Fill out your ft 1120-fi - tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ft 1120-Fi - Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.